Startup funding: The Japanese may be cautious, but they're betting big on India

While SoftBank seems to be an exception to the Japanese style of investment which embodies cautiousness, there are quite a few other Japanese VCs who are funding Indian startups but prefer to stay out of the spotlight.

Maruti Suzuki cars and Hero Honda bikes are ubiquitous on Indian roads. And both these marquee brands have one strong point in common – Japan. The world’s third-largest economy has a long history of investing in India, primarily in infrastructure and manufacturing. Of late, though, Japanese investors have begun to place bets in the Indian startup ecosystem as well.

India has the third-highest number of startups in the world after the US and Israel and has had investors from across the world showing interest. First came the American and the Europeans, and then came the Chinese. SoftBank began making investments around the same time and with several investors placing their bets, in the past year, Japan quietly announced that it was here to stay established its pole position in India.

One of the largest investors by value

SoftBank, Japan’s telecom and technology conglomerate, is one of the biggest investors in the Indian startup ecosystem. SoftBank CEO Masayoshi Son recently said that his company would be investing $10 billion in India by 2022. It has already invested close to $8 billion till date.

The company’s presence in India is fairly high-profile thanks to its investments in companies that are now unicorns or are close to joining this club: Paytm, Ola and OYO are just a few of these. In 2018, SoftBank led an $800 million funding round in OYO, which is now valued at $5 billion. It also invested $238 million in PolicyBazaar in a round that saw it achieve a valuation of $1 billion.

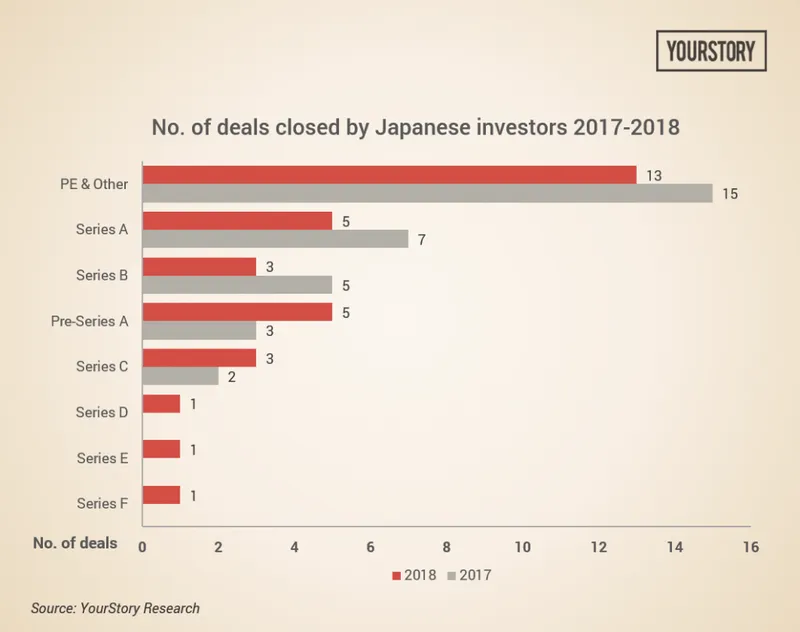

YourStory research reveals that Japanese firms invested nearly $2.1 billion in Indian startups in 2018, down from $5.9 billion. However, this decline should not be interpreted as a slowdown. Last year’s investments included two super-giant rounds - $2.5 billion in Flipkart and $1.4 billion in Paytm. The more important thing is that when it comes to the number of deals, the momentum has been steady: 32 deals in each year.

Focus on the early stage

Investments in terms of sectors are more diverse than they were in 2017. Japanese investors have showed wide-ranging interest while putting in their money into Indian startups across e-commerce, hyperlocal, SaaS, automotive, transport, real estate, biotech, real estate, media, among others.

Talking about the Japanese approach, Rutvik Doshi, MD, Inventus (India) Advisors, says, “The interest by Japan is very strong but the only difference is that the ecosystem is slightly smaller than the Chinese. They are coming in both as a limited partner (LP) and with a direct presence.” He cites the example of Inventus and Blume Ventures which have Japanese investors as LP.

