Key changes in interim budget 2019 explained

Finance Minister Piyush Goyal’s much-awaited Interim Budget that was presented in the Lok Sabha on Friday came as a big income tax bonanza for middle-class individuals. While there were several sops for the agriculture sector, the key changes in the tax payable by middle-class taxpayers was a highlight.

Here is a recap of the key changes in the Interim Budget for the individual taxpayer in case you missed out.

- No tax for individuals who have taxable income up to Rs 5 lakh. Around three crore middle-class taxpayers will get a tax exemption due to this measure.

- With this, the rebate under section 87A of the Income Tax Act has been increased from Rs 2,500 to Rs 12,500 and shall be admissible to individuals with an income of up to Rs 5 lakh.

- Standard deduction increased from Rs 40,000 to Rs 50,000 for salaried individuals.

- There will be no tax on notional rent on a second self-occupied house. Thus, an individual can declare nil annual value for two self-occupied properties without having to pay any tax on notional rent for the second self-occupied house.

- The tax deducted at source threshold on rent (section 194I) has been increased from Rs 1.8 lakh to Rs 2.4 lakh. Thus, a monthly rent of Rs 20,000 will not be subject to TDS.

- Ceiling limit of TDS under section 194A has increased from Rs 10,000 to Rs 40,000. This means interest, other than interest on securities, paid by a bank or co-operative society or post office is not liable for TDS up to Rs 40,000.

- Tax-free gratuity limit has been increased from Rs 10 lakh to Rs 20 lakh in the private sector.

