Mars Wrigley wants Bharat to indulge in more Snickers and Galaxy

The Indian arm of US chocolate and confectionery giant Mars Wrigley is looking to stock its chocolates at a million rural outlets in 4-5 years.

India’s chocolate and confectionery market has seen a major transformation over the two years with dozens of organic and artisanal D2C chocolate brands entering the market. To gain a deeper foothold in the market, the local unit of US chocolates, confectionary and pet foods maker Mars Wrigley is looking to further widen its distribution net in India.

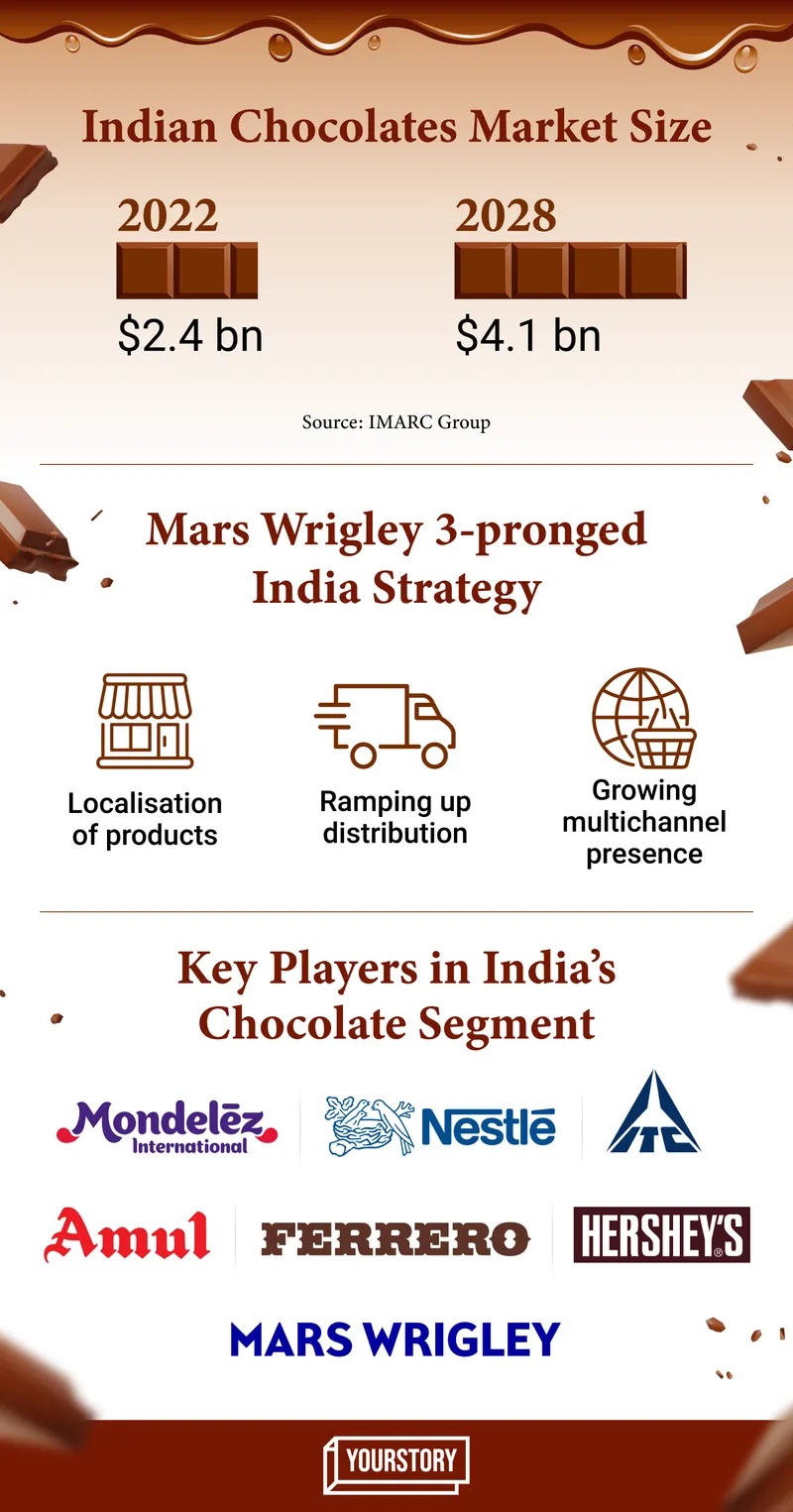

According to a report by market researcher and consultant IMARC Group, the Indian chocolate market size is expected to double to $4.1 billion by 2028 from $2.4 billion in 2022. A large portion of this growth is driven by young consumers and the better quality products available in the Indian market, say analysts.

