[Weekly funding roundup Aug 3-9] Venture capital investments decline

The second week of August saw a dip in venture capital (VC) funding, primarily due to the absence of large value transactions.

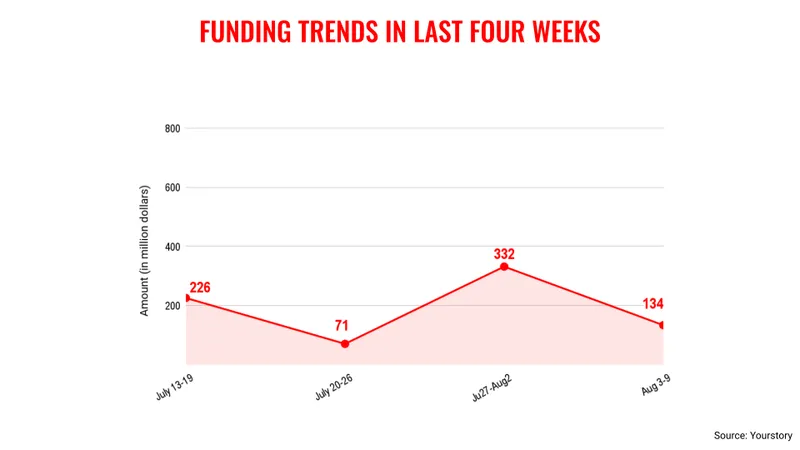

Venture capital (VC) funding in the second week of August saw a decline—primarily due to the absence of large deals—after it had crossed the $300 million mark in the previous week boosted by the transactions of $120 million from Rapido and $60 million of Gruner Renewable Energy.

The total funding for the week reached $134 million across 25 deals. In contrast, the previous week saw total funding of $332 million.

This uneven nature of VC inflows has been a dominant trend for the Indian startup ecosystem, as it has swung from below $100 million going all the way up to $500 million. On an average, the weekly fund inflow has been in the range of $100-200 million.

The present environment for the Indian startup ecosystem continues to remain challenging and this trend of uneven VC inflows will continue to persist for the remainder of the year.

On the other hand, there are positive developments for the Indian startup ecosystem in terms of public markets, that is, stock exchanges, as investors gave a favourable reception to recent initial public offerings.

Electric vehicle company Ola Electric had a blockbuster debut on the stock exchanges with its stock price surging 20%. The IPO offerings of FirstCry and Unicommerce received strong backing in the markets.

These developments provide hope for both founders and investors in startups as they are able to get exits.

Key transactions

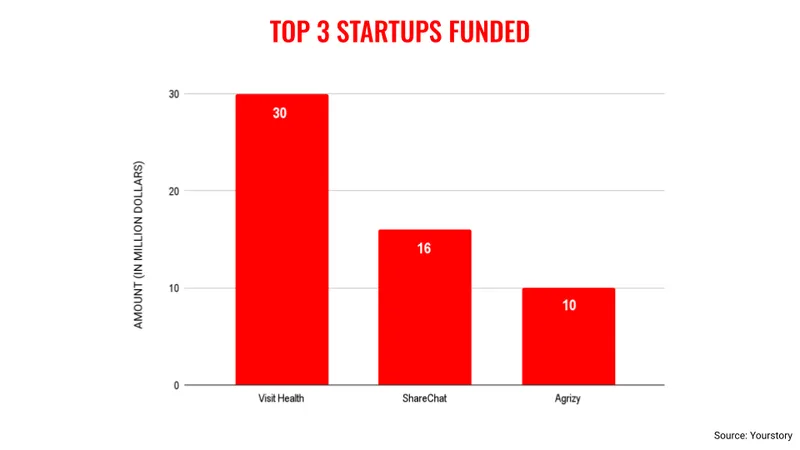

Healthtech startup Visit Health raised over Rs 250 crore ($29.7 million approx.) from Docprime Technologies, promoters and employees.

Social media company ShareChat raised $16 million in debt from Singapore-based EDBI.

B2B agri-processing platform Agrizy raised $9.8 million from Accion, Omnivore, Capria Ventures, Thai Wah Ventures, and Ankur Capital.

Speciality chemical manufacturing firm Scimplify raised $9.5 million from Omnivore, Bertelsmann India Investments, 3one4 Capital and Beenext.

Beauty, wellness, and health platform Kindlife.in raised $8 million from JB-Dooeun, TK Fund, MIXI Global Investments, Kalaari Capital and angel investors.

BlueBinaries Engineering raised Rs 60 crore ($7.1 million approx.) from Anicut Capital.

Option trading platform Punch raised $7 million funding from Stellaris Venture Partners, Susquehanna Asia VC, Prime Venture Partners, Innoven Capital, and angel investors.

Tech startup Metadome.ai raised $6.5 million from Siana Capital, Chiratae Ventures,Alteria Capital, 3to-1 Capital, and Manish Choksi’s family office.

Spacetech startup EtherealX raised $5 million from YourNest, BIG Global Investments JSC, BlueHill Capital and Campus Fund.

Healthtech startup Genworks Health raised Rs 41 crore ($4.8 million approx.) from Evolvence India Fund, Somerset Indus Healthcare Fund and Kasiraman Swaminathan.

(The article has been updated to add details of previous deals)

Edited by Jyoti Narayan

![[Weekly funding roundup Aug 3-9] Venture capital investments decline](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)