Axis Mutual Fund

View Brand PublisherHow you can be invested in some of India’s largest listed companies with the Axis Nifty Next 50 Index Fund

In an engaging fireside chat, Ashwin Patni, Head Products and Alternatives, Axis AMC spoke to YourStory about Axis Mutual Fund’s net wealth creation tool – Axis Nifty Next 50 Index Fund– an open-ended index fund tracking the Nifty Next 50 Index to help investors access the Nifty Next 50, and what it

The stunning rise in the stock market in 2021 has gotten more investors excited about equities – and it shows in the numbers. India’s Demat account holders more than doubled in three years to 7.38 crore as of October 2021.

The optimism in the market has led several investors to explore different mutual fund categories in accordance with their risk appetite and requirements. The mutual fund industry crossed a milestone of 10 crore folios in May 2021. In September 2021, the average assets under management (AAUM) of the Indian mutual funds industry stood at INR 37,40,791 crore.

Speaking of the India growth story, one of the mutual fund categories that have been drawing investor interest is the Nifty Next 50.

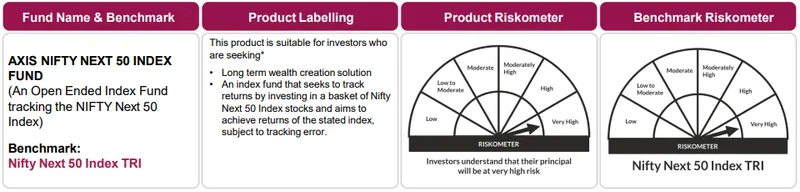

To help investors access the Nifty Next 50 index, Axis Mutual Fund has launched a new index fund, Axis Nifty Next 50 Index Fund, which tracks returns by investing in a basket of Nifty Next 50 stocks. The open-ended fund is suitable for investors who are looking for a long-term wealth creation solution.

In an engaging fireside chat, Ashwin Patni, Head Products and Alternatives, Axis AMC spoke to YourStory about Axis Mutual Fund’s new scheme and what it has to offer investors.

Here are the key takeaways:

Investing in India’s next generation market leaders

Simply put, the Axis Nifty Next 50 Index Fund gives an investor the vehicle to invest in a collection of companies that have the scope to become market heavyweights’ and are potential candidates for inclusion into the Nifty 50 index. In fact, over the last 18 years, more than 40 stocks have been upgraded to Nifty 50 - giving investors a chance to be part of a unique potential growth story.

“It's a really interesting space,” says Ashwin, talking about how the fund is all about the next generation of market leaders. “Because these companies are already reasonably large, with the ability to grow further and even get to the top of the pyramid,” he adds.

What makes Axis MF’s Nifty Next 50 Index Fund stand out?

“At Axis, we stand for true-to-label products and high quality execution. We are also extremely focused on minimising risk in every aspect of our process and running very tightly managed portfolios, as far as tracking, etc, is concerned,” says Ashwin on what sets the Axis Nifty Next 50 Index Fund apart from the rest.

“I believe that when investors come to access products, they can come in with the comfort that they will get something which is very close to the basket, with an extremely sharp focus on efficient execution and minimising tracking error,” he adds.

The advantages of being passively managed

Talking about the key benefits and reasons for popularity of the passively managed index funds, Ashwin says, “With an active portfolio, you constantly revisit the companies on a daily, weekly or monthly basis. Passive portfolios, on the other hand, are relatively stable, and the baskets tend to be fairly anchored over a period of time.”

“The advantage of a passive product is that it's very easy and transparent in terms of what it is trying to do. Simple, transparent, and stable portfolios – that's what passively-managed portfolios essentially stand for,” he adds.

A cost-effective investment option

Talking about how its minimum initial investment amount of just INR 5,000, lower expenses, a nil exit load made the fund a truly cost effective investment option for all classes of investors, Ashwin says, “It's really simple. You could invest a few 1,000 rupees, you could invest a few lakhs, or you could invest a few crores. That's the beauty of the mutual fund vehicle.”

“There are also a plethora of options, from apps to websites to distributors and investment advisors who also offer this product to investors,'' adds Ashwin, speaking about how investors could access the fund, based on their comfort level.

Ashwin also equated investing in mutual funds to taking a subscription service. “When you take a subscription, you do the groundwork, right, you understand why you're taking it, what is the objective? What is the horizon? Do the same homework for a mutual fund,” he advises.

The Axis Nifty Next 50 Index Fund NFO opened on 7th January and closes on 21st January 2022.

Source: NIFTY Indices, AMFI, Axis MF Research data as on 30th November 2021

Product Labelling:

(The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or the model portfolio and the same may vary post NFO when actual investments are made)

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds, portfolio management services and alternative investments.

NSE Indices Limited Disclaimer: The Axis Nifty Next 50 Index Fund (Products) are not sponsored, endorsed, sold or promoted by NSE INDICES LIMITED (formerly known as India Index Services & Products Limited ("IISL"). NSE INDICES LIMITED does not make any representation or warranty, express or implied, to the owners of the Axis Nifty Next 50 Index Fund or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly or the ability of the NIFTY 50 Index to track general stock market performance in India. The relationship of NSE INDICES LIMITED to the Issuer is only in respect of the licensing of the Indices and certain trademarks and trade names associated with such Indices which is determined, composed and calculated by NSE INDICES LIMITED without regard to the Issuer or the Product(s). NSE INDICES LIMITED does not have any obligation to take the needs of the Issuer or the owners of the Product(s) into consideration in determining, composing or calculating the NIFTY 50 Index. NSE INDICES LIMITED is not responsible for or has participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. NSE INDICES LIMITED has no obligation or liability in connection with the administration, marketing or trading of the Product(s). NSE INDICES LIMITED do not guarantee the accuracy and/or the completeness of the NIFTY 50 Index or any data included therein and NSE INDICES LIMITED shall have not have any responsibility or liability for any errors, omissions, or interruptions therein. NSE INDICES LIMITED does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the NIFTY 50 Index or any data included therein. NSE INDICES LIMITED makes no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE INDICES LIMITED expressly disclaim any and all liability for any claims, damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages. An investor, by subscribing or purchasing an interest in the Product(s), will be regarded as having acknowledged, understood and accepted the disclaimer referred to in Clauses above and will be bound by it.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.