Angel Tax: deciphering the notifications and the way forward

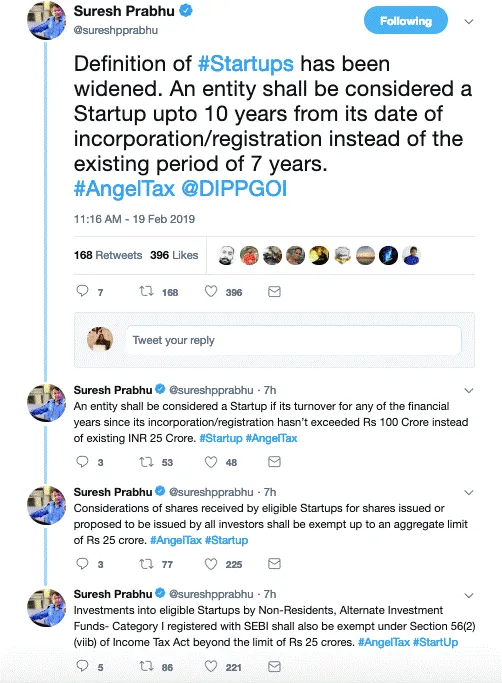

On February 19, entrepreneurs were greeted by a tweetstorm from Commerce Minister Suresh Prabhu in what can be considered as the single greatest announcement since the launch of “Startup India” in 2016.

It promised an end to the dreaded “Angel Tax” regime of Section 56(2)(viib), which taxed investments from Indian investors above “Fair Market Value” as income in the hands of the recipient company.

Shortly thereafter came the promised circular from DPIIT - the Department for Promotion of Industry and Internal Trade (formerly DIPP) - which gave formal credence to the minister’s tweets (link). And the entire notification can be broken into two parts – the good and the grey.

The Good

1.Increase in the tenure and revenue threshold for a startup to 10 years and Rs 100 crore, so a company incorporated in the last 10 years which has revenue below Rs 100 crore will be considered a startup.

2. Rs 25 crore blanket exemption on any capital raised from any source, subject to a self-declaration.

3. Exempting investments from listed companies into startups from Section 56(2)(viib) provided they meet the following criteria:

Their shares are frequently traded, and

- Their revenue is above Rs 250 crore

or

- Their net worth is above Rs 100 crore

4. The Rs 25 crore blanket exemption will exclude investments from:

- Foreign nationals

- SEBI registered venture capital funds

5. It will apply to shares issued or proposed to be issued

These notifications are significant as they finally unlock the vast pool of capital that lies with India Inc, our listed companies, whose acquisitions and investments seem to favour foreign startups as opposed to domestic ones.

The startup ecosystems of the US and China have developed and matured due to the active participation of their listed companies like Facebook, Google, Salesforce, Ali Baba, Tencent and Baidu. When Uber raised $2 billion to specifically invest in China, Jean Liu, the president of Didi Chuxing, the largest cab-hailing service in China, went straight to Tencent and Ali Baba to get the capital required to take them on. In the words of Yanbo Wang, a Chinese academician who studies startups, “for Uber, burning through $2 billion in China was a huge amount. But for Didi, and for Tencent and Ali Baba, spending $2 billion to win at home? It was nothing”.

Which Indian entrepreneur can boast of an Indian company giving him or her the capital to take on a global behemoth? Hopefully, with this notification, the legal shackles for investing in Indian startups will be removed and India Inc will become a greater participant in the Indian startup story instead of a cameo player.

The Grey

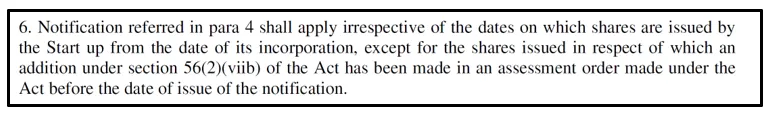

There’s a popular saying among professions like lawyers and accountants etc – “Every government notification has within it a single line that undoes the entire notification”. For many, this is exemplified by Section 6 of the DPIIT notification.

1. Section 6

Section 6 of the DPIIT Notification

With one fell swoop, the hundreds of companies who have received assessment orders were excluded from the relief granted by the circular. Minister Suresh Prabhu’s promise in his tweets seemed to have been rendered hollow by this section 6.

