[Weekly funding roundup] Early-stage funding maintained a steady momentum despite furore around angel tax

The $1 billion in funding raised by Swiggy put the startup community in a celebratory mood at just the right time.

The Indian startup ecosystem raised over $1 billion this week. The star of the show was Bengaluru-based foodtech 'unicorn' Swiggy, which raised the single largest round ever in the sector in India - a full $1 billion. This took the week's total to about $1.38 billion across 33 deals. Of these, 13 startups raised early-stage funding along with there late-stage deals, which accounted for 83 percent of total funding this week.

The big deal this week...

...was Swiggy, of course, which raised its Series H round, led by Naspers. The $1 billion it raised is the single-largest round raised by a foodtech company in India. Other participants included Meituan Dianping, Coatue Management, DST Global, Tencent, Hillhouse Capital and Wellington Management company. Avendus Capital was the exclusive financial advisor to Swiggy on the transaction.

1 – Vivriti Capital raises $28.5 million

Vivriti Capital, a Chennai-based lending platform for corporate entities, raised Series A equity funding of $28.5 million from Creation Investments, an investment management company focused on financial services.

Founded in mid-2017 by Gaurav Kumar and Vineet Sukumar, the startup received approval from RBI to float a non-banking finance company (NBFC) in January 2018.

2 – Logistics startup LetsTransport closes Series B from Bertelesmann, others

Bengaluru-based Diptab, the owner and operator of trucking logistics platform LetsTransport, raised $14.2 million from Bertelsmann India Investments and a Japanese-origin investor in a Series B round. The startup was founded by IIT-Kharagpur alumnus Pushkar Singh, Sudarshan Ravi and Ankit Parashar in 2015, and provides last-mile logistics to companies.

3 – Social ecommerce platform Shop 101 raises $11 million from Kalaari, Unilever

Mumbai-based Shop 101 raised $11 million in Series B funding round led by Kalaari Capital and Unilever Ventures. The latest round also saw participation from existing investors including Stellaris Venture Partners, Vy Capital and Ramakant Sharma, Co-founder of Livspace. The company said the funds will be used to enhance its technology platform and scale the supplier network.

4 – Hyperlocal startup Milkbasket raises a top-up round

Gurugram-based Milkbasket, raised added another $7 million to its earlier Series A funding of $7 million. This was led by US-based VC firm Mayfield Advisors, boosting the company’s total Series A funding to $14 million. Other investors include BeeNext, Kalaari Capital, Blume Ventures and Unilever Ventures.

5 – Vyng raised $4 million in Series A

Los Angels-based, Vyng that focuses on mobile conversations, has raised $4 million in Series A led by Omidyar Network India and March Capital Partners, with participation from Alpha Edison and the Entrepreneur Fund. The funding will be used by the company to grow its global team, partner with other app-based companies and to develop patents.

6 – Enrolment management platform NoPaperForms closes $4 million from InfoEdge

Delhi-based NoPaperForms Solutions Private Ltd, that runs an enrolment management platform for educational institutes, raised around $4 million in a Series B funding round in an all-cash deal from existing investor InfoEdge (India) Ltd.

7 – Fintech startup BASIX Sub-K iTransactions raises $3 million in Series B

BASIX Sub-K iTransactions Limited, a Hyderabad-based startup focused on financial inclusion, has raised $3 million through a second round from its existing investors. Sub-K had originally closed Rs 35 crore in March 2018, taking the cumulative series B round to Rs 57 crore.

8 – Medtech startup Generico raises Series A

Mumbai-based Generico has raised $3 million in Series A funding from Tomorrow Capital and Whiteboard Capital, along with angel investor Gagan Goyal. With the freshly raised round, Generico plans to expand to 100 cities including Pune, and a few cities in Gujarat.

9 – Edtech startup DataTrained raises $1.7 million on Pre-Series A

Bengaluru-based DataTrained raised $1.7 million from a pool of three high net worth individuals including Ashish Nadiadwala, Rupesh Sinha and Mithlesh Thakur, for a 20 percent stake in the company.

