Why more restaurants are preferring to go digital, and away from third-party aggregators

To save on commissions paid to food aggregators, a few branded and fine-dining restaurants have established in-house delivery platforms. This does help for the time being, but how feasible is this in the long fight against the pandemic?

The second wave of Covid-19 has had an harrowing impact on every citizen in the country. If not health wise, many people have had to suffer due to failing businesses or loss of livelihoods. The hospitality industry in particular has been affected severely, with scores of restaurants closing down during the first wave in 2020.

Delhi-based chef Radhika Khandelwal, who owned two fine-dining restaurants, had to shut one down last year due to Covid-led lockdowns, but that did not really affect her sense of optimism. This year though, the story is different. The second wave has caught individuals and businesses unawares, and its resultant restrictions have hit the industry pretty hard.

Dine-in restaurants across India have been facing major challenges due to night curfews. A major chunk of their business comes from customers visiting their restaurants instead of ordering in.

“When things started to open up in November last year, we were seeing signs of recovery, and we thought that the worst was behind us. But now, with a new set of restrictions and night curfews, running our business is very hard,” says Radhika, who runs Fig and Maple, a fine dining restaurant in Delhi.

Restaurants reach out

Radhika recently released a fervent plea on her Instagram account requesting guests to call the restaurant directly instead of placing orders through food delivery platforms. “The response was extremely good and I think I will urge more customers to order from us directly,” she adds.

And Radhika is not the only one who has been thinking on similar lines.

One of India’s top restaurant companies, Impresario Entertainment and Hospitality Pvt. Ltd (IEHPL), launched a platform last year in June, offering in-house deliveries across their brands including Social, Smoke House Deli and Salt Water Cafe.

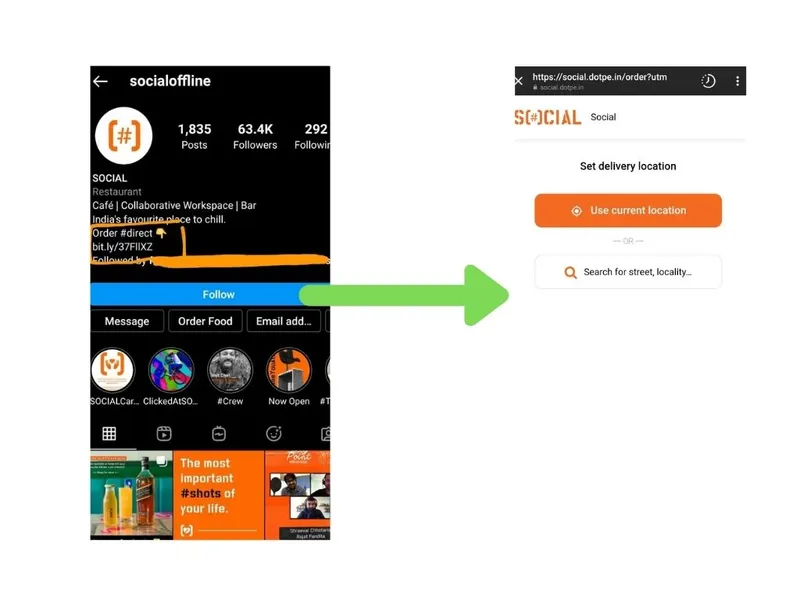

Impresario's restaurant brand Social draws in online orders through their official page on Instagram

“We are asking customers to order directly from us. This eliminates another layer of interaction and helps restaurants build a direct relationship with their customers,” says Riyaaz Amlani, CEO and MD of Impresario, over a call.

The 57-restaurant chain started using their on-ground staff, who used to work as waiters, as delivery personnels, and also brought in discounts of up to 25 percent to attract customers on to their platform.

Mumbai-based Hunger Inc. Hospitality also started their in-house delivery service last year. “As soon as the lockdowns came in place, we knew things were going to change. I sat down with my team in the beginning of April 2020, and zeroed down on our food menu. We brought in an online bakery and Indian Chinese delivery popup, and within two days, we started testing our platform and services,” says Sameer Seth, founder and CEO, Hunger Inc.

The menu changes every few months to bring in more fresh offerings. The restaurant company owns three brands-- local seasonal restaurant brand The Bombay Canteen, Goan restaurant O Pedro, and Indian traditional sweets brand Bombay Sweet Shop.

Sameer says that when the second lockdown came into place, although they were more prepared to cater to people ordering-in, by no means has it been replicating dine-in revenues.

