What is the Procedure to Start a FinTech Company?

Many business aspirants want to start a FinTech company, but don’t have enough knowledge about its procedure. Needless, to worry, this blog will provide a comprehensive guide to establish a successful FinTech company.

Technology has streamlined the operations of almost every sector in India, ranging from automobiles to the financial industry. A remarkable innovation that emerges in recent years is Financial Technology or FinTech. It is a robust technique that revamps the lending & borrowing activities. FinTech aims to dethrone the conventional modes of finances and enable customer-friendly experiences. It has not only revolutionized the financial sector but also formed a gateway for startups to channelize their talent. Many business aspirants want to start a FinTech company, but don’t have enough knowledge about its procedure. Needless, to worry, this blog will provide a comprehensive guide to establish a successful FinTech company.

A Concise Description of FinTech

Financial technology often abbreviated as FinTech refers to technology-enabled financial solutions. It is the perfect amalgamation of financial services with information technology. Though the connection between finance and technology might seem to be a new one, however, they share a firm link over centuries. In literal terms, both finance & technology are non-detachable. They intertwine from the beginning of the modern era and persistently play a vital role to strengthen the economy.

Peek into the History of Financial Technology

At an early stage, FinTech was considered as a fundamental category of technologies that were employed in the backend systems of banks and other financial institutes. Whereas, as time passed, the horizon of FinTech also expanded. Currently, it renders an array of services like automating insurance, banking, trading and risk management rather than just supporting financial institutes. FinTech has reignited the battle amidst finance and banking. Moreover, it also highlights the fact that FinTech and banks are two separate unites but co-dependent on each other.

Evolution of FinTech since its origin

After the radical impact of demonetization, FinTech companies sprouted at a fast pace. They act as a saviour for the people who were running out of cash. Although FinTech may have come into the limelight in recent years, it has a strong foundation since the year 1950s. FinTech belong to the financial realm from the start when credit cards took over the industry, and people prefer doing cashless transactions. Thereon, FinTech left its mark everywhere like in the functioning of ATMs, personal finance apps or building electronic trading floors and so on.

Scope of FinTech Services

FinTech companies have widened their domain at micro as well as macro levels. Presently, such companies offer multiple solutions, such as online accounting software and customizing specialized digital platforms. So let’s take a look at the services that a person can avail from a FinTech company:

P2P (Peer-to-Peer) Lending :- This lending platform has already been so popular nowadays. It is an online portal that directly connects suitable lenders with borrowers, thus, eliminates the role of any intermediately. The P2P lending platforms deploy Financial Technology to provide a faster and convenient way to access the required funds.

Retail Investment Services : - FinTech companies aims to suffice the variant personal and professional needs of a person. Hence, it provides customized financial services to individuals or companies. FinTech ensures the optimal use of finances and thereby promotes best management of funds as per the specific requirement. Some of the reputed companies commencing retail investment business are such as PolicyBazaar, FundsIndia.com, and BankBazaar.

E-commerce Payment Options :- FinTech has procreated several online payment options which simplify the process of cash flow. With the accessibility of online platforms to make and receive payments over the mobile and web, FinTech has knockout every other innovation. It facilitates a direct transfer of money from the payer’s bank account to the payee. Most popular payment systems in India are Paytm, FreeCharge, Mobikwik, etc.

Crowdfunding Solutions :- Insufficiency of funds is inevitable whether it’s a large scale company or a startup. However, FinTech has also covered such issues and given rise to crowdfunding service providers. It enables Entrepreneurs to procure funds for their new business ventures easily. These internet-mediated platforms render an option to raise funds from a large number of people.

FinTech Companies are gaining worldwide popularity because they satiate the modern-day needs of the conventional world.

Things to consider before starting a FinTech Business

Today’s FinTech Startups rupture the popular misconception that its boundaries are confined to mobile wallets. According to statistic data, India boasts of about 600 startups in Fintech, which belongs to different segments. Besides, it has been anticipated that those numbers shall soon rise with the introduction of new initiatives such as acceleration programs by local and state Governments. All startups should follow these tips

Win Customer Trust :- Security is the biggest concern of the customers, and they become more sceptical when dealing with a new financial company. As nobody can risk their lifelong savings, it’s apparent to have trust issues. Therefore, before laying out marketing strategies, a startup should ensure to win over customer’s faith. Since insecurities get double when sharing financial information, one must unveil about the advantages of FinTech and assure that it is secure enough.

Identify Your Company’s Niche :- It is utmost essential for an Entrepreneur to have a clear vision about the industry he wants to step in. As there are a wide variety of sectors in FinTech like Payments and International Money Transfers, P2P lending, Bitcoin, Data Analysis, Small Businesses Financials, one might get confused. So choose that industry of which you have adequate knowledge.

Hire Competent Staff :- You can only yield the best results when you have proficient employees with the right skills. The need to employ efficient staff increases, even more, when developing a FinTech company. Hire that professional who holds expertise in the domain of finance, technology and business. You may also have to recruit experienced lawyers to get through with the compliance requirements.

Incorporate Latest Technology :- The only way to grab customer’s attention is by embracing the latest trends and technology. There are arrays of dynamic technologies which are hyped in FinTech like Blockchain, Machine learning and Artificial Intelligence, so before choosing to invest in them, consult Robo-advisors.

