A look at SoftBank: the Japanese behemoth with global ambitions

There are few companies in the world that can compare to the SoftBank Group Corporation in terms of sheer diversity and scale of operations. What started off as a distributor for PC software in 1981 has today blossomed into a behemoth with undertakings in telecommunications, internet technology, transportation, finance, media, robotics, venture capital, and much, much more. Headed by its founder and CEO Masayoshi Son, the Japanese conglomerate has constantly stayed in phase with the ever-changing world of technology and business, earning itself a place among the largest and most valuable public companies in the world today.

Masayoshi Son is a serial entrepreneur who has made a name for himself by being an unashamedly outspoken risk-taker. The ‘Japanese Bill Gates’, who himself happens to be an admirer of Steve Jobs, has made several multi-million-dollar bets that haven’t always paid off and has often stirred controversy through his outlandish remarks. On the flip side, however, he has led SoftBank from being a fledgeling software distributor to being an international juggernaut with an arm in nearly any sector you care to name. He is also a generous philanthropist and has inspired several of his compatriots to defy traditions and take more risks.

Image: Flickr

The rise and rise of SoftBank

Under Masayoshi’s guidance, SoftBank’s steady rise has been primarily predicated on identifying promising verticals and making key acquisitions in the companies poised to disrupt them. Having started out as a software distributor that initially diversified into publishing, SoftBank has shown no reticence in venturing out into untested waters. The one vertical in which this modus operandi has paid the most dividends is undoubtedly the internet.

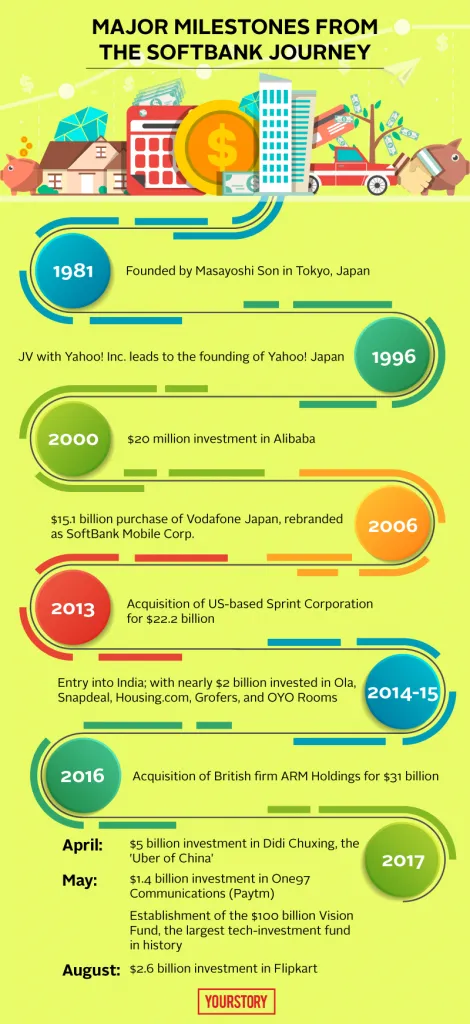

SoftBank’s tryst with the internet began in 1996 when it purchased a controlling stake in Yahoo! Inc. and established the Yahoo! Japan Corporation. Then, during the heights of the dot-com bubble in 2000, SoftBank invested $20 million in a little-known Chinese internet venture called Alibaba. The investment turned out to be a prudent one, and when Alibaba went public in 2014, SoftBank’s 19 percent stake in the company was valued at a whopping $60 billion, making it the most successful investment in the firm’s history.

While the value of its Alibaba investment was rising by the day, SoftBank stormed into the global telecommunications market as well. It began with the $15.1 billion purchase of Vodafone Japan in 2006, which granted the company leeway in the country’s burgeoning mobile market. After changing the company’s name to SoftBank Mobile Corp, it announced a partnership with Apple in 2008 which made SoftBank the sole official carrier of the iPhone in Japan for three years. A few years later, in 2013, SoftBank acquired the US-based Sprint Corporation for $22.2 billion but was unable to capture the US telecom market, making it a rare failure for the company.

In keeping with its goal of staying abreast of the ever-evolving space of technology, SoftBank made a slew of high-profile investments in the last two decades, most of which have brought large dividends to the company. SoftBank bought majority stakes in video game companies Supercell and GungHo Online Entertainment and sold them for healthy profits within a few years. In 2016, SoftBank then acquired British chip designer ARM Holdings in a $31 billion deal, the biggest-ever purchase of a European technology company.

