Axis Mutual Fund

View Brand PublisherDecoding how to leverage Low Duration Funds

Devang Shah, Co-head, Fixed Income, Axis Mutual Fund decodes the rising popularity of low duration funds. With multiple benefits Low Duration Funds are uniquely positioned to take advantage of the various market cycles.

Due to the increasing volatility in the market, investors are actively looking to create resilient and balanced portfolios that have the potential to weather multiple economic upheavals. In this endeavour, investors who wish to invest for short-term monetary requirements, can consider Low Duration Funds.

As the name suggests, Low Duration Funds invest in debt instruments with a duration between six to twelve months. In a rising interest rate environment, the mark to market losses on bonds is relatively less. Not only does this help in protecting investors’ returns, but also make Low Duration Funds a viable parking solution for investors and a good entry point for them to build their debt portfolio.

To help investors understand the various tenets of this category and the various nuances of building wealth in the short-term, YourStory spoke to Devang Shah, Co-head, Fixed Income, Axis Mutual Fund.

Here are the key takeaways from the conversation.

How does a Low Duration Fund work?

Low Duration Funds, as the name suggests, typically invest in short-term financial assets with a duration between 6‐12 months; meaning that they have a relatively low-interest rate risk.

“When interest rates rise, the mark to market loss on these bonds is relatively less,” said Devang. When interest rates increase, the funds cut back on duration to minimise capital losses, while simultaneously earning higher interest rates on new bonds.

Axis Mutual Fund’s bouquet of Low Duration Products

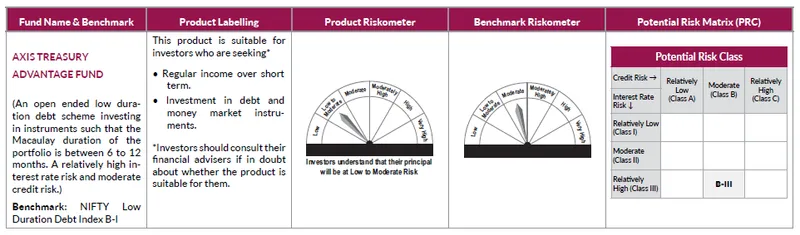

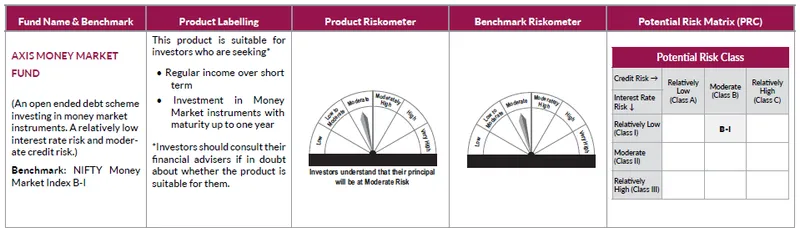

Devang also spoke about three Low Duration Funds by Axis Mutual Fund. These include: Axis Ultra Short Term Fund - an open-ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between three months and six months; A moderate interest rate risk and moderate credit risk, Axis Money Market Fund – an open-ended debt scheme investing in money market instruments; a relatively low interest rate risk and moderate credit risk, and finally, Axis Treasury Advantage Fund - an open-ended low duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between six to twelve months; a relatively high interest rate risk and moderate credit risk

“Typically, the decision of whether to invest in Low Duration Funds depends largely on the investor’s investment horizon. If the investment horizon is less than three months, they are advised to consider liquid to overnight category of funds. If the investment horizon is more than three months but less than twelve months, investors are advised to consider Low Duration Funds in the Ultra Short Term or Money Market categories,” said Devang.

Factors to consider before investing in Low Duration Funds

Typically, investors consider Low Duration Funds as parking solutions. An important question to understand, therefore, is when is the right time to make the shift from liquid to low duration funds. “A key factor that an investor should look into, while investing into the low duration category, is the gap in Yield to Maturity (YTM) between liquid and other low duration categories,” said Devang, while adding that understanding yield gaps are also important to study from a risk-reward perspective.

“Another important parameter to consider is the banking system liquidity. When the interest rate cycle is on the rise, one can park their money into low duration categories. Once the rate hikes are behind us, investors should typically shift their money from these low duration categories and manoeuvre them towards short- to medium-term funds where the investment horizon is two to three years,” he advised.

Negotiating the market volatility

“If one were to look at the underlying securities in low duration funds, most of them are maturing in the six to twelve-month period, making them relatively less sensitive to rising interest rates. Currently, we are witnessing steep rate increases which makes lower duration funds a good entry point for investor looking for some solution against volatility. Typically, duration acts like a hedge in a rising rate environment. Our understanding is that, the current market environment is good for short- to medium-term funds,” said Devang, explaining the relevance of these funds for investors looking to deal with market volatility.

“For investors who are just looking at parking solutions, Ultra short-term low duration funds make a lot of sense,” he said.

“However, for investors who are looking at medium-term solutions, with an investment horizon of between one and three years, short-term, medium-term funds, and target maturity funds, typically make a lot of sense at this point of time” he added.

You can visit Axis Mutual Fund’s website www.axismf.com or download mobile app ‘Axis Mutual Fund’ (Android/IOS) and start your investment journey now.

Source: Axis MF Research

Product Labelling*:

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds, portfolio management services and alternative investments.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.