Launched with Rs 5,000, house of apps AppyHigh recorded Rs 64 Cr revenue in FY21

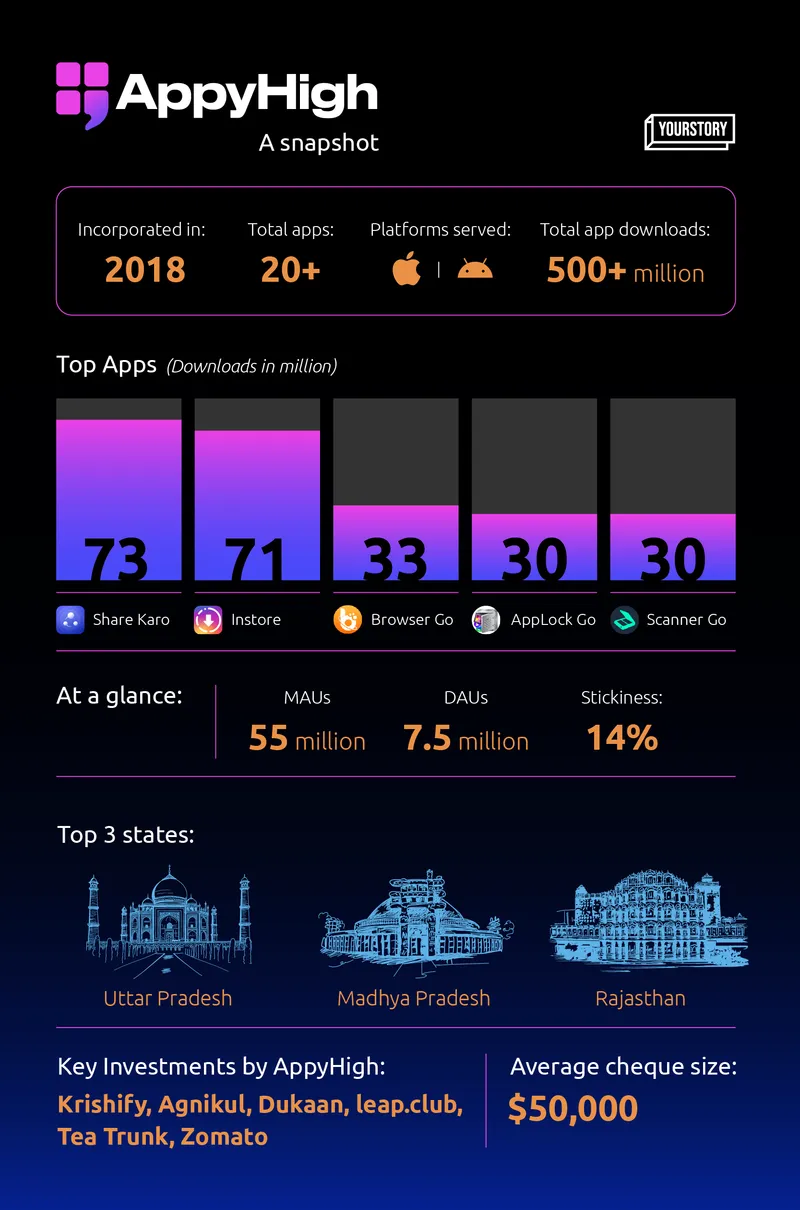

House of apps company AppyHigh, incorporated by Aneesh Rayancha and Venus Dhuria in 2018, has built a suite of 20+ productivity and utility apps with over 500 million downloads and 50 million active users.

In June 2020, India’s IT ministry, under Section 69 of the IT Act, banned 59 apps, including TikTok, ShareIt, UC Browser, Likee, WeChat, and Bigo Live. Since then, the government has banned many more Chinese apps, citing international conflicts as the most obvious reason, and paving the way for Made-in-India apps to grab the spotlight from their Chinese counterparts.

The ban created a huge void, and millions of internet users across India–especially in non-metro cities–began looking for alternatives that did the job just as well.

Gurugram-based house of apps was among those who decided to tap the burgeoning demand.

Incorporated by Aneesh Rayancha and Venus Dhuria in 2018, AppyHigh was already in the business of developing utility apps that targeted mass user segments from Tier II cities and beyond.

“There was a huge void out there,” Venus says. “We specifically picked products that matched our DNA, and focused on productivity, utility, and mass user play.”

Between July and September 2020, the company launched Share Karo India, Browser Go, and Scanner Go. These three apps have a total of 136 million downloads as of July 2022, and at least 20 million monthly active users (MAUs).

These apps, like many others on Google Play Store two years ago, tried to capture consumers using colours, logos, and a look and feel similar to the banned applications.

“When there is a void, people look for apps that were best in the market earlier. They always want a similar product,” Venus says.

Brands have spent millions of dollars in creating a brand identity and acquiring users. These users, in turn, relate specific apps to specific use cases. “This is like perception play,” Venus says.

For example, JioMeet looked similar to Zoom initially; Balaji Wafers uses similar colours as that of Lay's.

In this case, “the number was so huge that however much money you spent, you couldn’t acquire that kind of a user base. But, you can straightaway accelerate that acquisition by (letting users) relate to products that were already popular”, Venus says.