In Radhika’s case, the order value goes up from Rs 2,000 to Rs 4,000 when people come to restaurants as against ordering a delivery. “People can only have so much food but when they order alcoholic beverages while dining in, they spend more time and the order value shoots up,” Radhika adds.

Food deliveries only make up about 10-15 percent of the business of the total restaurant market pie. On top of that, food delivery companies like Swiggy and Zomato charge a commission between 20-25 percent, which could go up to 30 percent if restaurants advertise on the platform.

To save on these commissions, many restaurants have started offering in-house deliveries. This also helps them in retaining some of their staff.

Will it work in the long run?

But are restaurants able to match professional delivery service reach? This is how they tackle this - for long distance deliveries, restaurants partner with micro delivery platforms like Dunzo and WeFast. “We keep our average order value a bit higher and also charge delivery fees from customers for long distance delivery,” says Sameer.

To be sure, all restaurants mentioned in this story are also delivering through Zomato and Swiggy. Their in-house delivery is just another channel for them to decrease dependency on food aggregators and also build their own customer base.

A detailed questionnaire sent to Swiggy and Zomato to understand their perspective on this developing trend did not elicit much response. While Swiggy said they would not be able to participate in the story, Zomato did not respond to the email.

Partnering with delivery platforms is a great way to cope for quick-service restaurants and cloud kitchens, as they were built to cater to online orders and deliveries.

So while food aggregators give restaurateurs a good customer base and order volumes, in the current times, paying commissions to aggregators is taking away from revenues of dine-in restaurants. Primarily because restaurants are built keeping customer visits in mind. Their expenses include on-ground staff, kitchen staff, renting out a bigger place with seating arrangements, setting up a bar, and more.

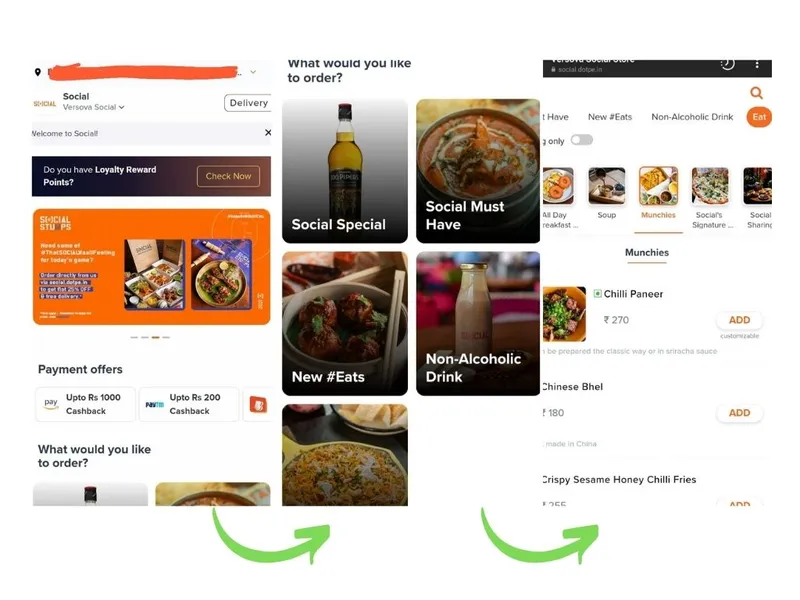

The website looks very similar to a food delivery aggregator's platform

“I think it is a lost cause,” says Arvind Singhal, chairman at Technopak Advisors, a market consultancy firm. “These in-house deliveries can work for big branded restaurants but most of the industry falls under the unorganised sector who cannot afford to have a tech-enabled platform. They cannot partner with third party micro delivery players for long distance deliveries,” he added.

According to data shared by Technopak Advisors, 41 percent of the industry comprises restaurant chains and organised standalone restaurants.

Zomato and Swiggy provide an array of restaurants for the audience to order from, and attractive discounts during mega events like IPL, which attract customers who rarely have brand loyalty.

As of now, the food delivery market is a duopoly with Zomato and Swiggy catering to the majority market. Cab-hailing platform, Uber, did try to work in the Indian market but ended up selling its stake to Zomato last year.

But the landscape could change once Amazon starts its food delivery services. The marketplace giant is set to charge lower commissions from restaurant partners and also offer deep discounts.

This development could also be beneficial for those restaurants who cannot develop their own online platforms, and are struggling to make ends meet during the pandemic.

Edited by Anju Narayanan