A brief history of money: from the barter system to Bitcoin

From lugging around goats in exchange for a chair to creating a decentralised digital currency, money, much like a man, has had an illustrious and tumultuous journey. Let’s take a quick look.

The early past

The global economic system is incredibly complicated. At its fabric, this seemingly complex system disintegrates into a set of few rules that sum up how humans trade their notions of value. The internet has changed the entire game for age-old systems ranging from commerce to dating, so it’s no surprise that it has caused immense disruption to the financial system too.

It doesn’t seem like technology is going to stop its disruption to financial systems anytime soon, and as we celebrate the 10-year anniversary of Bitcoin, let’s look at how humans ended up building a monetary system in the first place. From the origins of the barter system to Bitcoin, I’d like to weave a story that would build basic economic intelligence in less than 10 minutes.

Before I begin, I’d like to mention that the system of money predates the system of writing, so there is a lot of ambiguity. This problem is compounded by the fact that ancient records of financial activity don’t exist anymore because these records are often inaccurate, lost, or destroyed. Most of this history is accurate — it’s only the earliest days where the records are hazy.

If you step back in time to 6,000 BC, you wouldn’t be completely taken aback by the barter system. Introduced by Mesopotamian tribes, bartering allowed people to trade goods of value amongst themselves. Some folks were very good at fishing, some at raising livestock, some at growing grains and some at producing furniture.

As it was necessary for a farmer growing crops to also buy furniture, an unofficial trade market was born. Remember, trade stems from human need. If many people want something, it becomes “valuable” in public perception. In the barter system, both parties need to have what the other wants, and there is never a standard price of any good or service. In the barter system, a person who has only a minor need for apples will pay significantly less than a person who is craving apples and has the financial capability to buy them, even if they are all located in the same area.

Human beings can be gauged if they are trustworthy or not depending on the situation. One problem with bartering is determining how trustworthy the person you are trading with is. Since there is no central “market price” for a particular object, vendors can jack up prices and take advantage of the fact that consumers do not know the actual price of some good or service. But the biggest drawback with the barter system is that it is woefully inconvenient. Most goods being bartered were perishable, and carrying 10 adult goats around just to exchange them for a chair would have been incredibly physically taxing. If some “medium of exchange” had to be invented, it needed to be imperishable and light enough to carry.

In early 1200 BC, villages had found a solution to this problem — the coinage system. The first coins were actually cowry shells, which are durable, handy, small and their unique texture makes them immune to forgery. But trade was still not standardised. The farther the place was from the source of these shells, the larger value the cowry carried. In some places, you could buy a horse for only one cowry, while in other places, where the shells were more abundant, one cowry had a much lower value. In the Maldives, for example, a person needed thousands of shells to exchange them for only one gold bar.

But there was a problem with this system too — because cowry shells could be found by swimming to unexplored shores, people figured that they didn’t have to make the effort to rear cows or grow crops; they just had to swim well to literally pick up money lying there on the sand! So some chose to do just that, and this was posing a problem to the local economy.

To counter this, a group of people got together and proposed a new requirement for something to be counted as money — it had to have an inherent rarity. It should be difficult to find whatever object was going to represent money, otherwise everybody would simply waste time trying to find money lying around instead of figuring out how to add value by creating a good or service. Back then (and even today), a person’s net worth is actually a great measure of how much value they’re adding to people around them.

Gold fit this bill perfectly. It was hard to mine, it could be carried around and stored, and it could be melted into small coins where the weight of the coin represented its value. Gold was also hard to counterfeit as any difference in weight would indicate forgery or tampering. It was easy to measure as weighing scales were available in abundant supply. Gold is also imperishable — such is our faith in its resilience that people make gold investments even today, many still choosing to trust gold over any available currency in the event of financial collapse.

A standard trade pricing for common goods in a locality was also in effect. A small body of individuals was responsible for overseeing the market and making sure that this trade price control was in effect. This meant that it became hard for people in a community to overprice their goods and also meant fewer people imported goods in general because of fairer pricing. The market was becoming fair and either the ruling monarch or early governmental bodies controlled this fairness.

But this usage of gold (and other hard-to-mine precious metals in other parts of the world) caused another problem — the fear of robbery. Gold coins, being smaller, lighter and worth much more, opened a new can of worms. The extremely wealthy had trusted guards, but the middle class suffered from a theft epidemic. There needed to be somewhere you could store excess gold and only keep enough on you for say, a month’s worth of expenditure.

The recent past

Early banks solved this problem. Merchants preferred to store their gold with the goldsmiths of London, who possessed private vaults that guaranteed safety and trust. Trust became a critical factor in the choice of bank a merchant went to. The more stories of guaranteed deposit and return, the more merchants using the bank.

