Here's how a good payroll management system can benefit your startup in the long run

If hiring the right team is one of the key pillars of your business, then having a good system in place that helps you manage the team efficiently is another. This article is a step-by-step guide to help you understand how a good payroll management system can manage your business efficiently.

You had this one brilliant idea. An epiphany of sorts that only you experienced. You wrote about it, thought about it, and dreamt about it. For a few months that followed, there was nothing else that mattered more to you than working on that one idea.

After months of this relentless pursuit, your idea finally begins to take shape. You decide to take that leap and get started. You have now set up shop and your business is up and running.

This is typically how most of the new ventures are born.

But what sets a few promising new ventures apart from many businesses that come and go is this: a business’ decision with regard to how it chooses to handle it’s hiring requirements and it’s administrative tasks.

A new venture’s success heavily depends on these two variables. If hiring the right team is one of the key pillars of your business, then having a good system in place that helps you manage the team efficiently is another.

If you have successfully juggled many roles and helped your business stand on its own feet, you are probably looking to grow. Congratulations on getting this far!

Now, it’s time for you to hire your very first (or first few) employee(s).

And this is where a good Payroll Management System comes into the picture.

As Peter Drucker, the father of management thinking, famously said, “what gets measured, gets managed.”

A good Payroll Management System becomes a very vital element in the way you conduct your business’ administrative tasks.

Now that we have learnt the importance of having a good payroll process in place, let’s understand what a Payroll Management System actually is?

What is a Payroll Management Process?

A payroll management system is a tool - predominantly a software program - that enables your business to handle all your employee’s financial records in a hassle-free, automated fashion. This includes employee’s salaries, bonuses, deductions, net pay, and generation of pay-slips for a specific period.

Why do you need a payroll process for your business?

As you would have already realised, your business activities are primarily divided into two broad categories: the macro and the micro.

The macro here refers to the broader and big picture stuff. These are the activities that aid the long-term vision of your organisation. Your business development strategy, sales, revenue, cash flow, etc., fall under this category.

The micro refers to the everyday administrative chores that fuel the day-to-day operations of your business. Although these tasks seem mundane and repetitive, they are just as important to keep your business running like a well-oiled machine.

By having a payroll process in place, you are essentially automating a few of those micro administrative tasks so that you have the mental bandwidth to focus on the macro.

You don’t have to worry about manually handling things like generating pay-slips, calculating tax deductions and so on. All of this can be automated by using a payroll management system.

Before I go further and talk about the kind of payroll systems that are available in the market and how to choose one, let’s take a look at some key benefits of using a reliable payroll process

Key benefits of a payroll management system

There are several benefits of implementing a service like this for your business. Some of them have been briefly highlighted below:

- Employee morale - By making sure your employees are paid in a systematic and timely manner, you are reinforcing their faith in your business’ financial integrity. This will boost employee morale and motivate them to perform better.

- Statutory compliance - This refers to the legal framework your business must adhere to. As an employer, you are required to maintain various payroll and payment records of your employees. Every organisation that hires employees and pays salaries must comply with the labour laws. By having a payroll process in place, you are automatically complying with the employment and labour laws in India.

- Manage employee information efficiently - You will be able to accurately store and manage all your employee information in one place. There will be no need to use any additional tool for this purpose.

- Generate reports related to employee attendance, salary structure, etc. - A good payroll system will facilitate this process seamlessly. This can be extremely valuable when you are looking to retrieve information for any queries related to these matters.

- Startup friendly - As a new business, you may not have enough budget to allocate to every aspect of your business. Most of the payroll services are free for the initial few employees or charge a minimal fee; making it easy for you to afford setting up a service like this.

- Time-saving - Since everything in a payroll management system is automated, you will be saving a lot of time. You don’t have to manually enter the information for every cycle. You set it up once and let the software handle the rest. The only thing you will probably do is new employee registration for every new hire.

- Plan for the future - Most of the payroll management services provide a forecast feature. You can use this to plan staff costs and other relevant expenses. This will help you get a good picture of how much your business should be making in order to accommodate all the expenses and still operate profitably.

Key features for selecting a Payroll Management Service

There are a few features that are an absolute must; irrespective of the size of your business.

When you are deciding between multiple payroll products, please ensure that all (or most) of the features mentioned below are included.

Easy setup and on-boarding

A payroll service you choose to work with should be easy to set up without a lot of technical difficulties. Employee on-boarding should be smooth and seamless.

