What proptech startups want: a Brigade REAP survey builds a case

The real estate industry is slowing waking up to the benefits of technology, which means that proptech startups have a huge opportunity to tap. But what do India’s proptech startups need to succeed? Brigade REAP ran a survey to investigate this.

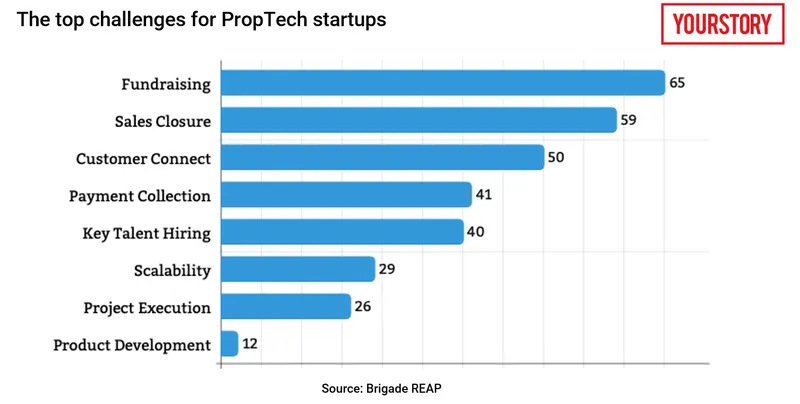

Real estate startups, just like startups in other sectors, are struggling to raise funds. Over 65 percent of startups surveyed by Brigade REAP, a real estate-focused startup accelerator programme, said that fund-raising was their biggest problem.

The second key challenge was something that can prove to be a huge obstacle for any company – getting the right connect at a potential customer.

An arm of the Brigade Group, a major real estate player in South India, Brigade REAP was established to bring in innovation and agility in the real estate, retail and hospitality industry. The first cohort was launched in October 2016 and the programme has mentored 24 startups since then and interacted with over 2,000. The fifth cohort had its Demo Day late last month.

Ankur Nandi, Sr Investment Analyst at Brigade REAP, points out that the real estate industry has traditionally lagged in terms of adopting innovative and disruptive technologies.

“Labour productivity has been stagnating for decades and projects going over budget by as much as 80 percent is fairly common. The sector is waking up to the benefits of technology for reducing wastage and improving efficiencies. Proptech startups have a golden opportunity to revolutionalise the real estate sector with their offerings.”

However, having mentored multiple startups, they realised that there is a lot of difference between what the industry demands and what startups are offering.

“To bridge this gap, it was critical to get to get a better understanding of the startups’ expectation from the real estate industry,” Ankur explains.

In order to uncover these expectations and to gain lateral insights, Brigade REAP conducted a purpose-built survey spanning over 100 startups of different types – from those with just a prototype to those who had raised external funding.

What the survey found

Sixty-five percent of startups surveyed ranked fund-raising as their top challenge. The group at Brigade REAP dug a little deeper to discover what were the key requirements that startups needed to fulfil to be able to raise money.

“We found five key factors,” says Ankur. These were:

- An innovative solution for a pressing problem

- A balanced, competent and ambitious team

- Clarity on roadmap – business and product

- A large addressable market, and

- A well-thought-out pricing model and some traction with potential clients

The next big challenge, the survey found, was sales closure (the top-ranking challenge for 59 percent of respondents), followed by customer connect (55 percent).

Given that the proptech segment is somewhat nascent, startups in this area struggle to close deals for a variety of reasons.

“We found startups suffered from a distinct lack of clarity about who their customer is – within the client organisation. They are not sure who they can approach and don’t know who the decision-makers are,” explains Ankur.

And when they do, they face the classic problem of lack of credibility, the survey found. This is a double-edged sword.

- Firstly, early-stage startups may not have the right business and pricing models, which tends to put off established real estate players.

- Secondly, even when the pricing, etc. fits, the failure rates of startups escalates the risk in the client’s mind.

As a report by the IBM Institute for Business Value and Oxford Economics, found, close to 90 percent of startups fail within the first five years. A startup, by definition, is young. In a time-intensive business like real estate, clients are often unwilling to take the risk that a startup may not survive the duration of the project.

Then there is the problem of being unfamiliar with the nuances of the complex and massive industry that real estate is.

“When a startup diligently pays attention to all these areas, we see that it starts attracting not only investors, but interest from the right kind of investors for the growth of their business. We have seen this play out multiple times through the companies that we have mentored through our five cohorts so far,” adds Ankur.

What else do proptech startups struggle with?

