Will the Flipkart-Walmart deal mark a significant exit for biggies SoftBank and Tiger Global?

As the Flipkart-Walmart negotiations continue, it will be interesting to see what kind of exits Flipkart’s largest shareholders - Japanese conglomerate SoftBank and Tiger Global - will get.

Like they say, it ain’t over till the fat lady sings. As the saga of the Flipkart-Walmart deal looks to draw to a close, it will be interesting to see which of the big investors get an exit - Tiger Global, SoftBank, or Naspers?

With the stake that Walmart is set to acquire in the homegrown ecommerce giant believed to be between 25 percent and 51 percent, the spotlight moves from the smaller stakeholders to the larger ones - SoftBank and Tiger Global.

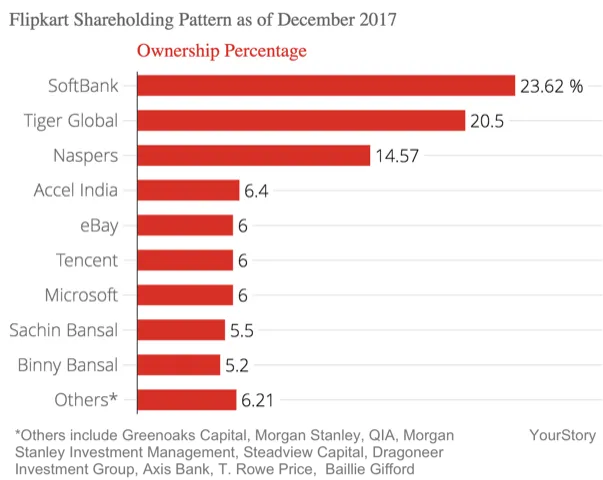

Market talk suggests SoftBank will sell a substantial stake in Flipkart, while Tiger Global or Naspers might make a complete exit. Softbank currently owns 23.6 percent stake in Flipkart, Tiger Global owns 20.5 percent, and Naspers has 14.57 percent stake.

When SoftBank invested in Flipkart, Tiger Global got $424 million, and Accel Partners got over $110 million, both partial exits. But investors now expect a blockbuster exit from the company. In an earlier conversation with YourStory K Ganesh, serial entrepreneur and startup investor, had said:

“A strategic investor always has a different equation than a pure financial investor. A strategic investor eventually wants control and a buyout. Tiger, SoftBank, and others will look at internal rate of return (IRR). Walmart will not look at just IRR. For financial investors, this is the only decent chance to sell their stakes and get returns. With Walmart as an investor, the risk is lower and the value will go up. Flipkart will be in stronger position.”

The Tiger’s bet

With Walmart looking at a controlling stake in Flipkart, it is believed to be investing through a primary and secondary purchase of shares. The secondary sales are set, according to several sources, somewhere between $8 billion and $12 billion. A major chunk of this secondary sale is believed to have come in from private equity investors, Japanese conglomerate SoftBank and Tiger Global.

Tiger Global has, over the last seven years, pumped in close to $2 billion into Flipkart.

Even after a stake sale to SoftBank's $200 billion Vision fund, Tiger remained the second largest stakeholder in the company. After its partial exit, Tiger had to focus on two things – ensuring Flipkart continues to grow and hold its valuation, and finding the right buyers for the company’s remaining stake.

An analyst close to the deal says:

“Lee Fixel, partner at Tiger Global, is in Bentonville, Arkansas, negotiating with Walmart and representing Flipkart's investors. He has always pushed for Flipkart - in the first three funding rounds for Flipkart in which Tiger participated, they led the investment only because of Lee's great equation with Sachin Bansal, Co-founder, Flipkart.”

Another analyst close to the deal adds that even when other investors were wary, Lee pushed them.

“Although Tiger Global has not invested in Flipkart in the last two years, they are keen for a successful exit for themselves and the founders. Naspers and other smaller investors will also exit completely,” adds the analyst, seeking anonymity.

The Japanese stake

There are two theories on what SoftBank could do next. Currently, SoftBank holds 23.6 percent stake in Flipkart. While few sources familiar with the deal state that Softbank may completely exit the company, many believe it will - at the moment - wait, and may only take a partial exit.

Mohit Gulati, an investor, says, “SoftBank might actually take a significant exit from the company. The $200 billion Vision Fund has a great talking point of showcasing a significant return from investment made few months back.”

It is interesting that speculation is currently strong on Softbank’s partial exit as it was earlier opposed to selling Flipkart to Walmart.

“They had invested more than $1 billion only a few months ago. However, the deal gives a great returns story; a $1 billion investment could give close to 5 to 6x returns in 10 months,” says another analyst on the condition of anonymity.

Sleeping Tiger and its exit

Tiger Global has been in hibernation in India for close to two years now. The hedge fund has the likes of Ola in its portfolio. In fact, when logistics startup Blackbuck raised its Series C funding, Tiger did not participate in the funding round.

“In 2015, when Tiger was active in India, it brought in exuberance into the market. However, in India, the waiting game is at least close to 10-15 years,” says another analyst, seeking anonymity.

Exits like these bring in more capital and money into the market. What will be interesting to see now is where these funds will next be deployed.

(With inputs from Athira A. Nair)