Why PhonePe is betting big on the calculator to enhance its offline presence?

Close to seven to eight lakh calculators are sold every month in India, and PhonePe aims to tap into this very market, and up the ante by offering an integrated payments solution that every merchant, big or small, can easily identify with.

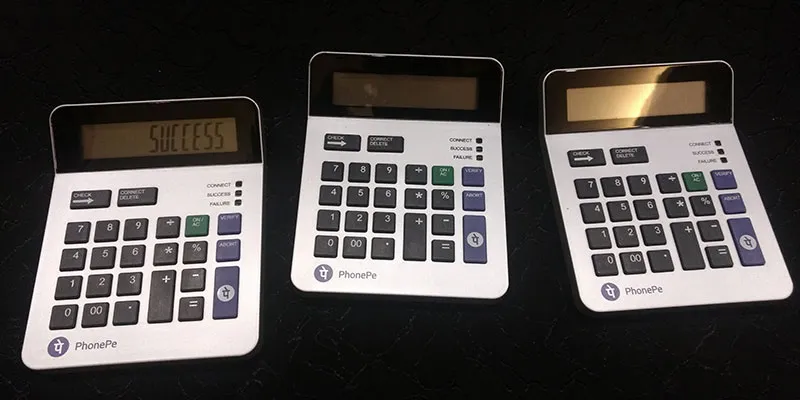

Flipkart’s payment arm on Tuesday (October 31) announced the launch of its indigenously designed Point of Sale (POS) device powered by Bluetooth technology. The device looks much like a calculator but does more than just tally numbers.

Using Bluetooth technology, the device allows a consumer to pay from the PhonePe app to the POS device by selecting the ‘Scan and Pay’ button. The merchant, on his part, has to press the ‘PhonePe’ button on the device to accept the payment.

Unlike traditional systems, the device does not need internet connectivity for the merchant. Only the consumer needs an active connection.

Sameer Nigam, Founder and CEO of PhonePe, says the inception of the product started around 18 months ago and sought to address merchants’ need for a rather simple device that they could understand intuitively.

According to the Reserve Bank of India (RBI), as of August 2017, India had approximately 2.8 million PoS machines, not to forget the increasing penetration of QR codes from wallets and banks (in the form of BharatQR).

So, with an existing QR strategy (in partnership with POS players), why is PhonePe working on a POS strategy of its own? A part of the answer lies in the design thinking behind the product, overcoming challenges of traditional POS systems in the market.

Rahul Chari, Chief Technology Officer and co-founder of PhonePe says,

“If you see, the calculator is central to any kirana store. We see it hanging from ropes or usually covered in plastic. It (the PhonePe POS device) is exactly like the calculator with the right-hand body of the hardware having buttons (of Verify, Abort, and PhonePe) to accept digital transactions.”

Value proposition

- The cost: A POS machine costs merchants between Rs 5000 and Rs 7000, and comes with a monthly rental levied by payment providers. This is not inclusive of the Merchant Discount Rates (MDR) levied on the consumer per transaction. In fact, due to the high cost involved in using the hardware, only 200,000 POS devices were added between April and August 2017, according to the RBI.

PhonePe claims a merchant will not have to pay any rental with its latest offering, and only have to pay upfront a refundable deposit of Rs 699.

- Trust and transparency: A major issue identified by the PhonePe team while building the solution was trust among merchants. When transacting through QR, a consumer puts in an amount and makes the payment. Sameer says,

“We saw that in stores the person operating the counter is not necessarily the owner. So, when a transaction is made, the owner gets the notification, who might not be at the store to verify the same from his end.”

The new device allows merchants to input the amount allowing for ease of transacting and verification. Being UPI-powered, the money is directly credited to the merchant’s bank account.

- Reconciliation: Another major pain-point with digital payment instruments in offline environment is reconciliation.

With multiple notifications, a merchant finds it challenging to tally each transaction against the balance in a bank account or various payment instruments. However, through the merchant app, payments made in the day can be easily tracked.

Rahul said,

“We are trying to make the solution as close as possible to a normal cash transaction.”

- Universal appeal: “We want to get rid of differentiation of POS or QR, and want to make a universal payment solution,” says Sameer.

In past interactions, the founders have said PhonePe is a ‘payment container’, and allows consumers to upload and pay through their debit and credit cards using UPI. Recently, the firm also partnered with Jio Money wallet, enabling transactions through the same on its platform.

The company is looking to start piloting with 5000 devices in Bengaluru.

According to the company, it clocked close to 16 million transactions in September, and is expecting a considerable rise in October. It also claims to have close to 50 million downloads of the PhonePe app.

Also read: The fault in our PoS: are we ready to go cashless?

In a market already penetrated with options of POS, QR codes, how does PhonePe plan to push its solution?

Sameer says,

“In large cities, we already have a strong consumer base and by creating awareness about the outlets accepting our POS, we might create a fillip. Second, we might allow the merchant to buy the solution on sites like Flipkart, and deliver it to their doorstep. The third strategy is of riding on the ‘network effect of stores.”

He explains shopkeepers interact regularly about challenges and digital solutions, hence creating a ‘network effect’, allowing higher adoption of a better solution.

Rahul adds,

“What demonetisation did was create awareness about digital payment options. Now, with the merchant understanding the value of such solutions, it will be about the best solution that fits the bill.”

He also hinted the solution may see a huge uptake with delivery personnel, adding a better consumer experience to Cash-on-Delivery transactions.

What does this mean for QR? Sameer says QR is still an efficient payment method for high transit areas such as metros.

While not putting any numbers or target to PhonePe’s offline strategy, Sameer says,

“Our offline transactions are still at the very nascent stage, say sub 10,000. It is exactly where PhonePe was a year ago. But we are sure that in the next one year, a few million transactions will come from offline.”

Just this month, in one of the largest commitments in the Indian payments space, e-commerce marketplace Flipkart announced an investment commitment of $500 million in PhonePe.

PhonePe had then said it will use the investment to scale up its technology, reach, and offerings.