BigBasket wants a slice of the 10-min food delivery pie

BigBasket is trying to expand beyond its core strengths into food, beauty, pharmacy, and electronics to venture into the competitive quick-commerce race.

Tata-backed BigBasket wants to adopt the 10-minute food delivery service, which is emerging as a key differentiator between quick commerce and food delivery platforms.

BigBasket is looking to offer a wide assortment of foods that can be delivered in 10 minutes, YourStory has learned. While the company is still in the process of finalising the service, it is likely going to be a mix of house of brands and private labels format.

“It will be a combination of all of it. It's not going to be one single strategy. Because, see, we don't have expertise to manufacture every kind of food. At the same time, there are areas where we will have to do it ourselves,” Vipul Parekh, Co-founder at BigBasket, tells Yourstory.

BigBasket, which was acquired by Tata Digital in May 2021, aims to tap on the synergies and FnB chains operated under the Tata brands like Starbucks and Qmin to add these players to its platform.

Tata Neu, Tata Digital’s ecommerce super app, already offers food delivery services through ONDC-enabled magicpin. However, the new proposition will focus more on food that can be delivered under 10 minutes.

BigBasket, which had re-branded its quick commerce service as BBNow, will likely launch the service in the next three to four months.

“The focus is on 10 minutes. So, we will deliver whatever we can in 10 to 15 minutes. All categories of food that can be delivered in 10 to 15 minutes, that’s the only limitation,” adds Parekh.

"Another reason why these platforms are jumping on 10-min food delivery is that the food delivery market is not growing very fast; it's saturating and growing in single digits. Most of the growth is coming from grocery delivery. By increasing delivery times and creating small incentives, they aim to drive additional growth in the food delivery business. However, it’s still early to determine the scale and extent of growth this strategy can achieve," says Satish Meena, Founder at Datum Intelligence.

“One thing we've seen consistently is that despite the skepticism about why is it needed in 10 minutes, etc. Indian consumers have voted with their wallets and feet and everything to show that they want things faster. It may not obviously always fit into a logical frame on why anybody should want this faster. And frankly, our job is not to judge why you want something,” Rohit Kapoor, Chief Executive Officer - Food Marketplace, Swiggy had told YourStory after the company’s earnings call.

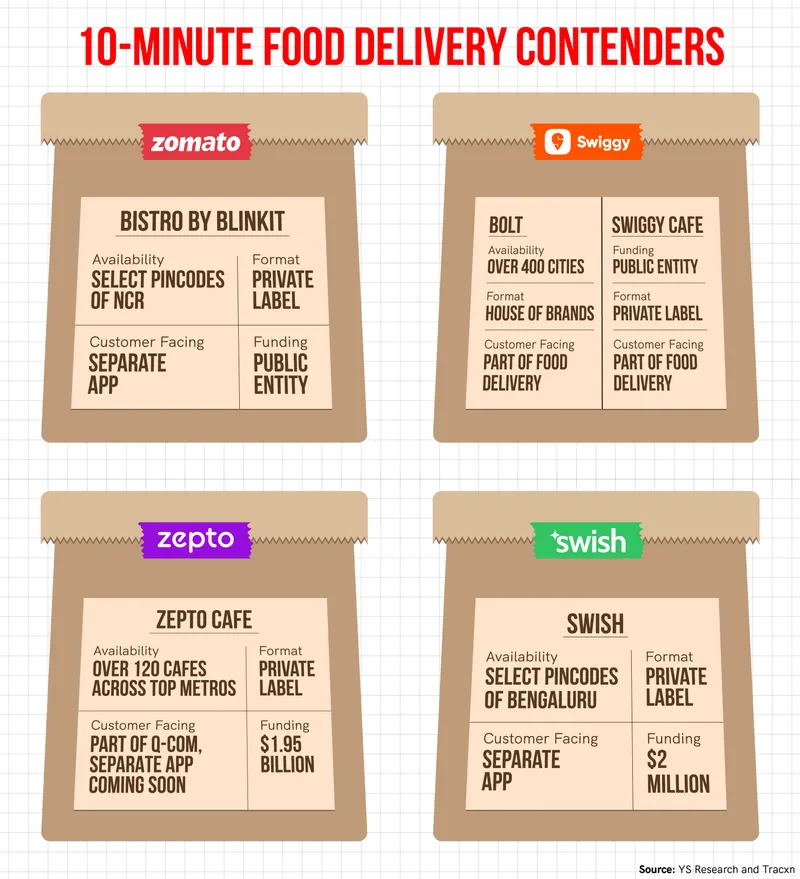

Swiggy, through Bolt, has adopted a house of brands strategy by partnering up with brands like Blue Tokai, Truffles and Sharief Bhai Biriyani to deliver food in under 10 minutes. It also operates a private label called Swiggy Cafe on its food delivery tab.

On the other hand, Zepto Cafe operates on a completely private label model, with the food and bakery items being delivered under the Zepto brand. The products are sourced out of the company’s dark stores and can be combined with a user’s quick commerce order. Zepto Cafe already clocks close to 30,000 orders a day and targets a revenue run-rate of Rs 1000 crore by 2026. It has announced plans to launch a separate app for the offering to tap on the growing demand.

"For Zepto, I think the focus is if this food delivery section becomes much bigger, they can go beyond that 10-minute quick food delivery, where they can on-board restaurants and compete directly in the full-fledged food delivery models. That is something which they can expect and that's why they are experimenting with this," explains Meena.

Market leader Zomato’s quick commerce arm Blinkit has also launched pilots for its similar service—“Bistro by Blinkit”—in select pincodes of NCR. At first glance, it looks to be operational under a separate app and has no quick service restaurants and brands listed under it.

Ten-minute delivery service has also seen interest from newer players like Accel-backed Swish and Zing, which are offering it in select areas of Bengaluru and NCR, respectively. magicpin, the third largest player in the food delivery space, has also launched magicNOW, its 15-minute service for quick bites in select pincodes cities like Delhi, Bengaluru, Hyderabad, Mumbai and Pune among others.

While there have been different iterations with standalone apps or an in-app tab, quick commerce players are ramping up focus on 10-minute food delivery along with the addition of more categories to increase average order values and bump up order frequency.

Edited by Affirunisa Kankudti