Even if you are someone who hasn’t done any of this before, the service should enable you to figure out all of this intuitively or with the help of a comprehensive checklist. Most of them should be able to provide one-click solutions.

Automatic payrolls/payslips

It should have the ability to automatically compute and process payrolls accurately for each payment period. It should also generate customised payslips and also enable direct deposits into your employee’s bank accounts.

Run on the cloud

The service should be able to run on the cloud and give you the flexibility to access it from anywhere and from your shortlisted devices. This way, you will still be able to administer timely payouts even if you are busy with other obligations.

Personalised salary components and structure

You should be able to input different salary components such as earnings, allowances, deductions, and reimbursements for multiple employees with varying pay grades. You should be able to clearly establish your company’s salary structure.

Inbuilt compliance

It should enable auto calculations of deductions such as Provident Fund, Professional Tax, ESI, Income Tax, etc. Many of these tax laws are dynamic and can change from time to time. The service you choose should adapt accordingly and make precise calculations.

Tax filing

Both your business and your employees should be able to effortlessly file for tax declarations directly from your payroll portal.

Reporting tools

It should help you generate multiple reports based on your requirements. An example would be a reconciliation report or a summary of professional tax report and the likes.

Employee self-service portal

An ideal product should also have an employee self-service portal that can be accessed by your people. This is important as it will allow them to keep track of their salary payments, tax deductions, and other important information in one place. This will also help them update their address and contact information if any changes occur.

Employee expense claims

Your employees should be able to claim out-of-pocket business expenses or any other spending that requires reimbursements.

Integrations

If you are already using other software to manage your business such as an accounting tool, the payroll service you select should offer flawless integration with such pre-existing software. It is important to verify this compatibility before you finalise on a payroll product.

For example, Zoho Payroll (a very popular service in this segment, one that I will discuss in a later section) integrates with Zoho People, which is a complete online HR solution.

Biometric attendance

This comes at an additional cost as it is not included in basic features discussed in this section. But it is a good option to keep in mind for future purposes.

There are also a lot of really good options that offer dependable payroll processes in India today. But, I will get to that momentarily.

Before we jump that far, I want to help you get a deeper understanding of all the umpteen elements that are part of the Indian payroll calculations.

The following section offers a brief summary of how these calculations are actually made. Let’s learn a bit about each of these payroll components

Payroll calculations in India

Indian payroll calculation is complicated. There are many variables that need to be factored in.

These calculations constitute four main components: basic salary, gross salary, deductions, and net pay

CTC = Gross Salary + PF + Gratuity

Basic Salary is the fixed income of an individual. It is the fixed part of one’s compensation package. Basic pay is 50 percent of gross salary.

Gross Salary is the sum of basic salary and other allowances before tax and other deductions.

Gross Salary = Basic Salary + HRA + other allowances

There are a few variables that are mandatory deductions. Deductions include income tax, EPF, ESI, and PT.

Therefore, Net Pay = Gross Salary - Deductions

If you don’t understand what some of these terms stand for, do not worry. I have included a section titled 'Glossary' at the end of the copy. It has a list of all of these terms and explains what each of them stands for. You will get a clear picture when you go through that list.

Now, let’s explore what are the available options for payroll management systems in the Indian market today.

Payroll software

Microsoft Excel

There are a handful of free payroll software options in India. In fact, one of them is already handy on your computer. That is the good old Microsoft Excel.

As a business owner, you will already be familiar with Excel and all of its incredible capabilities. Did you know that you can use Excel as a payroll processing tool as well? Yes, that right. Excel lets you set up a payroll sheet, for free.

Most businesses typically get started with Excel while handling their first few hires.

