Enabling companies to liquidate their stock and ease cash flow, this entrepreneur couple rakes in Rs 76 Cr GMV

The Purchase House is an online marketplace for buying and selling of surplus stock and non-moving capital assets. In times of COVID-19 pandemic, it has enabled 18,000 new industrial users to beat challenges.

Excess inventory is bad for business. It ties up the cash flow, takes up the warehouse cost, and gives a big blow to the balance sheet at the year-end. Liquidation of the piled-up inventory becomes essential for a business after a certain period of time to run efficiently.

Even in these tough COVID-19 pandemic times, many business owners have suffered huge losses due to their stacked inventory that prevented them from re-investing in their business.

Rushikesh Bhandari and Kanchan Bhandari, Cofounders, The Purchase House

Seeing this gap in the market, Rushikesh Bhandari (33) and Kanchan Bhandari (31) decided to start a portal where the companies can meet substantial buyers to liquidate their stock at a valuable price.

In an interaction with SMBStory, Rushikesh says,

“My wife Kanchan and I were into industrial goods trading in 2013. After spending a few years into the business, we realised that no matter what industry you’re in, surplus and non-moving stock is a common pain-point that can adversely impact the financial health of the MSMEs and even large corporations.”

Having to sell the stock to generate cash flow, companies could recover only a bare minimum of their investment, Rushikesh adds. This was leading to severe mismanagement of resources. After initially considering a physical set-up for reselling industrial goods, the couple decided to take a chance and invest in an online portal for the buying and selling of industrial goods as they believed in the scope and potential of the concept.

The duo founded in 2017 in Nashik and in a span of four years rakes in a GMV of Rs 76 crore.

Edited excerpts from the interview:

SMBStory [SMBS]: What is The Purchase House?

Rushikesh Bhandari [RB]: The Purchase House (TPH) is an industrial e-marketplace for buying and selling of surplus stock and non-moving capital asset. The importance and impact of the idea can truly be grasped in the current times of COVID-19 pandemic.

Small and Medium Businesses (SMBs) feel the dire need for cash-flow in these times. TPH creates a win-win situation for both buyers and sellers by helping the seller liquidate the cash stuck up in surplus stock and also the buyer by helping them procure quality, certified material at a reasonable price.

We’re helping change the age-old trend in business of scrapping materials that hardly recover any cost and causes a strain on the resources and the environment. Connecting genuine buyers and sellers, introducing services and suppliers across industries, and maintaining a simple, user-friendly online portal are few of the highlights of our company. This platform is optimising the nation’s resources and ensuring maximum utilisation.

The seller who wishes to liquidate the stock can simply onboard after registering on the platform. They need to select the listing type, get an easy-to-use dashboard, select the plan that suits them best, process the payment, and begin listing the products.

The portal only gives an idea on the kinds of products we have listed with us. Once the deal is initiated, the further process includes quality check from the buyer’s side, payment negotiation from buyer’s and seller’s end, logistics, and so on.

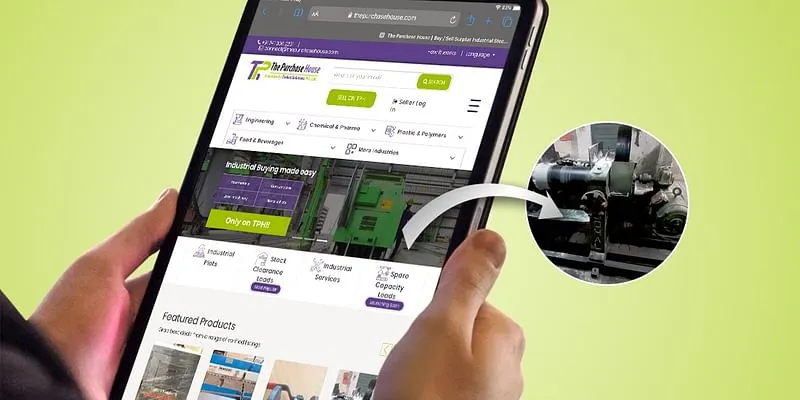

The Purchase House portal

SMBS: With how many companies have you tied up and at what percentage you liquidate the inventory?

RB: Hailing from the engineering background as I am a Chemical Engineer and Kanchan has pursued her Masters in Applied Chemistry, we first enlisted products on TPH from Engineering and Chemical industry. However, the issue of over-stocking and non-moving inventory was not unique to only these fields. No matter the scale or field of business, this was a common concern.

The portal kept evolving based on customer requirements and now includes inventory worth Rs 220 crore from across industries like pharmaceutical, F&B, plastic, paper, polymer, automobile, furniture, textile, petrochemical etc.

We believe there is a huge scope for them to grow in every sector that has to deal with the problem of surplus raw material and unused equipment.

At present, TPH has tied-up with over 50,000 companies on its portal including Tata Steel, Havells, BOSCH, Mahindra, among others. It has also tie-ups with MNCs and Indian MSMEs. On average, TPH quotes liquidation at 70 percent of the product cost charging 0.2 percent commission of the product value.

We also provide Value Added Services to clients who wish to opt for the same helping them to process and close the deal. TPH has also got leads from various ecommerce portals to liquidate their surplus stock.

Recently, we even joined hands with a Korean company as part of our global expansion plan.

SMBS: What are the major challenges you face in the business?

RB: We faced the same challenge as any new idea would which is to create the initial brand awareness. The concept of an e-marketplace for used goods was neither popular nor credible when we started out. We had expected certain scepticism on the part of our customers and were prepared to handle it.

Once we were able to break the initial barrier, our results spoke for us in the coming years. We now have repeat users, with a record of 18,000 new industrial users in the tough pandemic times when SMBs and large enterprises were struggling to keep their businesses afloat.

At the same time, we’re also developing our portal to provide seamless service to our clients. We owe a lot of the new listings to a simplified platform, making it easier for buyers and sellers to get what they’re looking for. Harnessing the correct technical data plays a key role in this process too, as does constantly working on developing our algorithms.

SMBS: What are your future prospects?

RB: Currently, our focus is on adding a range of value-added services for a personalised experience while dealing through TPH. We are focussed on building logistical support with the aim of expanding pan-India and creating channel partners for ease of trading.

We are constantly working on developing our algorithms and technology and have a plan to introduce a 360-degree viewing option and add to our list of verified products to maintain better transparency in all our services. After we have ensured that this concept has a proper foothold in India, we plan to take it global.

Edited by Javed Gaihlot