bhive

View Brand PublisherWhy Indians are slowly choosing commercial real estate over residential as investments

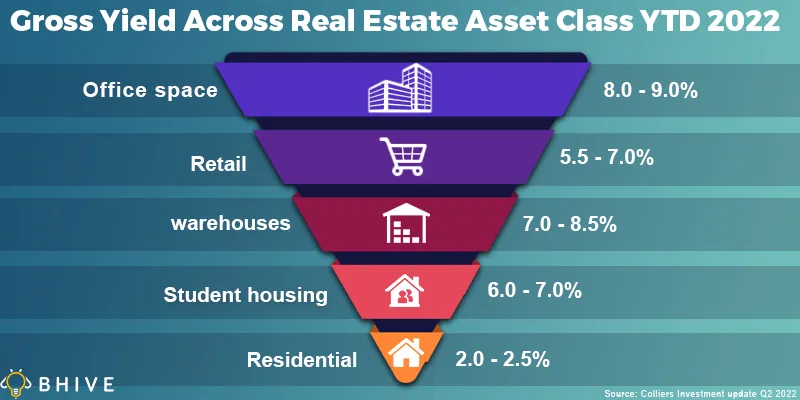

Given its capacity to generate a consistent income flow in the form of rentals and that it is one of the best investments for passive income, Indian real estate investors - particularly from the younger generation - are warming up towards commercial real estate as an investment class.

Since ages, gold and homes have been the preferred bet for retail investors who considered these instruments safe as against other forms of investments. This also formed the premise of the Indian real estate industry which now boasts of millions of residential units across the country. However, the emergence of newer tools such as Real Estate Investment Trusts, investing in stocks of listed companies, and fractional ownership have resulted in the younger generation gravitating towards commercial real estate (CRE).

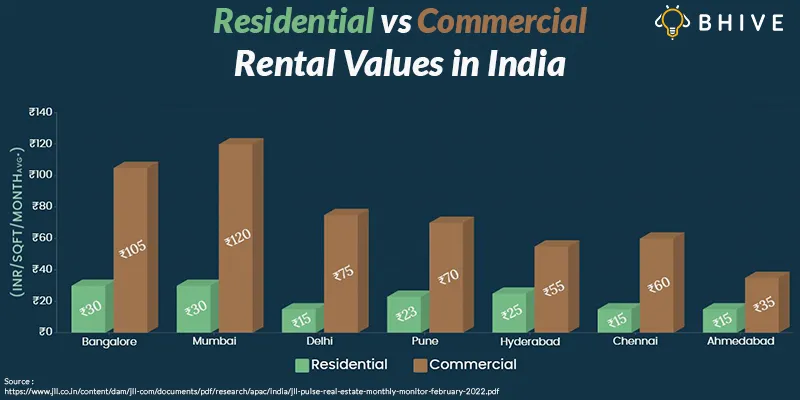

Why? Simply put, commercial real estate offers 3x more returns than residential real estate. As per industry research, the annual rental appreciation for commercial properties has been in the range of 8-11 percent as against residential which grew between 1.5 to 3.5 percent. That being said, both residential and commercial are equally important and effective investment instruments.

Choice between priorities and aspirations

A house is the third important pillar of the roti-kapda-makaan trinity (food, clothing and shelter), an adage popularised and iconised by the movie of the same name and has been both a necessity and priority for Indians. The COVID-19 pandemic has simply cemented the need to own a house as the world becomes more and more uncertain. This love for houses also propelled retail investors to own a second house to expand their portfolio of investments, avail tax rebates, and own a vacation house, among the various factors.

While buying a house remains the top priority for retail investors looking to invest in real estate, commercial real estate has been an aspirational investment for the retail class. This is primarily because of the high entry level investment required, the exposure to CRE only in major metros, and lack of awareness about quality assets. And that’s where the new age tools such as REITs, fractional ownership, stock market ownership etc, have enabled retail investors to participate even with low ticket sizes. This, coupled with commercial real estate expanding its presence in Tier-II and III cities post the pandemic, has offered a great opportunity for retail investors to make a bet on the commercial real estate.

Generational differences in real estate purchases

Interestingly, industry reports suggest that it’s the younger generation who is leading this change with digital means of investment enabling them to choose from a wide array of options.

According to ANAROCK’s consumer sentiments survey H2 2021, the percentage of those serious about buying homes in the 45-and-under age group has risen considerably in 2021 (67 percent) when compared to the 1990s and the 2000s.

This represents a considerable shift in general preferences from the early 90s when real estate buying was led by the 45-55 age group who preferred buying homes using savings and the 2000s where buyers in the 35-45 age bracket saw the most buyers motivated by improved tax benefits and easier access to home loans. The early 2000s however saw minimal participation from the 25-35 age group - a trend that appears to be reversed today where the 25 percent of respondents from the 25-35 age group were serious about buying houses.

Slowdown of residential real estate investment in India

Weak price growth since 2014 has dragged down returns on residential real estate investments in India. In fact, the compounded annual growth rate for residential real estate investment fell by 0.7 and 0.5 percent in the Mumbai Metropolitan region and the National Capital Region respectively.

Also, while low price rises and higher incomes have improved housing affordability in Indian cities since 2014, rents have stayed stable or grown only marginally and therefore rental income (chart below).

Commercial pips residential in rental, long-term returns

The past decade has institutionalised the concept of passive income and swathes of retail investors are turning to real estate, particularly residential, in search of continuous monthly incomes. While both asset classes come with their pros and cons, it’s the CRE which takes the cake with far superior benefits than residential, namely higher annual rental appreciation in the range of 8-11 percent on average, lifetime appreciation for asset value over residential which tends to depreciate after a certain timeline, and demand which continues to surpass supply, indicating greater long-term returns.

In all totality, both asset classes cater to a variety of needs of various sets of retail investors and are helpful in hedging against uncertainties, natural or man made. And with the COVID-19 pandemic ensuring only serious players with quality assets get to play, it’s a treat for investors in the long run looking to invest in either of the asset classes and reap the benefits of growth of one of the world’s fastest growing real estate industries.