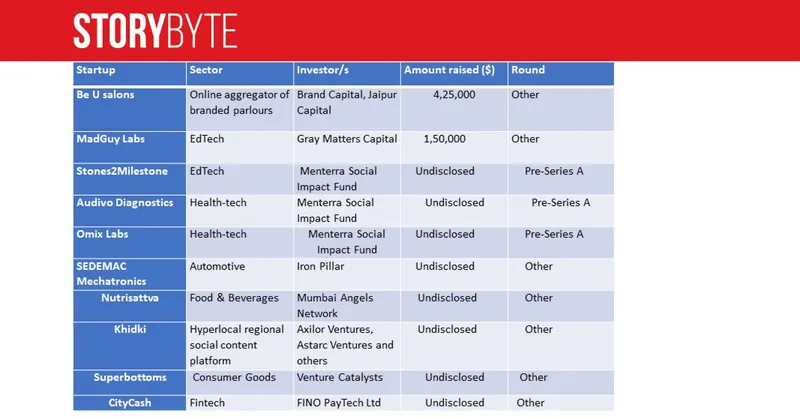

Additionally, Menterra Social Impact Fund pumped in undisclosed funds in health tech startups OmiX Labs and Adiuvo Diagnostics and edtech startup Stones2Milestones.

Late-stage deals:

1 - Edtech startup Toppr closes $35 million from Kaizen PE, SAIF, others

Mumbai-based Toppr raised $35 million from Kaizen Private Equity and existing investors SAIF Partners, Helion Ventures and Eight Roads Ventures. Alteria Capital and Times Group’s strategic investment arm, Brand Capital also participated in this round. Till now, Toppr has raised a total of $58 million and it plans to use these funds to improve its e-learning platform to make learning personalised.

2 – B2B ecommerce startup Moglix raises Series C

Noida-based B2B ecommerce player Moglix closed its Series C round of funding this week by raising $23 million from existing investors Accel Partners, Jungle Ventures and International Finance Corporation (IFC), member of World Bank Group. Venture Highway, Shailesh Rao and InnoVen Capital also participated in the round. The company has raised a total of $41 million so far.

Other funding deals

- Bengaluru-based dockless scooter sharing platform Vogo raised $100 million funding from Ola. The ride-hailing unicorn will help Vogo boost its supply by investing in 100,000 scooters. With this strategic fundraise, Vogo’s offerings will also be available on the Ola app.

- d.light Design Inc., a San Francisco-based solar lighting and power products company that also operates in India, raised $41 million in equity financing from a consortium led by African-focussed investment advisory firm, Inspired Evolution. The round also saw participation by Dutch Development Bank FMO, and others.

- Goa-based 91springboard, a co-working startup, raised $10.2 million in a fresh round of funding from Singapore-based marketing technology company Freakout and Shinsei Bank of Japan, along with few existing investors.

- MobiKwik raises over $3 million in bridge round led by Sequoia an included other existing investors like Net1 UPES and GMO Venture Partner.

- Proliva (Nutrisattva Food Private Ltd), a protein innovation company, raised an undisclosed amount from Mumbai Angels Network.

- VC Fund Iron Pillar invested an undisclosed amount in Pune-based SEDEMAC Mechatronics that specialises in manufacturing powertrain controls.

- US-based impact investment firm Gray Matter Capital invested $150,000 this week in Hyderabad-based government jobs app MadGuy Labs.

Three other startups raised undisclosed funds. One of them is Hyderabad-based Sreyas Holistic which raised money from Bengaluru-based Entrust Family Office Investment Advisors.

Private equity deals

1 - Multiples Alternate Asset Management has invested Rs 250 crore in Gunit Chadha-promoted APAC Financial Services. The company, which received a nonbanking finance licence from the RBI and a housing finance company licence from National Housing Bank earlier this year, has capital of Rs 400 crore funded by Multiples PE.

2 - Sapphire Foods, which operates over 350 outlets of popular eating joints like KFC, raised Rs 225 crore in a round led by Edelweiss Private Equity. The company said that the investments will be used for expansion activities.

Debt funding

1 - Kolkata-based microfinance institution Jagaran Microfin raised $7.8 million debt funding from two funds managed by BlueOrchard Finance Ltd. The funds were raised through the issue of non-convertible debentures. Founded in 2010, Jagaran is a NBFC currently operational in five states in eastern India.

2 - Bengaluru-based healthcare startup Portea raised $3.6 million venture debt led by Alteria Capital. Last November, the health-tech platform had raised an equity funding of $26 million.

3 - Sequoia Capital-backed OneAssist Consumer Solutions Private Limited, providing protection plans covering theft or loss of smartphones, laptops and credit cards, raised $2.4 million from venture debt provider Trifecta Capital.

Exits and Acquisitions

Online classifieds firm Quikr acquired Chennai-based real estate platform India Property Online this week for an undisclosed sum.

![[Weekly funding roundup] Early-stage funding maintained a steady momentum despite furore around angel tax](https://images.yourstory.com/cs/wordpress/2018/11/weekly-funding.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)