State of Startups - funding scene looks dull after a bright start

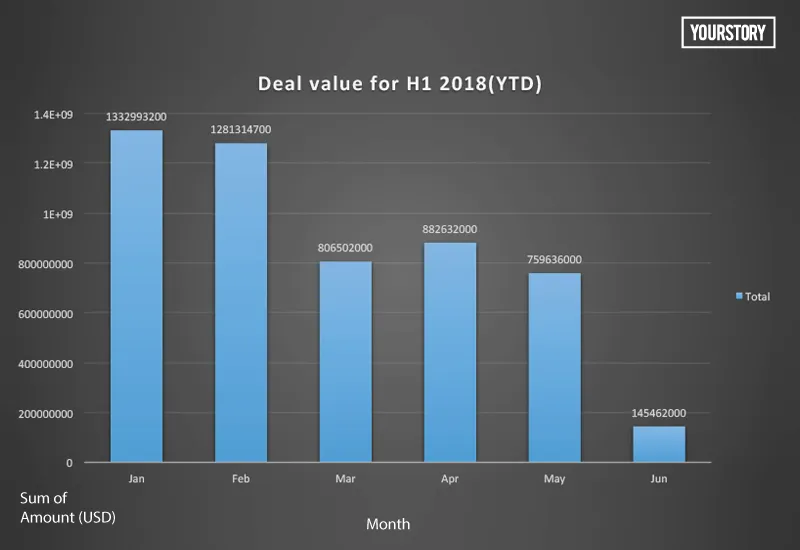

The Indian startup ecosystem has seen a slowdown in funding in the past few months, after getting off to a brisk start earlier in the year. While the first 40 days of the year saw investments totaling a staggering $1.8 billion, the funding has dropped pace since then.

The first six months of 2018, to this date, has seen $5.1 billion in startup funding, but that’s a disappointment considering the promise it held in the beginning of the year. If the ecosystem had maintained the early pace, the total funding volumes should have crossed $7 billion by now.

So, what exactly has halted the momentum?

In the first two months of 2018, the food-tech sector was especially hot. While Swiggy secured $100 million in a round led by Naspers, Zomato had done better by getting Alibaba to infuse $200 million through Ant Financial. But since then, the hunger has dropped. The travel and transportation segment, which saw investments of over $900 million in 2017, did not quite take off this year. Recently, many of the milk delivery startups like MilkBasket raised funds, but that’s a sector that is unlikely to see big ticket funding.

V Balakrishnan, former Infosys CFO and chairman of Exfinity Ventures, tries to put things in perspective.

“The scene can change with one big deal. All it takes is one big announcement and the momentum will be back,” he says.

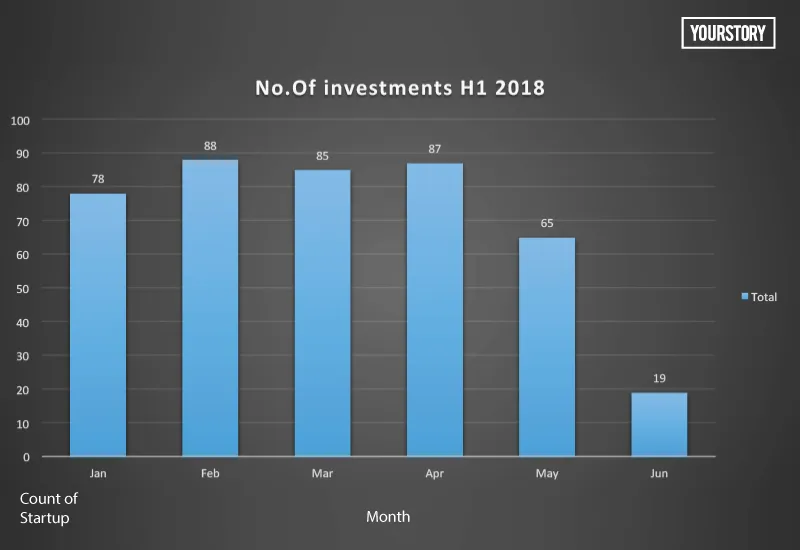

He’s right, if one takes into account the number of deals closed. According to YourStory, while in 2017 a total of 897 deals had happened, till June 12 this year, we have seen 416 deals. That’s quite close to the halfway mark. So it can be seen that we are just one or two big deals away in matching last year’s high performance. But, to be sure, those have to be really big deals in value terms.

Says Balakrishnan, “The series A and series B rounds of funding have definitely slowed down. But that’s not the case with seed funding. There’s a lot of seed funding happening, but that may not be a lot in terms of value.”

Exfinity Ventures looks at early stage startups, so he definitely gets to feel the pulse of the market.

The way the year started off, it looked like the total investments would cross $20 billion by the end of December. But that many not be the case, anymore. In fact, the ecosystem would do well to go past the $15 billion registered this year. Even that looks tough to achieve at this point.

Having said that, the second half of the year usually picks up steam. During the first half of 2017, the ecosystem saw funding of $7.05 billion. This year we are at a little over $5 billion at this point. It’s a big gap, but not something that’s impossible to bridge.

Who knows, a big funding round is around the corner. July, are you listening?