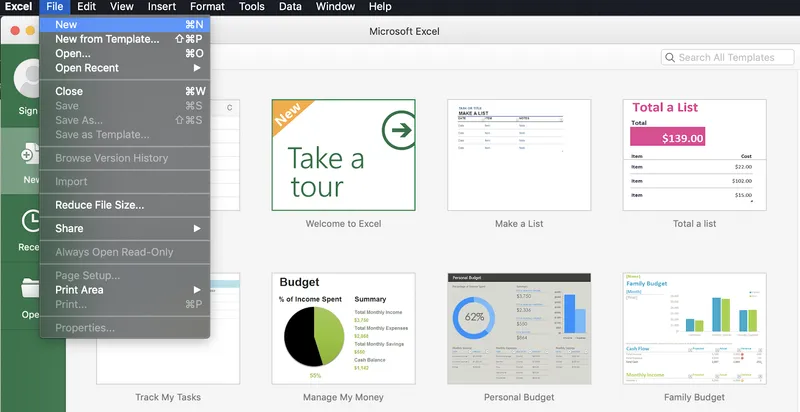

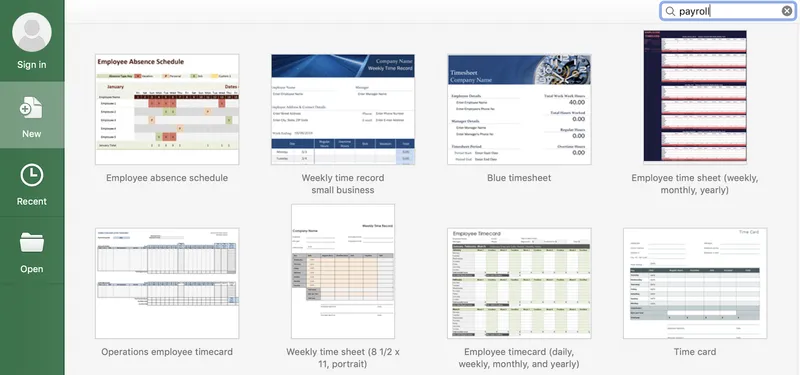

All you have to do is open Excel, click on the “File” tab in Excel, select “New”. Search for a payroll template by typing “payroll” in the search box (at the top right corner of the new window). Browse through the available templates and pick one that best suits your needs. The images included below show you the steps.

However, one of the major drawbacks of using Excel is that it can get tedious pretty quickly. For one, you will have to manually enter all the details such as employee name, allowances, deductions, etc. And then input the right formula for each of these calculations.

As we have learnt earlier, payroll calculations are fairly complicated. You can still manage with this tool if you just have an employee or two, but it may not be the best system for accurate and error-free calculations.

If you want to continue exploring free options, there are a host of those available as well.

Sumopayroll.com

Sumopayroll is a cloud-based platform that comes with inbuilt features such as compliance, expense tracking, automation, and others as discussed earlier.

The best part is that you get free access to all these features for up to ten employees. After you cross ten employees, you will have to pay a fee of Rs 49 per employee per month.

If you are willing to look at paid options from the get-go, in the following section, I have discussed a few popular options that are trusted by many businesses and have proven to be dependable in the long-run.

If ease of setup combined with ease of calculations is a key deciding factor for you, your safe bet would be to get started with one of these services.

Zoho Payroll

Zoho Payroll is one of the most popular payroll management systems in India today. It is a web-based application that entirely runs on the cloud.

The reason it is so popular is because of its ease of setup, simple and intuitive user interface and its ability to seamlessly perform and automate complex payroll calculations.

Zoho Payroll offers a 30-day free trial. The basic plan (billed annually) costs Rs 50 per employee per month.

