Startup, Shakeup, Separation: The unfolding of BharatPe-Ashneer Grover saga

The BharatPe saga had everything—high-stakes drama, corporate betrayals, and explosive allegations. Here’s all that went down between former CEO Ashneer Grover and BharatPe, leading to their settlement earlier this week.

Nearly two years and numerous court rulings later, the BharatPe-Ashneer Grover saga has finally ended.

On Monday, a surprising resolution saw the fintech company and ousted former CEO Ashneer Grover finally settle their disputes—but not before it altered their reputations and legacies forever.

It all began in 2018, one year after fellow IIT graduates Bhavik Koladiya and Shashvat Nakrani founded BharatPe, and Grover joined the company as a co-founder in July.

According to regulatory filings, at the time, Koladiya was the largest shareholder with a 42.5% stake, while Nakrani held 25.5% shares in the company, and Grover received 32% equity as a shareholder.

Shortly after, Grover’s wife, Madhuri Jain Grover, joined the fintech’s board, and his brother-in-law, Deepak Gupta, started overseeing sales operations. In October 2018, Grover rose the ranks to become the CEO of BharatPe and, in 2021, the managing director.

With this, the Grover family had deeply embedded itself in BharatPe’s leadership structure. And a year later, this House of Cards begins to fall apart—riddled with high-stakes drama, corporate betrayals, and explosive allegations.

What began as a meteoric rise to fame for BharatPe in India’s fintech scene and Grover—with him joining Shark Tank India as a “shark”—soon spiralled into a tale of alleged fraud and bitter feuds.

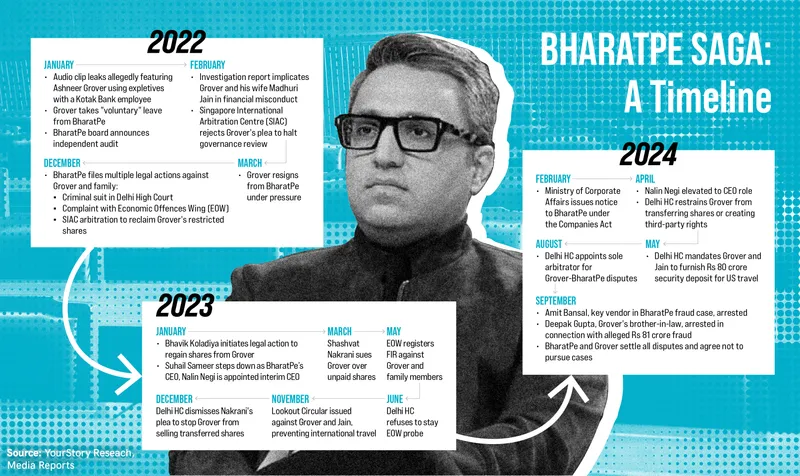

A timeline:

2022

January

A viral audio clip allegedly featuring Grover surfaced, where he was heard using expletives while speaking to a Kotak Mahindra Bank employee regarding the failure to secure IPO shares of beauty retailer Nykaa.

The then BharatPe CEO claimed the clip was fake, but it sparked a public outcry over his behaviour, particularly as a prominent figure on Shark Tank India.

Amidst rising tensions and scrutiny over the leaked audio, Grover took a "voluntary" leave from the company until the end of March, followed by an independent audit initiated by BharatPe’s board to investigate the governance and financial practices of the company.

February

In a commissioned report, consulting firm Alvarez & Marsal implicated Grover and his wife, Jain, in financial misconduct. As the head of controls at BharatPe, Jain allegedly facilitated fraudulent payments to non-existent vendors and misused company funds for personal expenses, including luxury trips and beauty treatments.

Meanwhile, the Singapore International Arbitration Centre (SIAC) rejected Grover's plea to halt the governance review at BharatPe.

March

With mounting pressure from the board, Grover resigned from BharatPe. He maintained that he was a victim of a "witch hunt" orchestrated by the company’s investors and board members.

