Startup IPOs in 2024: Private markets were cold but public markets were warm and welcoming

2024 was a defining year for the Indian startup ecosystem with more than a dozen companies getting publicly listed, setting the stage for a promising 2025.

Indian startups may not have gotten a lot of love from private investors in 2024 but they received more than a warm welcome from the public markets.

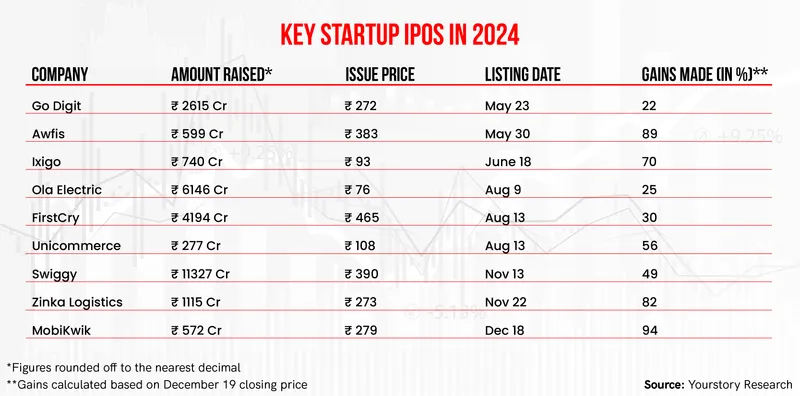

Thirteen startups became publicly listed entities this year. Leading names from the startup ecosystem, including Swiggy, Ola Electric and FirstCry, made a successful debut on the stock exchanges, and the year ended with the listing of the digital banking platform MobiKwik.

“Startups feel this is the right time for them to go public, because today, the public markets are valuing these companies much higher than private companies are,” says Vikram Chachra, Founding Partner, 8i Ventures.

The year 2024 has been a big learning curve for the Indian startup ecosystem, after a not-so-encouraging experience in 2021.

Four startups, Zomato, Nykaa, Policybazaar and Paytm, got listed on Indian stock exchanges in 2021, but the performance of their stocks did not meet expectations—there was no appreciable rise in their price. In fact, Paytm’s share price actually crashed on day one of listing.

There were many reasons for this lukewarm response: unrealistic valuations, lack of clarity on financial performance parameters, and, most importantly, the absence of effective storytelling.

It seems that the lessons of 2021 were well imbibed by the startups that went public in 2024. There were no more outsized valuation expectations, and the pricing of the shares was realistic.

Startups like Swiggy and FirstCry did not seek higher valuation with their initial public offering (IPO). FirstCry was valued at around $3 billion, the same as its valuation during its last venture capital funding round. It was the same case with Swiggy, which was valued at $11.3 billion at the time of its IPO.

Some like Ola Electric and MobiKwik lowered their valuation expectations.

The IPO of Ola Electric was valued at $4 billion, in stark contrast to the $6.4 billion valuation in its last private round of funding. MobiKwik witnessed a steep cut in its IPO valuation to around $250 million, compared to its peak value of $950 million.

“The Indian startup ecosystem is now much more mature, and they are treated very well by the capital markets,” says V Balakrishnan, Chairman, Exfinity Ventures, an early-stage venture capital firm.

Realistic pricing resulted in rich dividends for the startups that went public in 2024. The stock price of most companies did not drop below the IPO listing price.

While Ola Electric’s price dropped below its IPO listing price, it has seen a recovery since then.

This is in contrast to what happened in 2021, where there was no significant increase in the share price of the startups that got listed.

Startups today—even those with revenue as less as Rs 100 crore—are able to get listed on the stock exchanges, and they are raising relatively small amounts of money from the markets.

A good example is SaaS startup Unicommerce which raised Rs 277 crore.

Given these favourable conditions, many more startups are waiting to get listed next year.

Online jewellery brand Bluestone and logistics firm Ecom Express have already filed their initial IPO draft papers with the stock market regulator. There are also other startups actively looking to get listed soon—Zetwerk, Meesho, Urban Company, Zepto, Pine Labs, and Groww, to name a few.

Advantages for startups that go public

Once a startup goes public, it becomes relatively easier for it to raise capital through various channels such as debt and institutional placement—unlike in venture capital funding, where startups have to seek numerous permissions and approvals from various investors.

For instance, Zomato, which went public in 2021, was able to raise $1 billion through qualified institutional placement in November 2024.

Actual wealth is generated for founders and employees once the startups become publicly listed companies. They have the freedom to sell their shares whenever the need arises. This is not easily possible in a venture-backed environment.

India’s digital economy is expanding rapidly, fuelled by internet-based startups. However, their presence in the stock markets is negligible at the moment.

According to Chachra of 8i Ventures, digital companies account for only around 1.5% of the country’s stock market capitalisation, and this is not a true reflection of their contribution to the country's GDP. He believes there is enough headroom for digital startups in the stock markets as investors are keen to be shareholders in them.

Challenges going forward

However, opportunities aside, there are also considerable challenges ahead for the startups that went public in 2024.

The biggest question is how will they deliver on financial metrics, especially profitability. If they are not able to deliver, then their stock price could see a steep slide, which Honasa Consumer witnessed.

On the other hand, Zomato now enjoys a market capitalisation of around $27 billion, up from $11 billion three years ago, and this was primarily due to its upbeat financial performance.

Balakrishnan of Exfinity Ventures believes there was some amount of buoyancy in the stock markets in 2024.

Over the last year, the BSE Sensex moved from 71,000 points to 79,000 points. At one point, it even came close to 86,000 points.

However, the current scenario is different with the stock market value falling consistently. The BSE Sensex has declined by 6,000 points in a span of four months.

Given the current fall in the stock markets, startups will have to deliver on the financial metrics of growth and profitability for their share price to rise or remain stable, says Balakrishnan.

Having said that, Indian startups are on fairly steady ground as they look to get listed on the stock markets in 2025.

The public markets now have a better understanding of how startups operate and also see long-term potential in them.

Chachra sums it up, “There is a funding winter in the private market, but it’s still very sunny in the public markets.”

(The infographic was updated.)

Edited by Swetha Kannan