“We just entered India in the last 10 years and our real, active play has only been six years since we opened our factory in India... We are looking at running at 2x speed and it's not just 2x speed in terms of productive results but 2x in terms of inner potential,” said Kalpesh Parmar, Country General Manager, Wrigley India.

The company makes a wide range of chocolates, gums, and candies, including Snickers, Galaxy, Orbit, Doublemint, Boomer, Solano candy, and Pim Pom lollipop. At present, Snickers, Galaxy, and Boomer are the biggest contributors in terms of revenue within the chocolates and confectionery segment for the company.

Distribution strategy

Having invested over Rs 1,000 crore in its manufacturing units over the last seven years, Mars Wrigley is aiming to pump in additional funds to ramp up capacity in its Pune and Baddi units. This will help the company widen its distribution in smaller towns, cities, and rural areas.

“We started our rural journey with Boomer. It is already in 1.5 million outlets right now; the endeavour now is how to take chocolates to these outlets. We are already in 25-30% of these outlets. We are working to get our chocolates into a million outlets in the next four to five years,” Parmar said.

Mars Wrigley recently launched a heat-robust formulation of Snickers targeted toward rural areas, keeping the temperature, logistics, and types of retail outlets in mind.

Amit Purohit, Vice President, Elara Capital said there is a huge opportunity on the rural side as “consumers are looking at newer options in snacking and indulgence categories. Mondelez has seen strong growth in rural areas due to affordable price points”.

In terms of overall strategy, every company has a different segment within the chocolates and confectionery category that they operate in. To win in rural areas, companies must have lower price points, he added.

In terms of market share, data from Euromonitor suggests that Mondelez, the maker of Cadbury, 5 star chocolates commands about 66% of the Indian chocolate market. Nestle is ranked No.2, followed by Ferrero and Hershey.

In a recent investor call, Dirk Van de Put, Chairman and CEO, Mondelez International, said the company continues to expand its presence in high-growth channels, segments, and price tiers.

“For example, silk premium chocolate doubled its prior year penetration in India, while in emerging markets, we added more than 400,000 additional outlets. We have significant runway ahead of us…India grew strong double-digit (percent)for the year and quarter, driven by both chocolate and biscuits,” he said.

Localisation of offerings

Despite being the local arm of a $45 billion chocolate, confectionery, and pet food giant, Mars Wrigley has been able to maintain its agility in India with the launch of new localised variants.

“The pandemic allowed us to be bolder, go rural, and try ecommerce. We were able to evolve our products for this because shopping behaviour is different,” said Parmar, who has launched many limited version variants of their products such as a kesar-pista version of Snickers.

The go-to India strategy for the US-headquartered chocolate maker was clear - to bring to India some global products and then localise offerings to suit the Indian consumer.

In 2013, the company launched an eggless variant of Snickers, made only for India. In 2019, it launched almond Snickers especially for the Indian market. Recently, a new dark chocolate variant, Galaxy Fusion, was launched to appeal to the growing dark chocolate-loving community.

Along with localising variants, Mars Wrigley also tailored price points to become more appealing and affordable to Indian consumers. The offerings span price points between Re 1 and Rs 150.

“A combination of price points at various levels and communication strategy has helped us find success. If we want to be successful as a global organisation, we need to win in India. India has become very important in the global game because other markets have slowed down and it will be the key growth driver,” Parmar said.

Reports suggest that India contributes about 5% of revenues for Mars Wrigley.

Ecommerce and D2C

With many consumers tapping online channels for grocery shopping, Mars Wrigley saw exponential growth in ecommerce and quick commerce

“Ecommerce contributes to 10% of our overall sales mix and this number should be better at the end of calendar year 2023,” said Parmar, who hired many ecommerce specialists including performance marketers and digital marketers.

“We are still testing and learning on our D2C side. The runway for growth has been so good for us in many channels that we are being selective of where we invest now,” Parmar said.

In 2020, Mars launched an online store in India in partnership with online delivery platform Swiggy, and offered brands M&M’s, Mars, Galaxy, Bounty, Doublemint, and Orbit.

Having evaluated investments in other D2C companies in the past, Mars Wrigley is not looking at any just yet.

“The question is always build or buy. The growth that we have been driving has been by building. There are so many D2C players in the market, but players are very few in terms of scale,” Parmar said.

D2C players like The Whole Truth Foods, Paul and Mike, and Artisante have been seeing good growth in India.

An analyst, seeking anonymity said D2C chocolate and confectionery players may never be able to compete with mainstream chocolate makers because of distribution, scale, and price points.

“Any acquisition in the space will happen only if a mainstream player wants to get into a specific premium segment or if there is a certain brand appeal associated with the company.”

Edited by Teja Lele