December

The fintech firm pursued multiple legal actions against Grover and his family. First, a criminal suit in the Delhi High Court accusing Grover, Jain, and other family members of misappropriating funds. Second, a complaint with the Economic Offences Wing (EOW) of the Delhi Police, seeking a criminal investigation. Lastly, a suit with the SIAC to claw back Grover’s restricted shares, which he retained after his resignation.

2023

January

BhartPe co-founder Koladiya, too, initiated a legal action to regain shares Grover had allegedly taken control of during his tenure.

Earlier in November 2018, Grover told Koladiya that investors were hesitant to invest unless Grover was on the cap table. Further, Koladiya had a previous conviction for credit card fraud in the US, complicating his ability to raise funds for BharatPe.

Trusting Grover's assurances—for the benefit of BharatPe—Koladiya agreed to transfer 1,611 of his 2,900 shares to Grover, which involved a transfer price of about Rs 88 lakh. However, Koladiya claimed the agreement included a provision for him to reclaim his shares under certain conditions, which Grover allegedly did not honour.

Amidst the company’s internal conflicts, coupled with a tumultuous leadership environment, Suhail Sameer stepped down as BharatPe’s CEO. He had taken on the role in August 2021 after Grover was elevated to the role of MD. Post Sameer’s exit, the then BharatPe CFO, Nalin Negi, took charge as interim CEO.

March

Nakrani sued Grover over 2,447 unpaid shares that Grover allegedly purchased from him, which had since appreciated significantly in value.

The Delhi High Court also issued a summons to Grover and BharatPe following a suit by Koladiya seeking to reclaim shares.

May

Based on BharatPe’s earlier complaints, the EOW of the Delhi Police finally registered an FIR against Grover and his family members, marking the formal beginning of criminal proceedings against the former BharatPe CEO.

June

The Delhi High Court refused to stay the ongoing probe by the EOW into the allegations against Grover and his wife.

November

In a status report filed with the Delhi High Court, the EOW alleged that Grover and Jain set up HR consultancies to siphon off BharatPe funds. Following this, the court issued a Lookout Circular against the duo, preventing them from leaving the country. The couple was stopped at the Delhi airport from boarding an international flight.

December

The Delhi High Court ruled against an interim injunction sought by BharatPe co-founder Nakrani to prevent Grover from selling the shares he acquired.

However, the court ordered the former CEO to inform it before any proposed transactions involving the shares. Grover argued that Nakrani had agreed to postpone the payment for the shares, thus questioning the validity of the claim.

2024

February

A Ministry of Corporate Affairs notice—issued under Section 206 of the Companies Act—required BharatPe to provide information related to its internal governance, investments, and stock options offered to independent directors, including former State Bank of India Chairman Rajnish Kumar.

April

BharatPe elevated Negi to the role of CEO, following a period of significant growth and strategic advancements during his tenure as interim CEO and CFO.

Under Negi, the fintech recorded an 182% increase in revenue from operations in FY23 and clocked October 2023 as the first EBITDA-positive month.

Meanwhile, the Delhi High Court issued an order restraining Grover from transferring or creating any third-party rights on April 30, in response to an interim application filed by Koladiya against Grover concerning shares transferred to him.

May

The Delhi High Court mandated Grover and his wife to furnish a security deposit of Rs 80 crore in the form of immovable property before they could travel to the US. It also instructed them to provide detailed information about their travel plans, including accommodations and contact details, to the court and investigating authorities.

August

Legal actions culminate in initial arrest. The EOW arrested Amit Bansal, a key vendor linked to the BharatPe fraud case, on August 6, accusing him of being involved with non-existent vendors.

The Delhi High Court appointed a sole arbitrator to adjudicate the ongoing legal disputes between Grover and BharatPe on August 22—responding to a petition filed by the fintech seeking arbitration on Grover's alleged breach of confidentiality during his tenure as CEO.

September

Legal fallout spreads to Grover's inner circle. The EOW arrested Deepak Gupta, Grover's brother-in-law, on September 19 in connection with an alleged Rs 81 crore fraud case involving BharatPe, further entangling Grover's personal connections in the company's legal troubles.

On September 30, BharatPe resolved its long-standing dispute with Grover.

Edited by Suman Singh