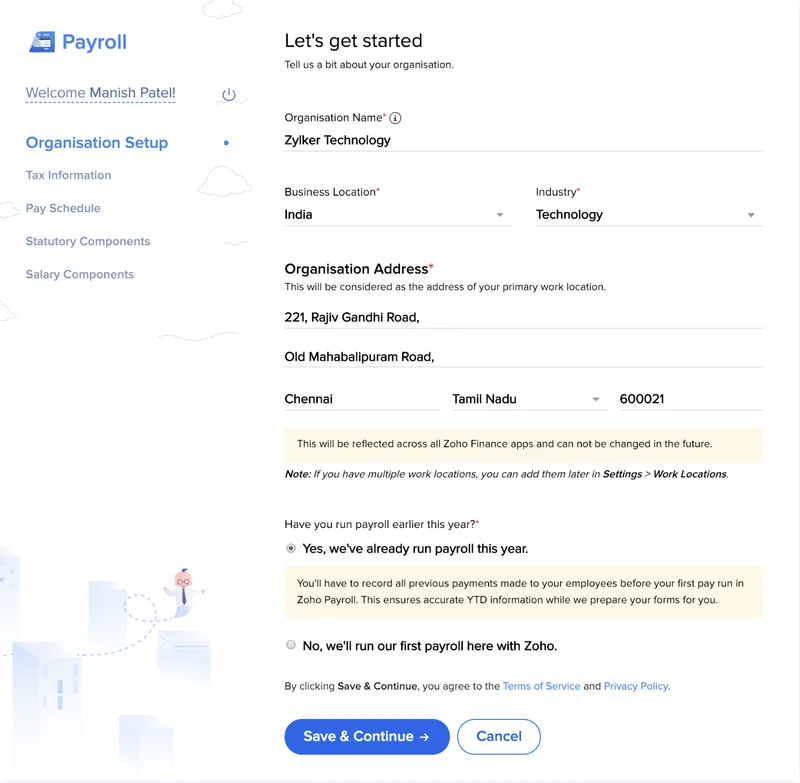

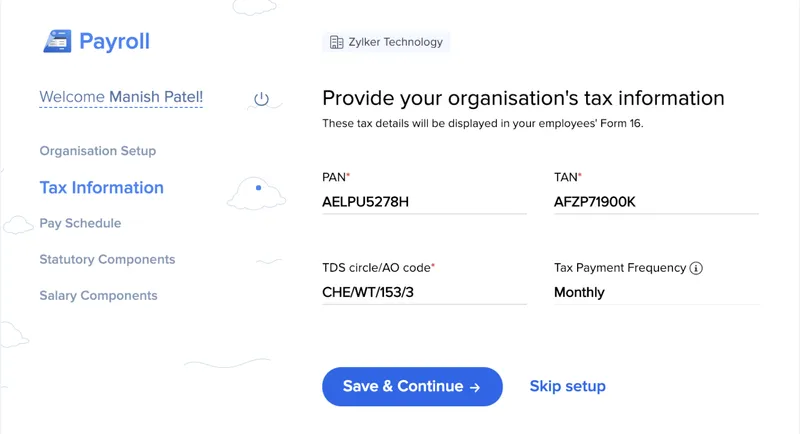

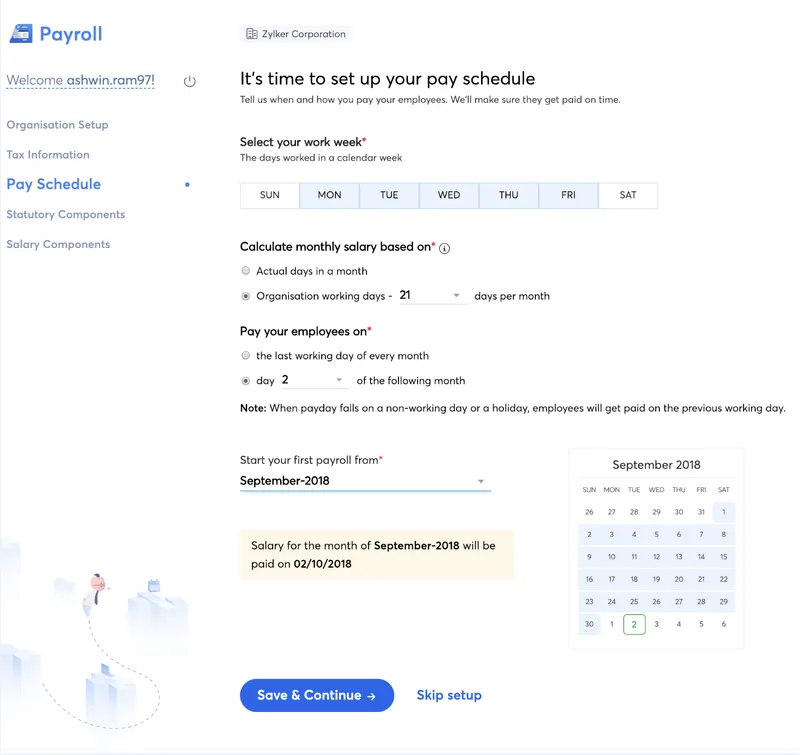

In order to help you get a better idea, I have included a few images that show how easy it is it set up Zoho Payroll. Zoho has in-depth explanations of each step in the setup process.

Once you go to the sign-in page and create a Zoho account, you will be prompted to set up your business information.

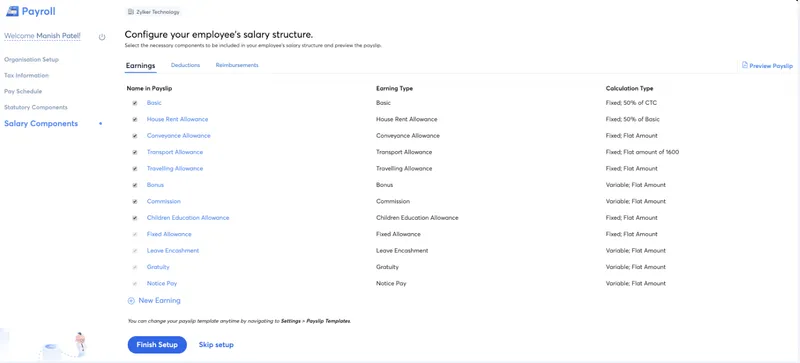

Similarly, you will be able to proceed further and add all other relevant information required to successfully set up Zoho Payroll. This includes tax information, pay schedule, salary components, and others.