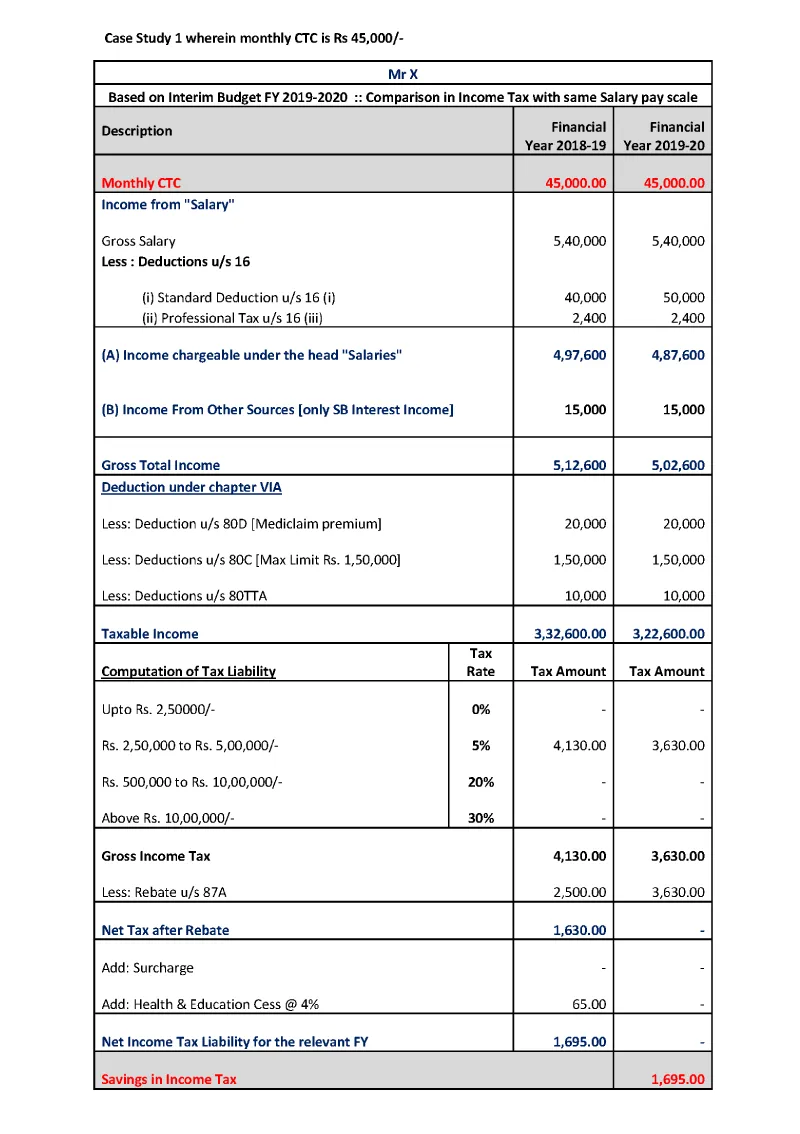

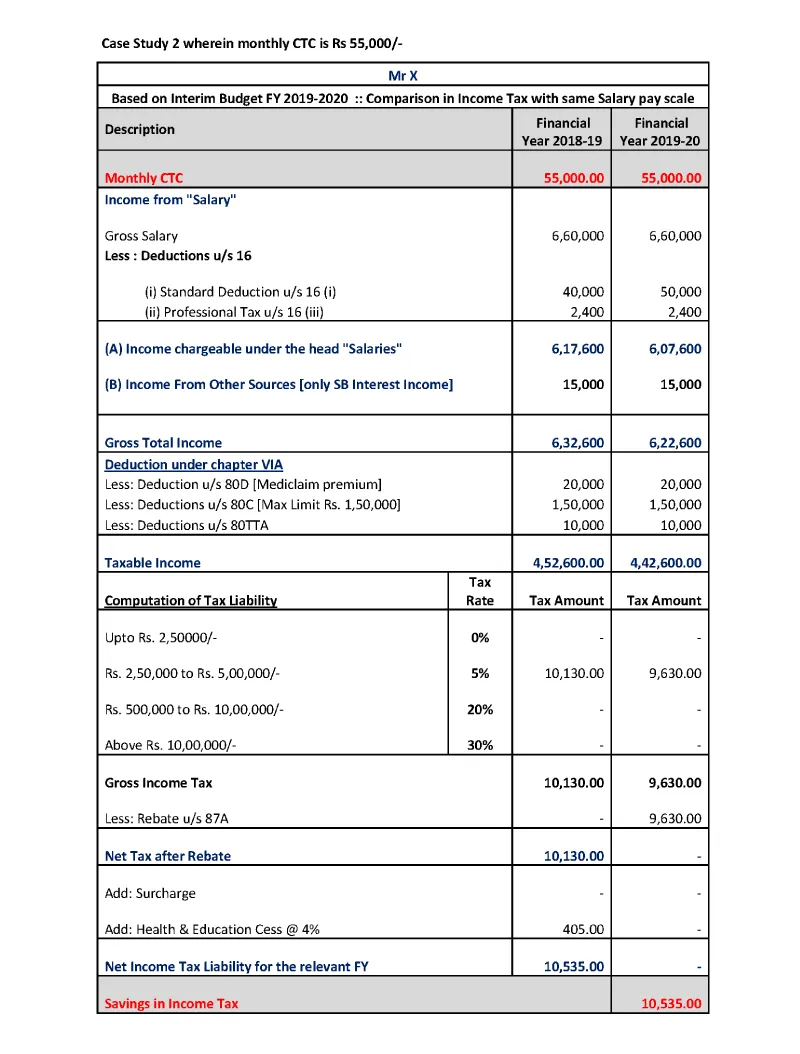

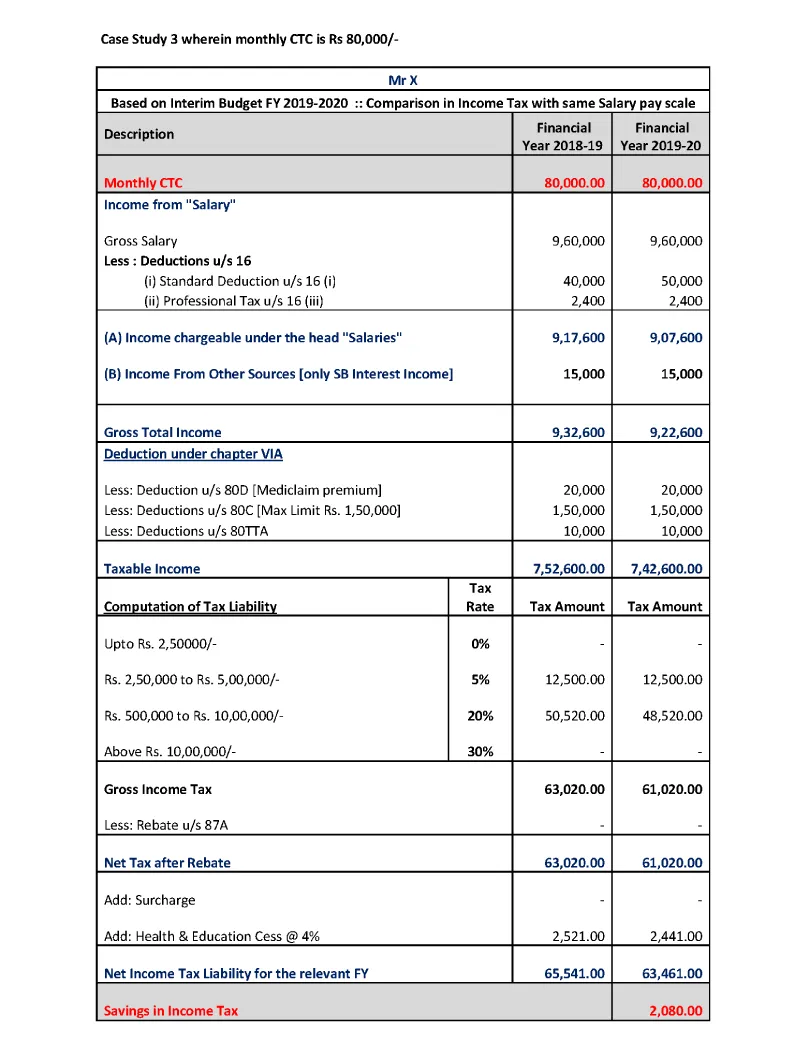

The above changes can be explained with the help of the following case studies. We have considered the following assumptions:

- Professional Tax will vary based on slabs of different states

- Other sources of income include only saving bank interest income

- Deductions under chapter VIA – it has been assumed that the assesse will do these minimum investments.

- Savings in tax will change based on investments.

- The assesse is neither a senior nor super-senior citizen, and is a resident of India.

Case study wherein monthly CTC is Rs 45000/-

Case Study 2 wherein monthly CTC is Rs 55,000

Case Study 3 wherein monthly CTC is Rs 80,000

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)