Once security became easy to guarantee, banks started offering out loans. Liquidity is an important concept to understand here. When a person invests money with a bank, they do not take it out immediately. So banks can technically lend out some of the money that has been invested in them. To coax more people into investing in them, the banks offering an interest on the sum deposited. The longer you keep your money in the bank, the more money you would be offering in return. The concept of a “loan” allowed banks to lend out money at a specific interest rate. As long as this rate of interest on loans was higher than the interest rate they were offering depositors, the bank was making money.

This also led to the invention of bank notes. When you stored gold in a bank, a slip with the amount and weight of gold was given to you, which you could redeem. To control the demand and supply of these notes and to standardise trade, the government stepped in and started printing the first currencies. A seal or print on the note would guarantee its authenticity.

The bank also became the verifier of transactions between people. If person A was to make a big payment to person B, it could so happen that person B claims that said payment hasn’t taken place at all. Each bank maintained a physical register of who paid who how much money and at what time. For merchants, this allowed a trusted third party to verify transactions. For banks, this allowed them to warrant a small transaction fee on each such payment whenever they wrote a transaction’s details to their register. This register came to be known as a ledger.

This process of borrowing and lending continued (almost) uneventfully until 2008. In 2008, the world was hit by the worst financial crisis since the 1930s. To understand this particular crisis, we must revisit the concept of liquidity.

When you give a bank $1,000, the bank doesn’t actually keep all that money for you. It is legally allowed to spend up to $900 of your money, and reserve just $100 in the off chance that you ask for your money back.

Here’s the shocking part — this is actually how most banks work in reality. In the United States, the amount kept in reserve requirement, or the percentage of deposits banks are actually required to keep in hand (liquid) is 10 percent for most banks. This means that if a bank has net deposits of a million dollars, it only needs to keep $100,000 on hand at any given time.

This works most of the time, as typically the customers of that bank won’t all try to cash out at the same time, and the bank is able to stay “liquid”. However, things can go awry very quickly. If just a small number of customers begin asking for all their deposits back, a bank can rapidly become drained of its liquid funds.

The financial crisis of 2008 amplified this risk of the banking system. When a bank goes out and gives out the remaining 90 percent as loans, it can become problematic if those loans are at risk of not being repaid. In the case of the 2008 crisis, banks lent out bad loans to subprime mortgages. These were mortgages taken out by borrowers very likely to not repay.

When a bank gives out a loan, it looks at your credit score — the probability of you repaying it in time. In 2008, driven by greed, banks were giving out loans to people with bad credit scores, as most bank employees were given a commission on the number of loans given out (and not on the number of good credit score loans given out). As housing prices dropped when the loan-giving bonanza was over, banks were left holding assets worth far less than the amount they had given out. As a consequence, they now had nowhere near the amount of money that customers had given them and began experiencing liquidity crises that led to their ultimate bankruptcy and death. Legitimate investors weren’t able to take their money out because the bank didn’t have any of this money left. A debt crisis was looming.

The earlier reliance on gold for banknotes was replaced by government-issued currency, which was backed by nothing but government faith. Most of these currencies are known as fiat currencies, and these fiat currencies having nothing going for them except faith (not even gold). A need for a new type of currency was necessary, one that was free from banks or governments. It needed to have the same templates for a currency – scarce, hard to mine, easy to transfer, and easy to carry. Gold was a good example of this, so one group called the Satoshi Nakamoto group decided to simply emulate the process of mining gold using computers.

The now

Gold is physically mined out of the earth. A cryptocurrency like Bitcoin is also ‘mined’, but digitally. The production of bitcoin is controlled by code that makes sure that you must find a specific answer to a given problem in order to “unlock” new bitcoins. This is simply to ensure scarcity and verify transactions.

Imagine a table of 10 people who decide to start a banking system among themselves. If person A wants to make a transaction with person B, someone needs to verify it (or person B can claim the transaction never happened). Until now, a single person, person C, was responsible for verifying this transaction (on a ledger). This person C was known as a bank.

The Satoshi group proposed something different.

Why not all 10 people become the bank?

This means that every person maintains a ledger and whenever anyone in the group transacts with someone else in the group, they write it down in their ledger. If any single person tries to manipulate their ledger, there are nine other people whose ledgers will show different values. The manipulator can easily be caught and kicked out of the group.

But everyone maintaining a ledger for every transaction sounds ridiculous – it’s simply too much effort. With computers and the internet, this isn’t as ridiculous as it sounds.