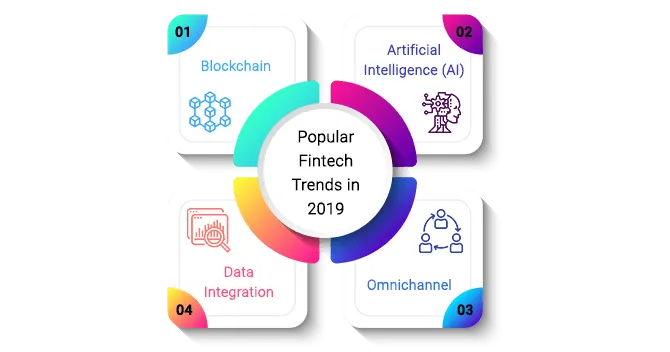

Popular FinTech Industry Trends that Ruled 2019

Now that you have perceived that technology is a crucial factor while starting a FinTech company, you must acquaint with the FinTech trends which ruled the entire year of 2019 and will continue to reign in 2020

Blockchain :- A technology which deserves the first spot in the FinTech trends is Blockchain. Blockchain has taken over the traditional banking system due to minimum paperwork and the leverage to update a digital ledger in real-time. Also, it enables to store a person records in a highly tamper-resistant ledger. The development of Blockchain payments will continue to persist with the key component of centralized systems.

Artificial Intelligence (AI) and Machine Learning :- Humans can never challenge the intelligence of machines. AI and Machine Learning can automatically process an enormous amount of customer’s data and suggest a perfect solution accordingly. If a FinTech company chooses AI, then it will help information are compared and results in suitable services/products that customers want. This essentially means finding what’s right for your customers and hence can achieve customer satisfaction at the highest level.

Omnichannel :- As the customer is the king of any business, it is indispensable to consider their requirements. By going Omnichannel, Fintech companies offer a customer-friendly experience and connect with them in a better way. It is beneficial for both the parties and creates a seamless communication channel between the service provider & their customers.

Data Integration :- It plays a significant role in the smooth operations of FinTech Companies. Data Integration provides many benefits such as real-time visibility into every aspect of the business, saves employees time to maintain data manually and helps them to focus on their core duties. Also, it organizes data in an accurate and synchronized form.

Encoding the procedure to establish a FinTech Company in India

Here are the guidelines for a startup to set up a FinTech in India

1. Select the right Business Structure: The foremost step to undertake an online financial business is to brainstorm about the befitting business structure. One can select from three types of business structure suitable for FinTech:

- One Person Company: An OPC is the mixture of a sole proprietorship and company, wherein only one person regulates the functions of a company.

- Limited Liability Partnership: An LLP is a blend of partnership and corporation, where all the partners have limited liability and liable for to their respective shares only.

- Private Limited Company: In the PLC, the directors and shareholders have no personal liability to the company’s creditors. The Private Limited Company has its rights and liabilities separate from its members. It is the most appropriate structure for a FinTech business in India.

2. Register for GST: The next step is to register your online finance business for GST and procure GSTIN. The GST regime will combine the old indirect taxes like excise duty, service tax, etc.

3. Obtain Legal Documents and Agreements: Documentation is an essential part of starting any online finance business. So get assistance from an experienced lawyer in drafting the legal documents in regards to your business type. Here is the list of some important documents and agreements:

- Co-Founders Agreement

- Privacy Policy

- Website User Policy

- Terms of use for mobile application users

- Vendor Agreement

- Product Development Agreement

- Employment Agreements

- Intellectual Property Licensing Agreement

4. Procure IPR: Intellectual Property comprises of Copyright, Patent, Trademark, and Design. To survive in the cutting through FinTech business, you need to protect your brand’s name, slogan, mobile app, website, etc. All such elements can be protected by registering them and obtaining an Intellectual Property Rights (IPR).

5. Apply for Licensing: Licensing and regulation of a FinTech startup depend upon the type of service it desires to offer. Services a company can provide through an online finance business include:

- Payment service: The Reserve Bank of India launches a ‘Differentiated banking license’ scheme to issue ‘on-tap’ licenses to those businesses who want to provide banking or financial services. The applicants must apply with the RBI to register themselves and follow prescribed regulations:

- Peer to Peer Lending: The applicant can only obtain a P2P Lending license if he acts as an intermediary.

- Retail Service providers: Acquire license to retail FinTech and carry out lending and depositing services to micro, small and medium scale industries along with unorganized sectors.

- Financial Management/Investment: There are no such regulations for finance management businesses. However, the RBI has proposed that all the Financial Management FinTech shall get registered as NBFCs (Non-Banking Finance Companies).

6. Register Domain: Lastly, the FinTech startup has to fulfil the basic requirement of having a web presence. Hence, domain name and an official website are the central priorities for an online financial business. Moreover, a FinTech company can also choose to build a mobile app to expand its customer base.

Final Thoughts

If you are in a dilemma of whether to start a FinTech company or not, then you must go for it. As Financial Technology seems to have a promising future, it will be a smart choice to head start your FinTech venture. To build an exemplary online financial portal, you must consult a reputed legal advisory like Swarit Advisors. Our competent team will guide you the right way and ease the entire registration process for you. Remember, the more you delay, the more competition you have to face, so contact us today and build your dream project.