India's digital ad spend to rise to $21B by 2028: Redseer report

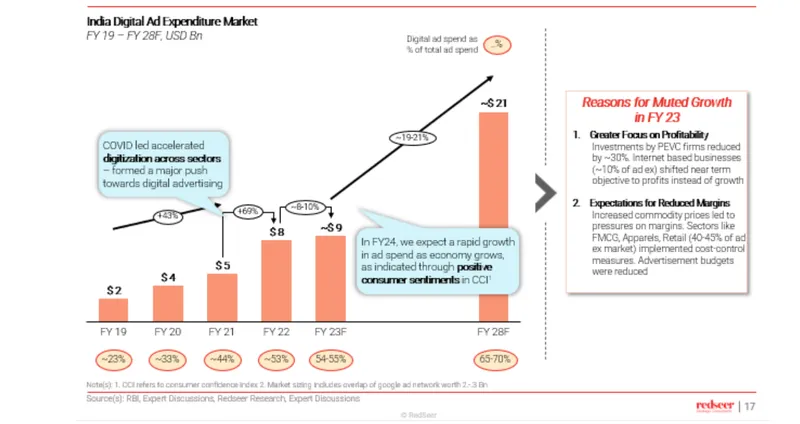

India’s digital ad spend will observe muted growth in FY23 due to macro factors, after which it will reach $21 billion by FY28, accounting for 65-70% of the overall ad spend in the country.

A recent report by Redseer Strategy Consultants estimates that the digital ad spend in India is expected to rise 2.5X in the next five years to $21 billion, growing at a CAGR of 19-21%.

“Upon mapping market sizing across media agencies, we observe a significant under-reporting of digital ad spend in India. However, the Redseer projection has considered enterprise spends, SMB spends, influencer marketing, affiliate marketing, and gaming," said Mukesh Kumar, Engagement Manager, Redseer Strategy Consultants.

As per Redseer, SMBs spent 30-35% of the total $8 billion on digital ads in FY22 and are expected to increase their share to ~40% of the total digital ads expenditure by FY28.

Growth in user-generated content will empower individual creators and influencers to build their digital identity, which brands can leverage for digital ads. This strong ecosystem of ~2.5 to 3 million creators is expected to drive marketing spending of $2.8 billion- $3.5 billion by 2028, the report added.

Digital ad spending in India will witness a steep climb, to Surge to $21Bn by 2028: Redseer Strategy Consultants (Source)

Empowerment of individual creators

According to the report, the content creator economy has emerged into 4 archetypes: Micro, Macro, Mega, and Elite creators. Micro/Macro influencers have given better ROI to bigger brands and enabled smaller D2C brands.

Redseer projects that influencer-led live commerce in India will grow to $8 billion by 2030, and marketing spending on influencers will grow to $3.5 billion by 2028.

As the creator economy grows, it is essential to bridge the gap between brands and influencers through a centralised platform such as a creator marketplace. Such a marketplace can become a single point for brands to discover and engage with creators. User-generated content and influencer ecosystems have the capacity to drive highly targeted advertising, the report said.

Advertising’s global scenario

Economies that have strong consumer spending can splurge on advertising. For instance, the US spends 1.4% of its GDP on advertisements, of which 64% goes to digital ads, and the UK spends 1.3%.

India, a developing nation, spends 0.5% of its GDP, of which 53% goes to digital ads. However, with India’s PCFE expected to grow ~ 6-7% over the next 5 years, advertising expenditure is bound to rise.

Edited by Teja Lele