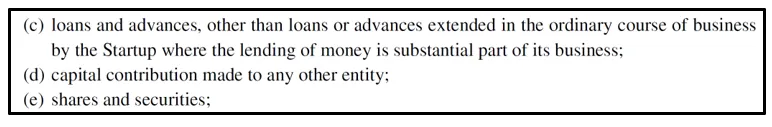

2. Self-Declaration

The self-declaration form, as well, had some noticeable issues:

Extract of the Self Declaration Form

This has five broad effects:

- It prevents startups from issuing loans and advances to vendors or employees, which form a critical element of working capital and business practises for all companies, not only startups (it only excludes those companies for whom lending is a substantial part of the business).

- It prevents startups from entering into joint ventures or creating subsidiaries – an important point for growth and expansion into new business lines or geographies.

- It prevents startups from making capital contributions to employee welfare trusts for stock options – given the harsh laws around the taxation of ESOPs, such capital contributions are invaluable and even allowed under the Companies Act 2013.

- It prevents exits via stock swaps and mergers – which forms a critical component of any exit.

- It prevents normal treasury management operations through SEBI-registered money market mutual funds.

Worse off, given the retrospective effect of this notification for “shares issued or proposed to be issued” and its tenure for seven years from the end of the financial year in which such shares were issued at a premium, many companies who have already done any of the above activities won’t be able to sign the self-declaration!

The Way Forward

On March 1, 2019, the DPIIT held another consultative meeting with various stakeholders – entrepreneurs, startups, investors, industry bodies, professionals, etc, which I had the privilege of being invited to. The good points were lauded and rightly so, but the grey areas were also heavily debated.

The summary of the debates is given below:

1. On Section 6 undoing the relief being given and leaving startups who have already received the notice in the lurch:

Context

- We were informed that the assessment proceeding is a quasi-judicial process in which the government or the department cannot intervene. Hence, the reason for Section 6 was to ensure that the principle of non-interference of the government in a judicial process is upheld.

- The section meant to elaborate that the circular will not invalidate the assessment order or the appeals process, in line with applicable law.

- The intent of the circular – “for any shares issued or proposed to be issued” – still holds true and the circular along with the self-declaration can be submitted by an aggrieved company as evidence during the process and Section 6 does not impugn this right in any way.

Way forward

- Startups who are in the appeals process should submit the following documents during their appeal:

- DIPP Certificate

- Copy of the self-declaration

- Copy of the December 24, 2018, notice from CBDT stating that no coercive action will be taken (attached below)

- DPIIT circular of February 19, 2019, about the new definition of a startup, self-declaration, etc (link)

- March 5, 2019, circular by CBDT affirming the February 19, 2019, DPIIT circular (link)

2. Measures for those undergoing appeals

1. The CBDT has issued instructions to all its Principal Commissioners on two specific points:

- That no coercive action will be taken

- That their cases will be disposed of expeditiously

2. A copy of this was provided to the attendees for circulation to any affected startup.

3. Furthermore, startups were advised to meet their Principal Commissioners with the above documents and the attachments as those officers have been instructed and sensitised to the needs of startups.

3. Self-Declaration insertions:

Context

- The self-declaration was crafted after analysis of the over 4 lakh shell companies that were recently de-recognised and the analysis of cases where high share premia investments were used to launder unaccounted funds.

- The reason behind those insertions regarding loans and advances, capital contribution and shares and securities were instituted to prevent the circumvention of the circular by the creation of other entities who in turn would purchase land, gold, jewels, etc

Way forward

- Following feedback from the attendees, we were assured that the matter would be looked into and other measures like ensuring downstream investments/capital contributions subject to the same self-declaration and negative list of assets would be permitted for DPIIT registered startups.

The measures instituted by the circular will go a long way in strengthening the startup ecosystem and unlocking new avenues of capital and more inclusive participation from entrepreneurs. The pending issues have been articulated and there is still an ongoing dialogue among those who were part of the meeting and those who have been aggrieved by notices to expedite the changes required to address ongoing issues. The true test of this circular will be when the last startup has finally closed its assessment and appeals in a few months and cries of “Angel Tax” no longer throng the airwaves or print.

With this, the “Angel Tax” issue is close to being relegated as a footnote in the history of Indian startups, and I for one, among many others, am looking forward to it.

Note: It’s important to speak with your professional advisors on all these points and to take it forward accordingly.

(Disclaimer: The author Siddarth Pai is a co-founder at 3one4 Capital, which is an investor in YourStory.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)