Cheer for the middle class as FM announces new tax reforms; benefits for incomes up to Rs 12 LPA

Finance Minister Nirmala Sitharaman announced in the Union Budget 2025-26 that personal annual income up to Rs 12 lakh per annum would be exempt from taxes. This comes at a time when India’s consumption has been slowing and inflation is rising.

There’s finally something to cheer for India’s vast middle class. In an effort to boost consumption and reduce the salaried population’s tax burden, Finance Minister Nirmala Sitharaman announced a slew of new tax reforms in the FY26 Union Budget presented today.

In one of the most notable changes, those earning up to Rs 12 lakh per annum (LPA) need not pay any income tax under the new tax regime from the next financial year (FY26). This will effectively be applicable to those with a net income of Rs 12.75 Lakh, as the new regime offers a standard deduction of Rs 75,000, announced the FM adding that this will significantly increase people’s disposable incomes and boost consumption.

“A tax payer with an income of up to Rs 12 LPA will get a tax relief of Rs 80,000 (100% of the taxes paid),” said Sitharaman, adding, “A person with an income of Rs 18 LPA will get a relief of Rs 70,000 (30% of the taxes paid).”

In her Budget speech, the FM also said that the basic income exemption limit will be hiked from Rs 3 lakh to Rs 4 lakh.

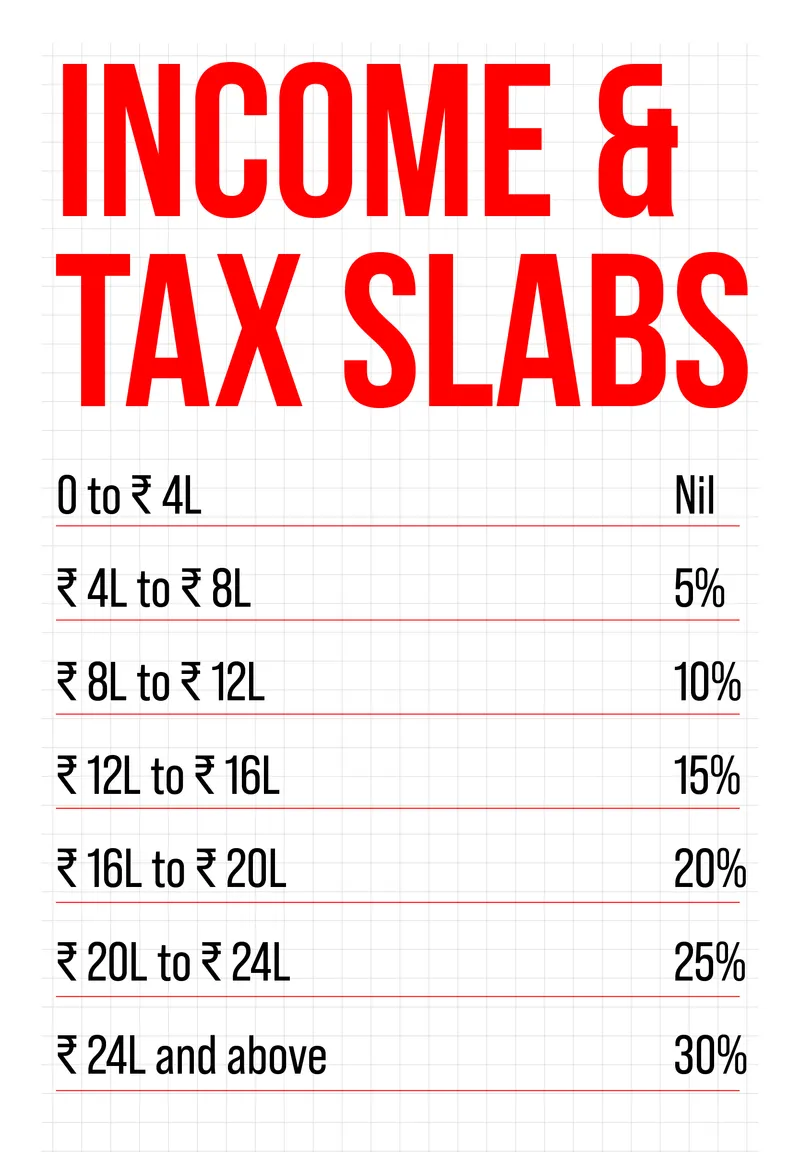

The revised tax rates, which come into effect from April 1, 2025 (FY26/ Assessment Year 2026-27), are:

Graphic: Nihar Apte

“The slabs and rates are being changed across the board to benefit all taxpayers. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment,” Sitharaman explained.

Prior to this, the rebate for Personal Income Tax was raised in the FY24 Budget. “Right after 2014, the ‘Nil’ tax slab was raised to Rs 2.5 lakh, which was further raised to Rs 5 lakh in 2019 and to Rs 7 lakh in 2023,” said Sitharamam. “I am now happy to announce that there will be no income tax payable up to income of Rs 12 lakh,” she remarked as the Parliament cheered loudly.

This year’s Budget also announced an extension of time-limit to file updated returns, from the current limit of two years to four years. The annual limit of Rs 2.4 lakh for tax deducted at source (TDS) on rent was also increased to Rs 6 lakh.

The government expects to forego a revenue of about Rs 1 lakh crore in direct taxes after the proposals. The latest announcement can be seen as the Centre’s push towards the new and simplified tax regime, which disallows all exemptions on investments.

Government data shows that the new tax regime was more popular among the income tax payers in Assessment Year 2024-25 (which is FY24). In that period, 72% of the taxpayers opted for the new tax regime, higher than in any previous financial year. However, the latest Budget documents show that in the same fiscal, the government was projected to have foregone Rs 2.2 lakh crore as part of exemptions and deductions to individual and Hindu Undivided Family (HUF) taxpayers. A major part of it—Rs 1.15 lakh crore—was owing to section 80C of the Income Tax Act, which can be claimed only under the old tax regime.

Welcoming the new tax announcements, Nikhil Behl, Co-founder & CEO, Stocks at INDmoney, said, “The proposal to make income up to Rs 12 lakh tax-free is a game-changer, offering substantial relief to the middle class. Not only will this boost savings and consumer spending, but it will also inject fresh momentum into the economy by increasing disposable income for millions of taxpayers by putting them in the tax-free bracket."

(With inputs from Sohini Mitter)

Edited by Megha Reddy