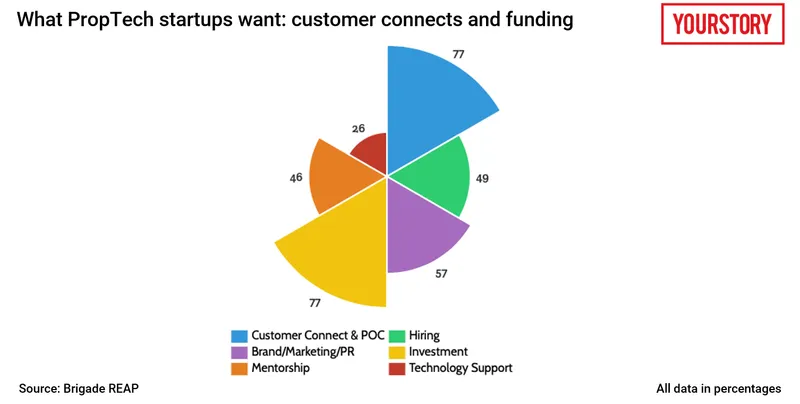

According to the survey, startups struggle with three more areas in the following order of priority.

- Brand building – to increase visibility and credibility

- Hiring key resources, resource planning, and devising a team structure

- Mentorship – startups know what their weaknesses are and want help to address these problems.

“The findings reinforce common wisdom about the wide range of opportunities that startups could exploit in the real estate and construction industry,” points out Ankur.

Is the real estate industry ready to adopt tech and work with startups?

Tech is yet to become an integral part of the real estate industry. As per a 2016 study by McKinsey & co, the sector deploys less than 1 percent of revenue on technology. This resonates with the startups’ opinion that real estate players have been slow in the rate of technology adoption, which translates into a relatively large potential customer pool and an underutilised market.

The survey found that two out of every three startups believe that technology adoption is limited to a few players only. This emboldens them to go after the large customer base that they perceive to be still unserved by technological and material innovation.

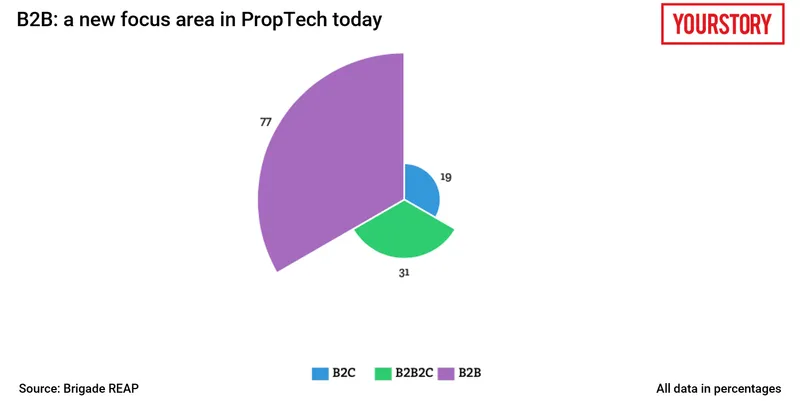

While a majority of the early proptech startups such as Housing.com, No Broker and Magic Bricks squarely operated in the B2C segment, the segment has rapidly evolved in the past few years. The novelty of aggregation businesses and marketplaces has also worn off, both with startups as well as investors.

Over 80 percent of proptech startups surveyed are aggressively targeting the B2B and B2B2C segments. This is also in sync with the broader market scenario.

“We firmly believe that marketplace businesses suffer from too many players with little differentiation between them. This has been proven by consolidations and business closures in this space. This market scenario has given rise to a number of promising startups that focus exclusively on the B2B or B2B2C space, where there is a lot more clarity around pain points than before,” explains Ankur.

Commenting on how the bulk of companies surveyed were three years old, he said, “Our explanation for that is that the initial novelty of transformation of traditional businesses and business processes over to digital has worn off and that industry has seen a lot of consolidation. The B2C segment in the proptech world has already been exploited. The industry is looking out for real solutions that can solve some real world problems from the real estate industry. Any aspiring proptech startup must possess a disruptive technology that can help the industry battle some of the crucial problems in arrears where there is less or no tech intervention.”

Are proptech startups generating revenue?

Yes, proptech startups are generating revenues. The survey found that a good number of startups are posting aggressive growth numbers (see figure below), quite possibly as a direct result of the shift to the B2B segment. “Businesses look at startups as a bonafide means of introducing innovation and a way for businesses to remove traditional inefficiencies and leakages,” adds Ankur.

As Ankur puts it, “This survey has reinforced the belief that the proptech industry is healthy and growing. The emergence of proptech startups has also forced the industry to take a hard look at traditional wastage, expenditure, and inefficiency. At the same time, they have allowed customers to make better decisions with the aid of all the technology and data that is on offer.”