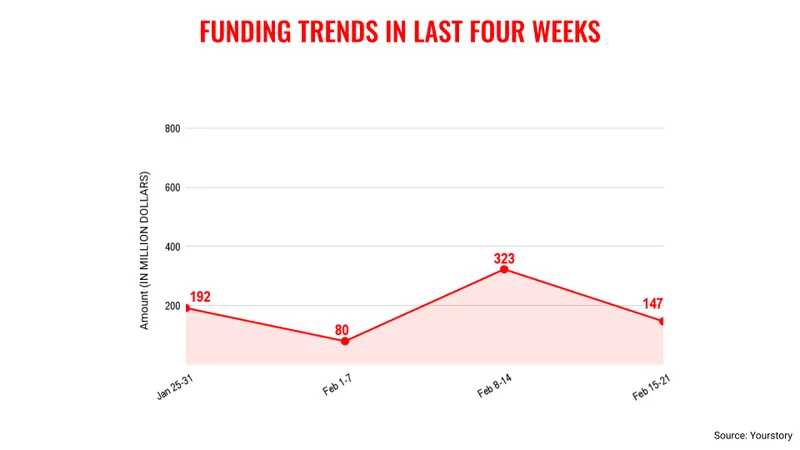

[Weekly funding roundup Feb 15-21] Sharp fall in venture capital inflow

Venture capital funding into Indian startups saw a steep decline in the third week of the month largely due to absence of large deals.

Venture capital (VC) funding into Indian startups continues to remain slow as large deals remained absent during this week.

The total VC funding for the third week of February came in at $147 million across 22 deals. In comparison, the previous week saw a total inflow of $323 million. This drop in funding shows the challenges faced by the Indian startup ecosystem in raising capital.

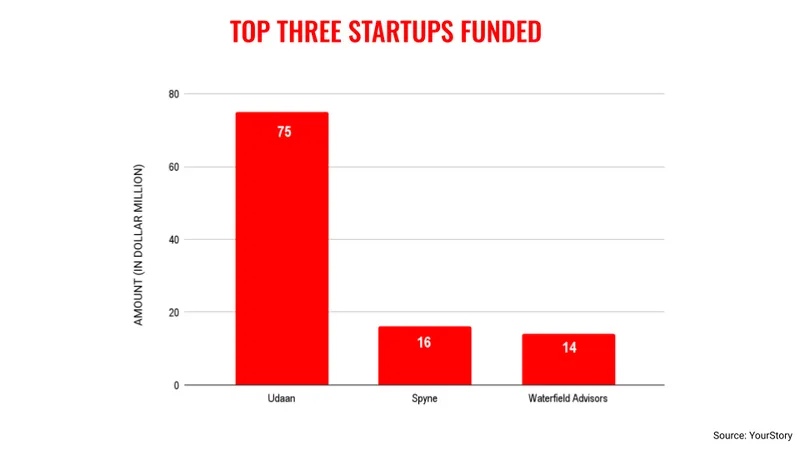

During this week, there was just one single deal by Udaan with a value of $75 million with the rest falling below the $20 million level. VC inflow receives a boost only with presence of large value deals.

This shows how venture capitalists continue to remain cautious about startup funding as the broader economic environment is not providing positive news. This uneven flow of funding is likely to persist for more time before there is a certain amount of clarity on the direction of the economy.

At the same time, the early-stage funding continues to see the highest amount of deal activity with 20 deals during the week. However, the amount of funding was just $66 million. The real growth in deal value will come from the late-stage deal activity but this has remained dull for the year so far.

The biggest development this week from the startup ecosystem has been the announcement by PhonePe to go for a public listing. This would be most watched by the Indian startup ecosystem.

Key transactions

B2B ecommerce firm Udaan raised $75 million from M&G Plc and Lightspeed Venture Partners.

Deeptech startup Spyne raised $16 million from Vertex Ventures, Accel, Storm Ventures, and Alteria Capital.

Wealth management firm Waterfield Advisors raised Rs 122.99 crore ($14 million approx.) from Jungle Ventures and angel investors.

Pet food brand Dogsee Chew raised $8 million from Ektha.com, Shivanssh Holdings, Poddar Family Office, and existing promoters.

Omnichannel fashion retailer Rare Rabbit raised Rs 50 crore ($5.7 million approx.) from A91 Partners.

Deeptech startup Probus Smart Things raised $5 million from Unicorn India Ventures.

Edited by Affirunisa Kankudti

![[Weekly funding roundup Feb 15-21] Sharp fall in venture capital inflow](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)