Walmart closes in on Flipkart, to look at buying out smaller investors this week

Top shareholders in Flipkart include Tiger Global, Softbank, and Naspers, and Walmart has to handle each of them to take control of the company.

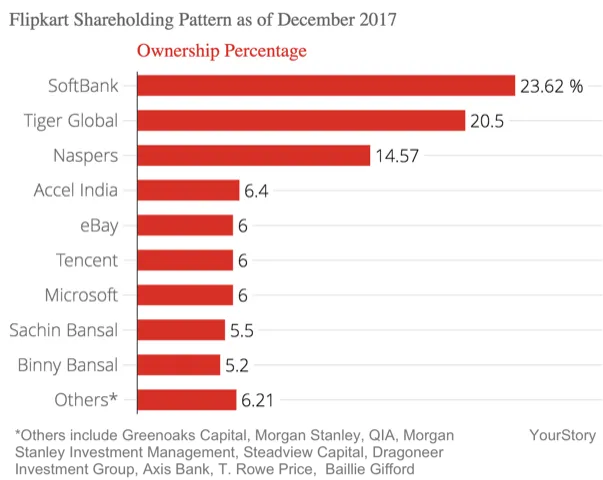

Walmart is set to enter India with a bang, and very soon at that. In its bid to buy controlling stake in Indian ecommerce major Flipkart, word on the street is it may spend this entire week trying to buy out smaller shareholders in the company like Greenoaks Capital, Morgan Stanley, T Rowe Price, and Dragoneer Invest Group, among several others.

There are over 50 investors in Flipkart, and to avoid making an open offer as per the Singapore Repurchase Code, Walmart will have bring this number below 50 by buying out smaller shareholders.

Walmart has to comply with Singapore laws in its bid to take over Flipkart as the latter is registered in the country.

Once the US-based chain reduces the number of shareholders in Flipkart, it will have to contend with the larger ones on the price to be paid to buy their stake.

Flipkart has so far raised $7.3 billion, and could command double that amount as valuation and that means a helfty sum for Walmart to pay to take control of the company, say sources. However, what matters here is who exits, and who stays when the new investor comes on board. Sources say a major shareholder does not want to exit its holding in Flipkart.

That could be either Softbank or Tiger Global, which own 23.62 percent and 20.50 percent of the company, respectively, or even Naspers, which owns 14.57 percent. Co-founders Sachin Bansal and Binny Bansal together own 10.70 percent in Flipkart.

“Walmart is buying controlling stake, and SoftBank is completely exiting the company. Only one PE company wants to remain, and is bargaining hard on the dilution. The founders will remain by diluting a little stake, and only of the founder will dilute stake,” says a source familiar with the deal.

Other sources say Walmart, on its part, is turning on the heat when it comes to that shareholder as it is looking for complete control of Flipkart.

Why Walmart wants this bad?

The Walmart-Flipkart deal, if it goes through, will allow the duo to take on Amazon.

Amazon’s annual revenue stands at around $177 billion, whereas that of Walmart is around $480 billion. The comparison to note here is that while Amazon’s entire revenue comes from the digital space, that of Walmart is not more than 3 percent, or around $14.8 billion. In this context, industry experts say, India becomes vital and Walmart would look to own a significant stake in Flipkart to boost its global revenues.

With the Flipkart brand, Walmart will also get data on its consumers, the company’s engineering team, its 400,000 vendors, and a supply chain that includes 17 fulfillment centres.

FDI rule hurdle

While Walmart cracks the shareholding pattern in Flipkart, it has to also figure out how to operate in India given that FDI in multi-brand retail is capped at 51 percent. It already has a presence in India through its 21 Best Price Modern Wholesale stores, and one will only have to wait and watch its plans for a retail foray. Sources say that FDI rules do not permit a market place (which are Flipkart/Amazon) to be in the business of fulfillment of multi-brand items. Walmart, globally, is big in food and multi-brand retail and would want to ramp up its selection to win consumers. India's organised food business is only $30 billion, according to E&Y, the opportunity can be as large as $300 billion. Walmart perhaps has to lobby with government to compete with Amazon Pantry, in India, to fulfill food items.

The government is yet to come to a consensus on selling multi-brand items and here is the white paper on the same, which Walmart has to contend with because the government has not yet visited the rules when it comes to certain products, especially food.

Now, this is where Amazon has invested in local companies like Cloudtail and Olympia, to circumvent the problem of rules regarding local fulfillment. Nonetheless, sources add, multi-brand is a tricky situation for market places in India.

If all goes according to plan, say sources, Walmart will have a firm foothold in India in a couple of weeks. In those two weeks, some investors will count on an exit, and some Flipkart employees will rejoice in their wealth multiplying.

As the Indian ecommerce sector enters a new era, what needs to be seen is how the Indian consumer will make the most of it.