That’s what AppyHigh did, building on what it had been doing from 2017.

Getting started

Venus, a graduate from PEC Chandigarh, and Aneesh, an alumnus of IIT Bombay, met when they were working at Reckitt in 2012. They shared an interest in entrepreneurship and took the plunge in 2014 by launching Rutugo, an outstation cab aggregator. They expanded this service to 20 cities before selling the startup to Ixigo in 2015.

Rutugo was merged with the online travel portal and renamed Ixigo Cabs, which they headed and scaled to 10,000 bookings per day. The duo worked with Ixigo until 2016 until the integration was complete.

The idea behind Rutugo was a “SkyScanner, but for cabs”. This also inspired their next idea.

“People love productivity. People love saving time and saving money,” Venus says. “If you give them an all-in-one kind of a play in their day-to-day lives, they will immediately use it.”

The duo quit their jobs and got down to work. They launched multiple consumer apps, including jobs search engine AnyJob and shopping browser Smartshoppr, in 2017.

“Aneesh and I worked with freelancers/interns or in a revenue sharing model. We have never hired anybody, until we had the eureka moment,” Venus says.

The duo had struggled to raise money for Rutugo because of “negative market sentiment”. This made them sure that they didn’t want to raise capital immediately in their second stint.

“We thought we will first build a business,” he says. “Bohot ho gaya funding. Pehle dhanda banate hai. (Enough of funding. Let’s grow our business first).”

Aneesh recalls that the eureka moment was in 2018 when the startup scaled and generated more than $3 million in revenue. That was when the founders decided to incorporate the company and hire a team.

AppyHigh currently has a team of 135 people.

What it does

The founders use a digital analogy of Maslow’s hierarchy of needs to explain the apps and the audience they build for.

The base level of the pyramid comprises apps that help gain traffic, with people using them to scan, lock phones, change fonts, and clean residual data. The middle has apps that help you browse, post on social media, and edit videos while the top of the pyramid includes apps that allow users to share files and connect socially.

Most of these—part of the utility and productivity, creativity and design, and entertainment and content discovery categories—are products used by the masses.

AppyHigh, which aims to solve the digital needs of users in India, has launched over 20 apps, including AppLockGo, M Video Maker, SmartShoppr, Fonts App, QR Code Scanner, Screen Recorder, InStats, TV Lens, and Cleaner Go.

Its target audience is people who started using the internet in the last five-six years, and are now exploring further. For example, InStore allows users to post images, videos and stories, get hashtag and caption suggestions, and make collages and grids among other things.

AppyHigh apps have been downloaded more than 500 million times. A lot of consumers are common across apps, and the company says it has about 55 million monthly active users.

About 28% of users are from metros, and 53% hail from Tier II cities. About 40% of the app company’s user base comes from Hindi-speaking states: Uttar Pradesh, Madhya Pradesh, Rajasthan, Bihar, Haryana, Uttarakhand, Jharkhand, and Chhattisgarh.

“We are identifying gaps, [looking for] opportunities…and that’s where we are launching products,” Venus says.

AppyHigh, which aims to be the market leader for each of these categories, launched eight to nine apps in 2020. These witnessed greater adoption from a new set of users, driven by the pandemic.

Venus says its user base increased significantly after the first wave, with demand rising across apps including those that were launched pre-COVID-19.

The company says this user base has grown 10X since the pandemic.

He cites changing needs for the rise in demand. For example, most banks started doing digital KYC only after April 2020, which created a demand for document conversion and code scanner apps.

The company is following an approach similar to TikTok owner ByteDance, Xiaomi, and Cheetah Mobile. These companies created an ecosystem to bring in mass users. They launched further services after adoption, and then started monetisation.

Growing AppyHigh

The founders launched AppyHigh with an initial investment of Rs 5,000 and used the revenue as the seed capital for further growth. In FY21, the company generated a revenue of $8.6 million (Rs 64 crore).

Since then, the company has experimented with numerous apps, shutting down those that did not get enough traction or generate money. These included AnyJob and a news aggregator app, Samaachari.

All AppyHigh’s apps are free; it earns through advertisements.

Currently, majority of AppyHigh’s revenue comes from its top eight apps, which include Share Karo India, Instore, BrowserGo, AppLock Go, Scanner Go, QR Code Reader, and TV Lens.

It is also generating revenue through in-app purchases now.

“We are also building our data stream in-house, categorising users based on their actions and metadata, and will be able to improve monetisation going forward,” Aneesh says.

Along with growing its suite of apps, AppyHigh has since 2019 invested in more than 75 early-stage startups, with an average of 2.5 deals every month. Its portfolio includes the likes of Dukaan, Krishify, leap.club. Pankhuri, and OneImpression.

“It is more like an opportunity-driven corporate fund, with partnership opportunities. As much as 70-80% of our capital goes to startups that we have partnered with or plan to in the future,” Venus says.

“Our sweet spot is to enter at a very, very early stage because of our experience.”

The startup crossed an Annualised Recurring Revenue (ARR) of $10 million (about Rs 80 crore) in October 2021. Its revenues grew over 60 percent in 2021. In terms of ad impressions, it is growing at the rate of 300%.

“We want to reach a billion MAUs–a 20X scale-up–in the next five years,” Venus says.

Edited by Teja Lele