CoinDCX

View Brand PublisherThese stats from CoinDCX show how The Merge’s benefits could take a while to kick in

ETH post Merge analysis by CoinDCX Research Team

Ethereum’s Merge event took place last week, with a promise to make the blockchain energy efficient, speedy, and cheaper to use. Here’s how the move from proof-of-work to proof-of-stake has worked so far.

Contrary to popular belief, Ethereum isn’t going to be scalable right after The Merge, with the transaction speed and finality only reduced marginally. Ethereum plans to combat network congestion and consequently high network fees primarily through Optimistic and Zero-Knowledge Roll-ups which constitute the “Surge” part of Ethereum’s roadmap to improve scalability.

The Merge has been touted as one of the most significant changes to the blockchain and crypto trading industry, promising a 99.95% reduction in energy consumption thanks to the Ethereum blockchain switching from proof-of-work to a proof-of-stake mechanism. It will also eventually make transactions on the Ethereum blockchain quicker and reduce gas and transaction fees, especially on Layer-2 solutions.

However, statistics observed by shortly after the Merge event was completed shows that it will most likely take a while before users on Ethereum start seeing its benefits:

1. Ethereum trading volume increased by 16% on the day of The Merge (September 15, 2022), and witnessed a 32% rise in the week leading up to it (September 9-22).

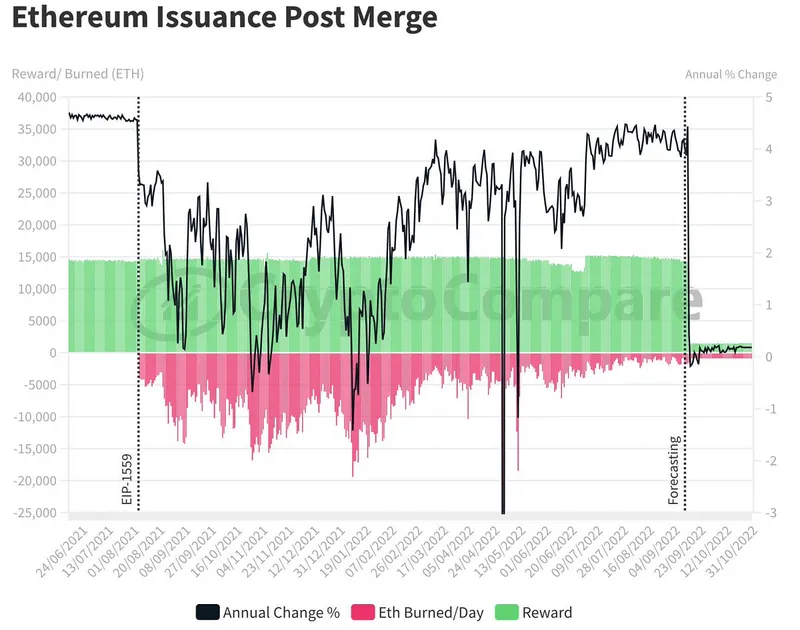

2. After the Merge, Ethereum’s issuance rate is expected to decline by ~90%, with staking rewards becoming the main driver of ETH issuance.

3. Funding rates turned positive immediately after the merge. Prior to the Merge, ETH had consistently nominal negative funding rates which reached a value of -0.6% — which was the most negative in the last six months. Negative funding increases when shorts in the markets are higher than longs, which in turn were closed after the successful merge when funding rates became slightly positive again.

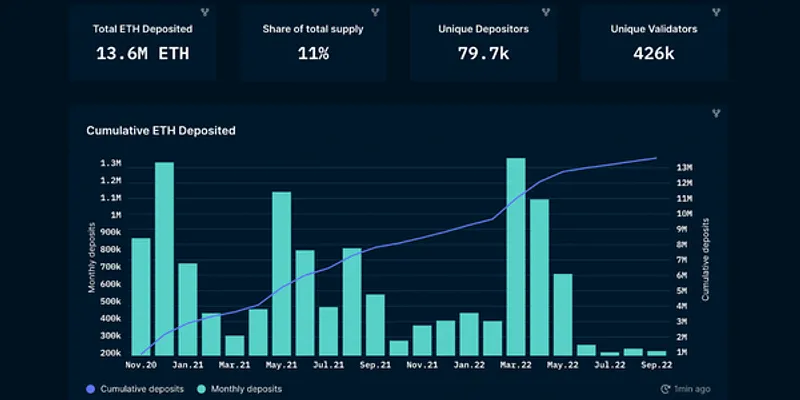

4. Total number of Ethereum staked for ETH2.0 is 13.6 million ETH corresponding to 11% of the circulating supply.

5. 426,000 validators are now running ETH Proof of Stake (PoS) consensus mechanism and will be securing the ETH 2.0 economy.

As on 15th Sep’22 (Source: Sanbase)

As on 15th Sep’22 (Source: Coinglass.com)

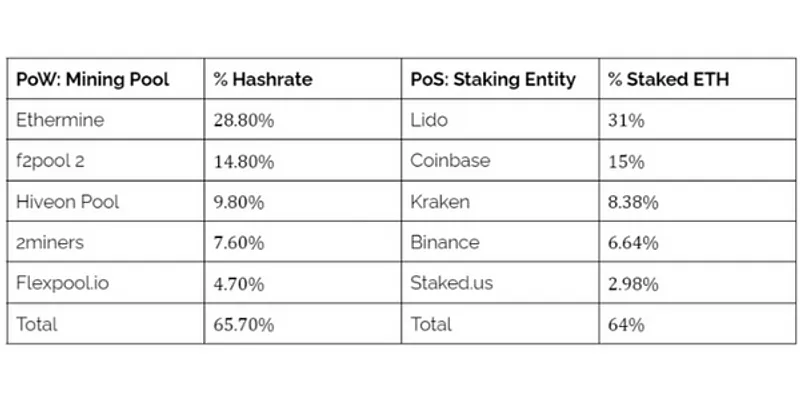

6. Before and after Merge ETH concentration metrics with Mining/Liquid Staking aggregators:

As on 15th Sep’22 (Source: Nansen.ai)

(Source: ultrasound.money)

As on 15th Sep’22 (Source: Nansen.ai)

(Source: Cryptocompare.com)