The N.I.K.E. Framework – meeting the content needs of India’s users

2018 has been the year when content, especially on mobile, has found its wings in India. There is a lot of excitement about content businesses in India, and rightly so. There is a tremendous opportunity created by the next 500 million Indian internet users, with nine out of 10 users not being conversant in English. This opportunity has created the potential across languages, regions, interests, and multimedia formats. But given this diversity, saying that we are excited about content businesses would be an unjust generalisation, especially for a country like India.

As the web welcomes the newest and most diverse set of consumers it has ever seen, the demand for relevant content will far exceed the supply for a few years to come. While there will be horizontal platforms like Sharechat that will serve the needs of multiple types of users, we believe that there is enough demand in the market to support platforms that serve a specific type of user. We thus use the N.I.K.E. Framework to define content needs for varied users. We believe each of these categories can have large standalone platforms, reflecting unique user need/ behaviour, product nuances, and monetisation models.

The N(ews).I(nformation).K(nowledge).E(ntertainment) Framework

News

News is a highly verified piece of content, which is generally relevant for a limited period of time. It can appeal to users defined by geography (national, local, etc.) or by interests (politics, sports, etc.). For the literate members of the next 500 million internet users, newspaper reading is a daily habit and quite often the only source of news.

People care about news that is highly relatable to their life, neighbourhood, city, state, nation, the sport they like, or the celebrities they follow. Demand for news is so high that many cities have mid-days and evening dailies in high circulation, besides the morning edition. People prefer reading news in the language they best understand. That explains why the largest newspaper in India is in Hindi (Dainik Jagran) with a daily readership of 70 million.

In fact, in Tier-II towns and beyond, to be able to read a newspaper is directly linked to one’s literacy levels. So it is not surprising that in India, newspapers have an estimated readership of about 400 million while television has an estimated viewership of around 780 million.

These macro conditions imply that a mobile news platform should provide news in regional languages and use multimedia formats, especially videos, to appeal to a vast audience. Moreover, since users care about ‘relevant’ news, personalisation of news is also an interesting open piece.

Information

Information is verified content, but unlike news, it may be relevant for a longer period of time, mostly a few days to years. Some relevant examples would be content on platforms such as Zomato, Babycentre, Tripadvisor, and so on.

In the offline world, information is concentrated with local ‘experts’ – relevant people you trust in your network. For instance, in different parts of India, most women in their pregnancy phase consult their elders or a trusted doctor for parenting related queries. Holiday planning gets heavily influenced through the experiences of one’s friends or relatives.

The first wave of information platforms in India addressed the needs of the English speaking audience. But the first-time internet user in India today doesn’t just need information in their own language but also seeks locally and culturally relevant content.

Therefore, platforms need to solve for both creators and consumers. Creators need access to a broader audience base to disseminate their information as well as tools to create seamless information. For this information exchange, they need a way to be paid – either in the form of virtual currency like recognition (likes, followers, etc.) or real currency. Consumers, on the other hand, need information in an easily consumable and discoverable format. Vernacular audience adds another level of complexity given varied languages, needs, and consumption patterns, which the platform has to solve.

Knowledge

Knowledge is what you get when you combine information with experience and analysis. It helps you get better at something or teaches you an entirely new skill-set.

Educational institutes are considered the primary source of knowledge dissemination in the society. But there are two problems with this system for the end consumer – limited access to quality knowledge and affordability. A lot of students migrate to test-preparation hubs such as Kota because some of the best quality teaching talent is concentrated there. Some US universities offer advanced degrees in domains such as machine learning, but a large number of students cannot afford to pay their tuition fee. Many people want to learn how to speak English, but the social stigma attached to group classes stops them.

Platforms can bring trust into the knowledge ecosystem by enabling the most qualified tutors or curating high-quality content in different verticals and making them accessible to the relevant audience. Various features can enhance delivery of this content such as interactive live-streaming formats, tutor-to-peer and peer-to-peer discussions, and so on. Companies like Toppr and Unacademy are building products in this vertical.

Entertainment

Entertainment content thrives on leisure time. While leisure time spends may be different for different types of users, the need for entertainment is truly ubiquitous.

Offline, entertainment content is served through various mediums such as TV, cinema, radio, magazines, events, shows, etc. Each of these formats has either large organisations or celebrities which create content and act as a pull factor. For instance, people pay for a movie because it stars their favourite celebrity, or buy their favourite magazine because it caters to their interests.

Earlier, the expertise involved in creating such high-quality content and distributing it resided with a few companies and people. But YouTube changed that by allowing any creator to upload content for a large online audience. However, the onus of quality content creation remained with the creator. The next wave of platforms is democratizing content creation by bringing quality creation tools to the masses. For instance, Musical.ly and Douyin are letting everyone show their talent innovatively and become a micro-influencer, and sometimes, command an even bigger following than mainstream celebrities.