This is essentially what cryptocurrency solves. The original intention was to give power back to the masses, with full transparency on who transacts with whom. We’re not going to dive deep into how one-way hash functions (the system that drives cryptocurrency security) work; all you need to know is that it tries to emulate the difficulty of mining gold, with a security layer on top that prevents anyone reverse-engineering transactions. The system also guarantees this by ensuring that the code that dictates the new creation of crypto automatically increases the difficulty of mining system in proportion to the number of computers trying to solve the problem at hand.

Bitcoin’s code solves this problem by ensuring that every 2,016 times a new Bitcoin is mined, the difficulty adjusts to become proportional to how much more or less hashing power is mining for Bitcoin, such that on average new Bitcoin continues to be found roughly every ten minutes or so.

This system has advantages over the gold mining system it tries to replicate. Gold’s mining is effectively random and not specified by any perfect computer algorithm. If a huge supply of gold is accidentally found somewhere on earth, it could theoretically dramatically inflate the rate at which gold enters the existing supply, which would quite obviously cause a decrease in the market price of gold. Bitcoin, on the other hand, will always be mined on a regulated schedule, because it can perfectly adapt no matter how many people begin to mine it or how technologically advanced bitcoin mining hardware becomes. Bitcoin’s max cap of 21 million coins also prevents unexpected changes in the future supply of the coin. In theory, it was a perfect system — one that seemed to take power from the banks and give it back to the masses.

However, there’s one fundamental flaw with Bitcoin and crypto in general. A Bitcoin is fundamentally a unit of energy. Large miners with computing equipment and power supply could technically control more nodes than smaller miners. And control they did. Wealth, which was supposed to go from the few rich to the masses, ended up going from the few rich to the miners. The goal of “decentraliation” was to redistribute wealth among everyone. Because miners could simply afford more nodes, this redistribution is still skewed.

True decentralised technology is also very slow as of today. A blockchain is simply a shared database at its core. Since every transaction is copied onto every node, it’s simply getting slower as the number of nodes on the network gets larger, a problem several of the brightest minds in the world are currently working on.

Finally, there have been several instances where the creators of several cryptocurrency networks have made questionable, “bank-like” decisions. On June 2018, members of the cryptocurrency community Ethereum noticed that funds were being drained from a particular smart contract called The DAO and the overall Ethereum balance of the smart contract was going down. A total of 3.6m Ether (worth around $70 million at the time) was drained by the hacker in the first few hours thanks to an exploit.

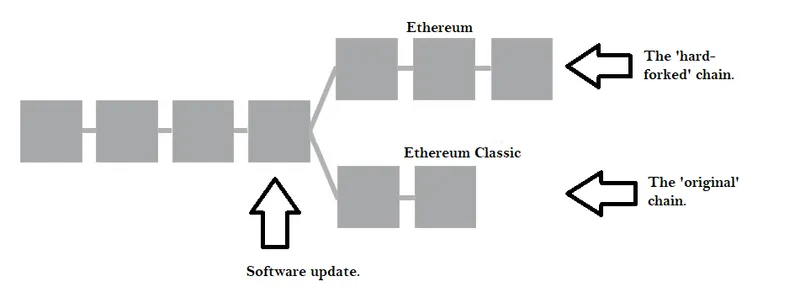

The DAO team had a plan. They would perform a hard-fork: a way to reverse the hacked transactions. It had the sole function of returning all the Ether stolen from the DAO to a refund smart contract. This proposal created a lot of controversy among the Ethereum community, which was split into two groups: hard-fork supporters and non-supporters. A fork basically means that all the transactions in the register up to to the fork date are the same, but after that day the transactions can be different depending on which chain you decide to adopt.

Hard-fork supporters had just one thing to say: What The DAO leadership suggested was eerily similar to what a bank would do. Regardless of whether there was a hack or not, the rule was that things that happen on the blockchain are immutable and they should never change regardless of what the outcome is. What if the team decides to modify other transactions later for their own need and greed? It was a slippery slope.

Ethereum foundation developers were investors in The DAO and were basically bailing themselves out. This was similar to what a bank might do; something the blockchain was the antithesis of.

The future

History seems to be repeating itself, but to be fair, this is technology’s first real crack at disrupting the very nature of money. Things like smart contracts are like standing instructions at a bank — programmatic money, which has a zillion use cases that have never been seen before. In my experience, I’ve seen an entire market form in front of my eyes and seen the intersection of economics, human psychology, and technology play out in real time.

There are a lot of benefits (and pitfalls) of such disruptive financial technology, but I’m most interested in seeing how this pans out in the virtual economy/gaming world because that’s where I think most humans will be when the world runs out of jobs.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)