As you can see in the picture above, you will have the ability to add all these complex salary component variables directly into this platform and enjoy the benefits of automated calculations that Zoho Payroll provides.

Zoho Payroll also offers an Employee Portal, which provides a clean and sophisticated user experience to your employees. It also has a payroll app for both iOS and Android users.

Employees can download the Employee Portal - Zoho Payroll app from the App Store or Google Play and access all of their salary information on the go.

Zoho Payroll also supports integration with other software such as Zoho Books (Accounting), Zoho People, and GreytHR (Human Resource) to name a few.

This kind of integration with other tools that you might use to manage different verticals of your business is important.

The only disadvantage of this platform at the moment is that it lacks time and attendance module but that might be included soon.

Paybooks

If you have a team of 20 employees or more, Paybooks is another popular software in this segment. It is a cloud-based, all-in-one HR and payroll software.

Paybooks also offers a free 30-day trial. The price is Rs 1,800 per month for up to 20 employees and Rs 50 per month for every additional employee thereafter.

You can also outsource your entire payroll process to Paybooks. You can get a quote by reaching out to them.

GreytHR Payroll Software

Just like Zoho Payroll, GreytHR is one of India’s most popular payroll software. It streamlines every aspect of the payroll process and helps you manage everything on a cloud-based web application.

One of the key advantages of GreytHR is that it has a sophisticated attendance and leave management module. You can get started for free and purchase a suitable plan if you are satisfied with the trail.

There are many other options in addition to what I have discussed here. Keka Payroll, PeopleWorks, and Saral PayPack are among the many others available in the market today.

Conclusion

At the end of the day, no one knows and understands your business better than you. You are the only one who can determine what your business' current needs are.

Use all of the information discussed in this article as a reference point to do your own research. You can also talk to the existing users of these payroll platforms and get some feedback.

Personally reach out to the sales teams of each of these software platforms and discuss your requirements in detail.

By now, it must be clear that having a good payroll software takes away a lot of stress and administrative burden off your shoulders. So be sure to do your due diligence thoroughly and take a wise call in this regard.

Glossary of payroll terms

CTC

CTC means Cost to Company. This refers to the total salary package of an employee. It is the amount of money that you as a business will spend on each employee in a given period.

Professional Tax

It is the tax levied by the state governments of certain states on salaried employees. Karnataka, Maharashtra, Andhra Pradesh, Telangana, Tamil Nadu, Gujarat, and Assam are a few examples of the states that are subject to this particular tax.

EPF

EPF refers to the Employee Provident Fund. It is a retirement benefits scheme that is meant for all employees. Any organisation with 20 employees or more must register for EPF.

ESI

ESI stands for Employee State Insurance. It is self-financing social security and health insurance scheme applicable only to employees whose monthly income is Rs 21,000 or less. As an employer, your contribution would be 1.75 percent of Gross Pay and your employee’s contribution is 4.75 percent of your Gross Pay.

HRA

HRA stands for House Rent Allowance. HRA is the amount paid by the employer to the employees, as part of the salary, for the employee’s rental accommodation requirements.

TDS

TDS refers to Tax Deducted at Source. TDS is part of the deductions applicable to employee’s salary based on the rates prescribed by the tax department.

Income Tax

The Income Tax is an annual tax levied by the government on individual income. The total tax amount depends on the income level and the prescribed tax slab an employee falls under. For your reference, there is a table below which shows the tax slab for the year financial 2019-20.

Gratuity

Gratuity refers to the amount paid by the employer to the employees in return for continued services offered to the company.

Form 16

Form 16 is a certificate issued by the employer. It is required by your employees when they have to file for their income tax returns.

Labour Welfare Fund

This is a statutory contribution managed by individual state authorities. It is applicable only to those employees whose monthly income is less than Rs 15,000.

Mandatory Payroll Deductions

For the sake of statutory compliance, there are four deductions that are considered mandatory, they are: EPF, PT, ESI and Income Tax (or TDS).

(Edited by Megha Reddy)