ARM designs and licenses most of the chips used in mobile devices today and has recently diversified into creating chips for devices in the Internet of Things (IoT) and Virtual Reality (VR) verticals. Despite boasting customers like Apple, Samsung, and Qualcomm, ARM only netted around $1.5 billion in revenue in 2015. However, SoftBank’s investment in the company is certainly long-term, and the company hopes its bet will pay off as the IoT and VR sectors continue their rise in recent years. In a similar vein, SoftBank invested $5 billion into Didi Chuxing – dubbed the ‘Uber of China’ – which is keen on using artificial intelligence to bring advanced systems to its driving service.

To further increase his company’s already vast investment capabilities, Masayoshi Son has also masterminded the largest-ever tech investment fund, dubbed the ‘Vision Fund’. Backed by Saudi Arabia’s Public Investment Fund, Abu Dhabi’s Mubadala Investment Co, Apple, Qualcomm, Foxconn, and Sharp, the SoftBank-led fund has used its $100 billion corpora to acquire stakes in scores of tech companies around the world. Some of the biggest deals using this fund include investments in WeWork ($4.4B), Flipkart ($2.6B), Roivant ($1.1B), and Improbable ($502M).

SoftBank in India

The Japanese conglomerate began its tumultuous journey in India in 2014 under the direction of then Vice-President Nikesh Arora, a former Google executive who was touted to be the next SoftBank CEO. To capitalise on the fast-rising consumer internet market in the country, SoftBank poured in millions in those startups which it thought had the most potential. E-commerce marketplace Snapdeal, ride-hailing service Ola, property search platform Housing, grocery delivery service Grofers, and hotel room booking platform OYO were the chosen beneficiaries, and they collectively raised around $2 billion from SoftBank until the end of 2015.

In June 2016, SoftBank COO and heir-apparent Nikesh Arora abruptly quit the company. The official press release from SoftBank announcing his departure stated, “Son’s intention was to keep leading the Group in various aspects for the time being, while Arora wished to start taking over the lead in a few years’ time. The difference of expected timelines between the two leads to Arora’s resignation from the position of Representative Director and Director of SBG with the expiration of the term of office and his next steps.”

Nikesh’s overseas investment duties were then placed in the hands of SoftBank board member Ron Fisher and founder of Baer Capital Partners Alok Sama. The role of President and COO went to Ken Miyauchi, a long-time SoftBank employee who was President and CEO of the company’s telecom division, and an employee since 1984.

While there initially were worries about the impact Nikesh Arora’s departure would have on SoftBank’s investments in India, it wasn’t the change in personnel but rather a change in the market that heralded trouble. The large initial influx of capital had skyrocketed the valuations of these startups, but it all came crashing down when the market began to turn around.

SoftBank’s troubles in India began with the Housing fiasco and came to a head with the implosion of Snapdeal. In early 2017, the devaluations of Snapdeal and Ola, which had initially raised $627 million and $210 million respectively from SoftBank in October 2014, incurred losses of around $1.4 billion to their benefactor. Soon after, a bid to merge Snapdeal with rival Flipkart fell through, leaving SoftBank all the worse for wear. But the India chapter of SoftBank was far from done.

Snapdeal and Housing aside, the other startups which SoftBank had initially invested in (and continued to back over the years) went on to become market leaders in their respective verticals. Ola, in particular, has been highly successful in its segment and has even taken measures to prevent SoftBank from increasing its stake in the company. But come 2017, SoftBank made it loud and clear that its tryst with the Indian startup space still has a long way to go. In May, SoftBank bought a 20 percent stake in One97 Communications, owner of payments platform Paytm, for $1.4 billion, and followed it with an estimated $2.6 billion investment in Flipkart in August.

With these latest investments, SoftBank is well on its way to meeting the target of investing $10 billion in India by 2025 – a target set by Masayoshi Son in 2015.

Today, armed with the Vision Fund and its founder Masayoshi Son’s unwavering dedication, SoftBank is poised to continue its bankrolling of some of the world’s largest and most disruptive technology companies. But with an incredibly diverse portfolio with assets that already include everything ranging from artificial intelligence to e-commerce, it begs the question: how much is there left really that SoftBank doesn’t already have a stake in?