[The Turning Point] How cloud kitchen startup Curefoods followed Thrasio model to step up its D2C play

The Turning Point is a series of short articles that focuses on the moment when an entrepreneur hits upon their winning idea. Today, we look at cloud kitchen startup Curefoods, which recently merged with foodtech player Maverix.

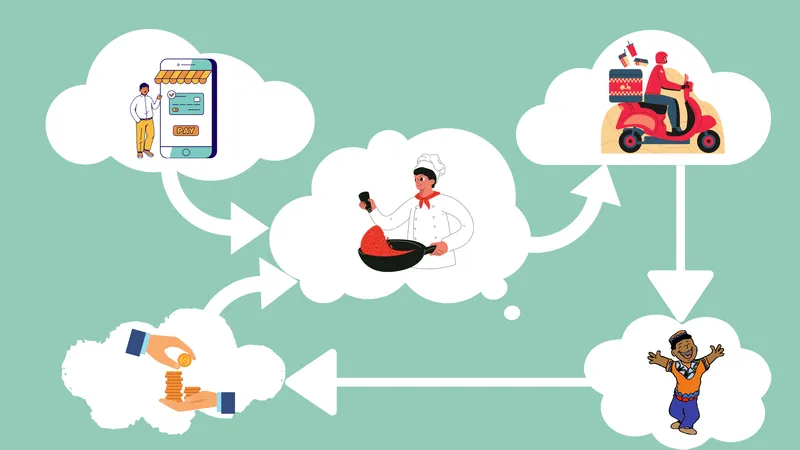

The pandemic has triggered the rise of cloud kitchens in India. , a network of cloud kitchens, recently announced a merger with Maverix, a Mumbai-based foodtech player, making it the second-largest cloud kitchen player in India in terms of footprint.

Founded by former executive and Cultfit founder Ankit Nagori, the startup, with a Thrasio-like model, acquires cloud kitchen brands across different cities and helps them scale their business.

Curefoods is now at the cusp of two fast-growing business segments, which are cloud kitchens and roll-up commerce.

“At Curefoods, we are on an ambitious path to build the strongest food brands in the market with a digital-first strategy,” says Ankit.

“Together with Maverix, we now have the largest manufacturing capability in the fresh food space. We are confident that our combined growth and stronger-than-ever platform will benefit our consumers on their quest for the best food options in India,” he adds.

The light-bulb moment

According to Ankit, “between the first two waves of Covid-19, Curefoods re-jigged its approach and added YumLane and Aligarh House to the company, which yielded immediate benefits.”

“We realised instantly that a pizza and a biryani brand did very well between the waves, indicating that people were ordering in much more as a proxy to eating out. They were ordering in for celebrations and entertainment. From this learning, we arrived at our current House of Brands model, which seeks to cater to all eating occasions with a truly diverse range of offerings,” he adds.

Prior to this, Curefoods had a single brand approach and only worked with Eatfit, a food delivery platform, which was spun off as an independent entity from Curefit in October 2020.

The pandemic led to a lot more people ordering in food as it was a safer option. Curefoods researched everything - from consumer behaviour to changing trends - and strategically planned to move forward with this business plan.

House of Brands

Executive-turned-entrepreneur Ankit Nagori has been on a deal-making spree since he started Curefoods. Late in 2021, Curefoods acquired many D2C food brands across India, including Mumbai-based legacy pizza brand Juno’s Pizza, Bengaluru-based Cupcake Noggins, Bengaluru-based organic ice cream brand Iceberg, Delhi-based pizza delivery startup Nomad Pizzas, and Jaipur-based multi-brand cloud kitchen company White Kitchens in a House of Brands model.

“The most important metric in this business is orders per kitchen, much like revenue per square foot and the number of footfalls in malls. You need multiple brands, which people can order from at different occasions,” says Ankit.

In October 2021, the startup acquired 7 food brands - CakeZone, MasalaBox, Paratha Box, Ammi’s Biryani, two Hyderabad-based pizza brands — Olio and Crusto, and Chaat Street - which had brought the total number of brands to 15.

After the merger with Maverix, Curefoods has assimilated marquee brands including Great Indian Khichdi, Canteen Central, and Home Plate.

Last month, Curefoods raised $62 million in a fresh round of funding. While $52 million was raised in equity funding from Iron Pillar, Chiratae Ventures, Sixteenth Street Capital, Accel Partners, and Flipkart founder Binny Bansal, $10 million came in debt financing from Alteria Capital, BlackSoil Capital, and Trifecta.

The startup hopes to be a fully profitable company by the end of the year, Ankit tells YourStory.

At present, Curefoods has presence across 12 cities, catering to over 10 cuisines with 125 kitchens.

Edited by Megha Reddy

![[The Turning Point] How cloud kitchen startup Curefoods followed Thrasio model to step up its D2C play](https://images.yourstory.com/cs/2/4d03ae105be411ebb93d1523d01d233d/ImageBranding-Amisha7-1643981612906.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)