The spread across stages is also encouraging given the significant Japanese interest in the early stage.

YourStory data reveals that of the 32 deals that Japanese investors participated in, 10 were pre-series A and Series A. Another 13 deals were largely bridge financing or top-up to existing rounds.

Beyond SoftBank

The Japanese investment story isn’t all about SoftBank; there are quite a few Japanese VCs, industrial houses and universities which are betting big on India.

This year, funds like Dream Incubator and Incubate Fund were active investors, each with four investments in their respective portfolios. Dream Incubator is a Tokyo-based strategic consulting and business development firm that helps startups in their growth and expansion. It has invested in companies such as HealthifyMe - a digital weight loss platform, Myra, an online medicine delivery app and self-drive car rental startup, Revv.

On the other hand, Incubate Fund is a seed and pre-seed stage focused fund that has invested in startups such as AI-driven recruitment platform Skillate, B2B eprocurement company Kobster, e-sports startup Gaming Monk, etc.

Besides these two, there are a host of other VC funds that have continued with their investments since 2017. Gree Ventures, an early-stage seed fund which invests from seed to series A, has made two investments into startups such as AI startup Hasura and digital content player POPxo.

Das Capital is another active investor in the Indian startup eco-system having invested in companies such as SlicePay, a payment platform for college students and food tech player InnerChef. This is an investment fund founded by Japanese serial entrepreneur Shinji Kimura. There is also the participation of University of Tokyo with its University of Tokyo Edge Capital, which is an early stage, technology-focused venture firm. This year, it invested in deep science startups such as Tricog and Bugworks.

Outside of these venture capitalists, there are also established Japanese corporates which are also active participants in the Indian startup ecosystem. These include Denso, Toyota Tsusho, Dentsu, Mitsui and Yamaha.

In fact, car and bike-rental platorm Drivezy had recently announced a vehicle sharing marketplace had announced a fund raise of $20 million in Series B, which saw fresh participation from Yamaha Motor.

Studied approach to funding

Among the investors in the Indian startup ecosystem, companies from the US and China seem to take lesser amount of time to close a deal unlike the Japanese.

Siddarth Pai, founding partner and CFO, 3one4 Capital says,

“Japanese investors take a cautious, careful and studied approach to make an investment since they view investing as a partnership with both parties contributing according to their strengths.”

He points to Japan’s long and successful history of operating in India, with several joint ventures like Maruti Suzuki, Hero Honda and Toyota Kirloskar becoming household names.

Vidhya Shankar, Executive Director, Grant Thorton India, says that it would be wrong to think Japanese investors are not keen on putting their money into Indian startups.

“They have not been headline-grabbing but are interested in early-stage companies.” According to Shankar, Japanese investors are very keen on areas such as cleantech and waste management.

The Japanese style of investing could possibly test the patience of many as it is considered to be quite slow.

Siddarth says, “Many Japanese investors also bemoan this approach since deal velocity is critical and this lag may result in the deal slipping through their fingers. But once they invest, the Japanese model relies on the prowess of the individual entrepreneur and bolstering their expertise, not supplanting the existing model with something that has worked in another geography.”

V Balakrishnan, chairman, Exfinity Ventures, says,

“They (the Japanese) take a long time to decide. But once they make up their mind there is no looking back even if the market conditions have changed.”

Bullish prospects

Given this backdrop, investors from Japan are very bullish on the Indian startup ecosystem. Rutvik says, “They are fairly bullish in India and across sectors. China is the new money but Japan has had it for three decades.”

According to Siddarth, the recent bonhomie between Japan’s Prime Minister Shinzo Abe and his Indian counterpart Narendra Modi has accelerated Japanese interest in the Indian startup ecosystem.

“The Japanese manufacturing edge, combined with Indian technological know-how, will be a formidable force and counterfoil to the US-China model of technology and entrepreneurship,” he says.