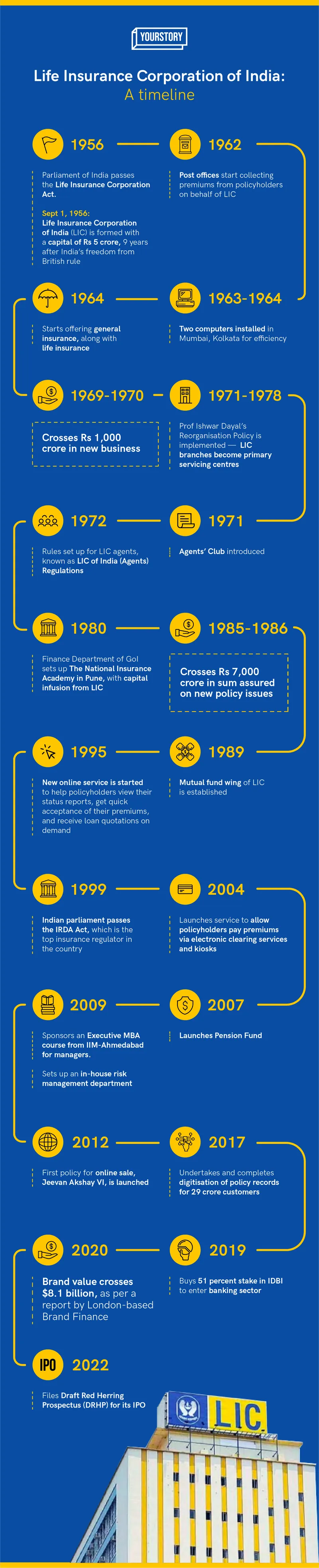

While LIC is going public, take a look at some key moments in the insurer's history

LIC, the country's biggest life insurer, has over 13 lakh agents who help people sign up for insurance policies. The state-owned insurer was formed after the government took over the 240-odd private insurers that were operating in the country.

Life Insurance Corporation (LIC) of India opened its much-anticipated $2.7 billion initial public offering (IPO) for subscription on Wednesday, following strong demand from domestic mutual funds who have been allocated 71.12 percent of the total book.

Conscripted to be India's biggest IPO to date, LIC is reportedly commanding a premium of Rs 60-65 apiece for its shares in the grey market - nearly 7 percent higher than the upper end of the IPO price-band of Rs 902 to Rs 949 apiece.

The government is selling 3.5 percent stake in the insurer, and hopes to raise around Rs 21,000 crore from the phased divestment. Its shares will start trading on the exchanges on May 17, a week after its books close.

Earlier, the plan was to sell a 5 percent stake - but the IPO had to be truncated following uncertainties around the Ukraine-Russia war and bearish global markets.

Even at 3.5 percent, LIC's IPO is historic. It's the biggest in the country, exceeding the Rs 18,300 crore IPO from -operator One97 Communications, which listed in November 2021. The insurer has carved out special subscription rates for policyholders and employees, encouraging people to be part of LIC's growth journey as shareholders in it.

Here's a quick look at LIC's journey so far since it was founded 66 years ago:

(Design credit: Daisy Mahadevan, Team Design @ YourStory)