Entertainment platforms must make users hooked to the platform and not just the content on it. These are two different things. The content can be a commodity in nature (example, licensed non-exclusive PGC content), and users will watch the content wherever they can find it, with limited loyalty to the platform. The content can be differentiated (platform-created UGC content, original PGC content, etc.) and users will use the specific platform that serves it.

The two Ms of content: Moat and Monetization

There are two types of moats that a content platform can build:

Creator network moat: By having creators who create differentiated content on your platform. Netflix’s IP-driven content is immensely defensible and enables it to have unique content that one would not find elsewhere. Instagram has created micro-influencers who create quality content on the platform using robust platform-provided creation tools.

Distribution moat: By having sizeable captive userbase consume content on your platform. For instance, telecom and smartphone players such as Jio and Xiaomi have distribution moats. Instagram today has a distribution moat as a consequence of the creation moat.

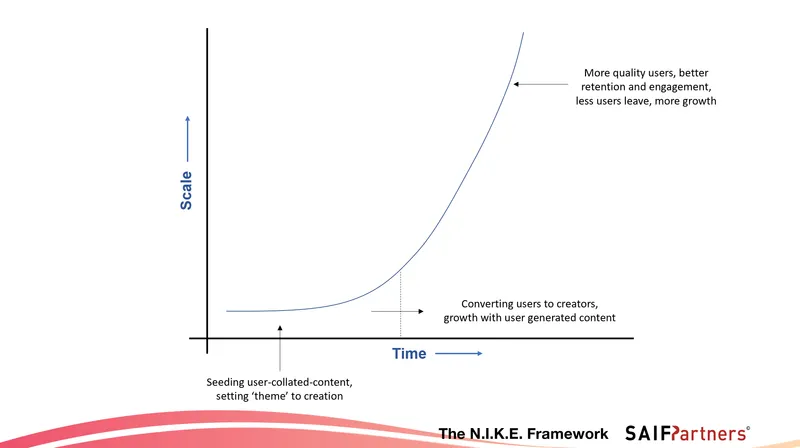

Distribution moat either comes with time and scale or with marketing spend. Hence, startups in the early days should focus on a creator network moat. Let’s take an example of a UGC platform.

The initial days require a strong focus on providing ‘highly relevant content’, which can be seeded too. This becomes a base for new users to learn from. But true exponential growth kicks in when users start generating content directly on the platform. This leads to better engagement and retention. To achieve this, the platform needs to give users tools to create content as well as create “heroes” out of its users. Once this happens, the consumers come to the platform not just for the content but also for the content creators, and the creator network moat is established. This has been done successfully by the likes of Instagram, Douyin, and Sharechat. We will talk more about this in our next post in the series.

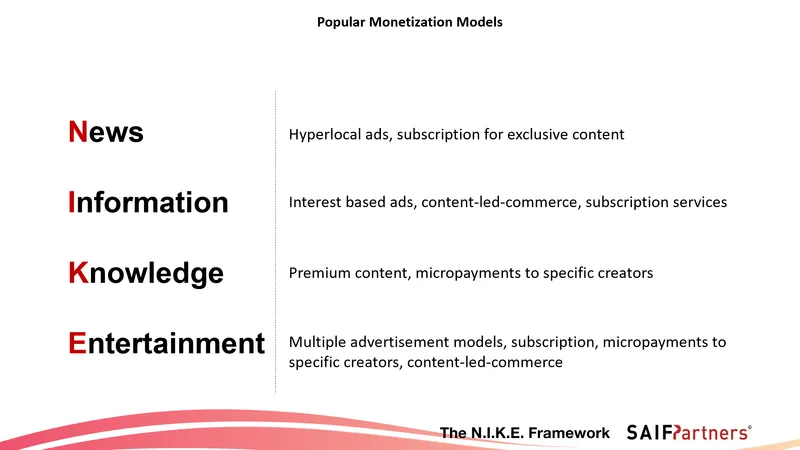

Stronger the moat, the higher the ability to monetize. Quantum of monetization depends on various factors such as the underlying target group (TG), type of interest, and the size of the userbase. Below are some popular (not exhaustive) monetization models across categories. Although, once you have a captive user base loyal to your platform, there is no dearth of the number of things you can try to make money.

Don’t guess, talk

If you are building a platform in one of the above categories or thinking towards building one, make sure you go deep into understanding what the user needs are by talking to a large number of regional users. There is a limited history of how these users consume content online; hence, guessing will not work. The only way to know is to talk to them. Of course, you can also ping us, and we would love to brainstorm with you.

If you are building a content/social networking startup, SAIF Partners is organising ‘Jamghat’, a meetup for content/social networking entrepreneurs on Wednesday, August 1, at The Leela, Bengaluru. Request for an invite here.

Mayank Khanduja and Videt Jaiswal oversee investments in the social-networking and content practices at SAIF Partners. SAIF Partners is an India-focused fund with USD 4 billion of AUM. Some of the investments that SAIF has made include MakeMyTrip, Paytm, Justdial, BookMyShow, Sharechat, Rivigo, Swiggy, and Unacademy.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)