[Winning Pitch] How NestAway got Tiger Global and Yuri Milner to invest

When NestAway CEO Amarendra Sahu met Yuri Milner in San Francisco two years ago, his pitch was clear.

Russian billionaire Yuri Milner was an early investor in startups with great potential across the world - Facebook, Whatsapp, Spotify, JD.com, Airbnb, Alibaba, and Twitter - through his VC firm DST Global. In India, he is an investor in Flipkart, Ola, Practo, Udaan, Razorpay, and Blackbuck.

Two years ago, Bengaluru-based home rental startup NestAway caught Milner’s eye. Founded by Amarendra Sahu, Smruti Parida, Deepak Dhar, and Jitendra Jagadev in 2015, this startup is backed by Tiger Global Management, IDG Ventures India, Ratan Tata, Flipkart, and Inmobi, among others. It has raised a total of $91 million with its most recent Series D funding in January 2018.

So, what won these investors for NestAway? In an interaction with YourStory, Co-founder and CEO Amarendra answered the question in one word: Luck.

“There is no recipe (for fund raise). It’s about market, and finding the right investors who are keen on your model. They may have invested in a similar space or company. You reach out to them; figure out what is and what is not working for them,” he says, adding that based on the startup founder’s vision on how he or she wants to build the company, what needs to be fixed can be.

“If you go raise funds later, chances of course correction are limited,” he adds.

Credit to luck

So, what were the magic words that got Lee Fixel, partner at Tiger Global, to invest in NestAway? Amarendra says, “When Lee asked for a unique insight in this market, I said India is a large market (worth $20 billion); rental is a big problem; and a full stack approach may produce results.”

So it is not just luck, is it? Amarendra quickly adds,

“What if I had met Lee three months later, and what if the market had tanked by then? So, it was luck. What you can’t reproduce, you should never take credit for. Funding is one of those things.”

But luck does not bring you funding unless your pitch is strong. When Amarendra met Yuri Milner in San Francisco two years ago, his pitch was clear.

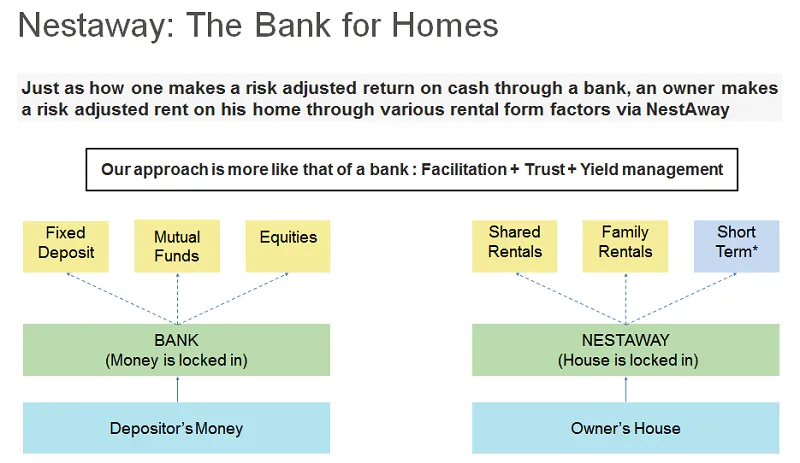

“I talked about how NestAway wants to change not just where India lives, but how India lives. I told them we are building a ‘Bank for Homes’, that we are already present in seven cities, about our growth rate, how we make money, how this is scalable etc,” he recollects.

In three years, NestAway has generated revenue of Rs.350 crore. Notably, Nestaway has an arbitration clause in its agreement with tenants and owners. Rather than go through a court procedure (which may take years), Nestaway resolves issues between tenant and owner through an arbitration.

The valuation game

What decides the amount of investment you raise? Amarendra says, “What you raise depends on investors’ willingness to give, the company’s valuation, how much (stake) you are willing to dilute etc. Once you get an idea on how much money you need to do what you want to do, you strike a balance (with the investors).”

Amarendra explains why NestAway decided on $51 million in the most recent funding round. “If you offer me $99 million at the same valuation and dilution, I will take that. But taking high valuations is risky, because then you have got to perform at a different level. It will be like a fast track treadmill. You want to start at 5, and then go to 7; but if you get offered more money, you will need to go above that.”

![[Winning Pitch] How NestAway got Tiger Global and Yuri Milner to invest](https://images.yourstory.com/cs/wordpress/2018/04/L-RDeepak-Dhar-Amarendra-Sahu-Jitendra-jagadev-Smruti-Parida.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)