Going beyond doctor-patient interactions, healthcare is getting smarter by the minute

Healthcare in India seems to be in the pink of health. A Kalaari Capital and Grant Thornton report says healthcare now means more than just detection and cure; it’s about prediction and prevention.

Gone are the days when naïve patients would be given placebos. Healthcare is no longer restricted to doctor-patient relationships, with a few rounds of consultations and medicines. The focus is now shifting from detect-and-manage to predict-and-prevent.

Shashank ND, Co-founder and CEO, Practo, says, “When we started, I was surprised that none of the reports were digital or online.” Practo was one of the first platforms in India to take patient records online; today it is considered one of the highest funded healthcare startups in India.

Over the past few years, several startups have disrupted the space, making healthcare more than just cure. The healthcare report by Kalaari Capital and Grant Thornton shines the spotlight on key emerging trends in the healthcare ecosystem:

From patients to consumers

As Vrinda Mathur, Partner, Grant Thornton, points out, the space is moving from detect and manage to predict and prevent. Consumers today are no longer looking for just a cure; a healthy lifestyle is what life is about. Thanks to the growing digital landscape, information is no longer difficult to access.

Fitness begins at home

With growing awareness and understanding of what is happening, there is a growing focus on fitness at home. From the food one eats to the kind of workout people look for, healthcare isn’t confined to hospitals. This is shown in the kind of startups operating in the space – Truweight, Sprout Life Foods, Yoga Bars, Curefit’s Eatfit and Zago to name a few.

The report by Kalaari Capital and Grant Thornton also points to a Nielsen Global Health/Wellness survey, which states that Indian consumers today are willing to pay above 70 percent premium for certain variants of foods for their health and wellness attributes.

Interest in superfoods and diets

The Nielsen Global Health /Wellness Survey, Health and Wellness foods market in India is estimated to be Rs 10,352 crore, and growing at 10 per cent annually.

Consciousness about the type of food being eaten, its nutritional value, and increased knowledge of its effects on the overall body system have led to the emergence of dietary rules. Terms such as “trans-fat”, “low carb”, “superfoods”, “natural”, “gluten-free” and “keto diets” are now commonplace.

The dietary supplements market in India is projected to grow at a CAGR of nearly 12 percent over the course of the next four to five years. Super foods such as quinoa, barley/millets, cold pressed juices, protein and vitamin supplements and several others are widely consumed. Technology platforms such as Healthkart, Neulife, Medisys and Amazon are playing a significant role in improving access to health and functional foods.

Growing focus on fitness technology

The fitness technology market in India is expected to double in value to $250 million by 2023 (of which nearly 90 percent is expected to be fitness wearables).

Growing smartphone penetration in India will increase access and use of fitness applications and technology. Everyone today is looking for “fitness on the move”. The report points out that Fitbit currently holds close to 82 percent market share in Indian activity trackers.

Using data to bring in predictive care

Growing smartphone penetration in India will increase access and usage of fitness applications and technology. This, in turn, generates data that can be used to bring in predictive healthcare. Examples include Goqii , which tracks body vitals and provides advice; the Micromax Yu App-based workout progress and diet tracker; Boltt, which offers virtual health coaching to users; Endomondo, which tracks fitness through mobile applications; UE Lifesciences for portable breast cancer screening; Sensoria, which brings in AI-based sportswear; Call Health, which offers integrated healthcare, pharmacy and allied services; and Athos, which focuses on clothes integrated with wearable tech.

Startups like ICT Health offers admission/revenue cycle management while Practo helps automate the doctor consultation model by scheduling visits online. Attunes Technologies, Vita Cloud and Dr Lal PathLabs are emerging startups that use cloud-based tech to automate hospital records, lab tests reports and medicine stocks.

AI playing a strong role in predictive healthcare

The use of Artificial Intelligence (AI) for early detection of diseases can improve mortality rates and lower costs of healthcare.

AI also has the power to disrupt clinical diagnosis as it provides much better accuracy in a relatively lesser period of time. The growing use of wearables and the amount of data being generated has made it imperative to use the information to come up with healthcare needs and requirements for each individual.

Healthcare at home

Startups like Portea, Medwell Ventures and Callhealth bring healthcare services like lab diagnosis and tests directly to homes. Companies like Healthcare at Home and Care 24 enable patients to outsource specialised post-diagnosis care like managing post-surgery chronic pain, home IC and therapy.

Over the past few months, health tech has been buzzing with startups helping in hospital management systems, doctor discovery, delivery of medicines and now home healthcare services.

The home healthcare market is believed to be growing at a CAGR of 9 percent and is estimated at $349 billion. Many reports suggest that the growing need for home healthcare is because of double income households, social structural changes, and an increased need for geriatric care.

Conclusion

Just off the first half of the year, India’s startup ecosystem has seen a lot of action at several levels. According to YourStory research, the first half saw close to $7 billion raised in funding across 455 deals. In comparison, the first half of 2016 had over 552 deals, but funding raised was far lower at $2.3 billion.

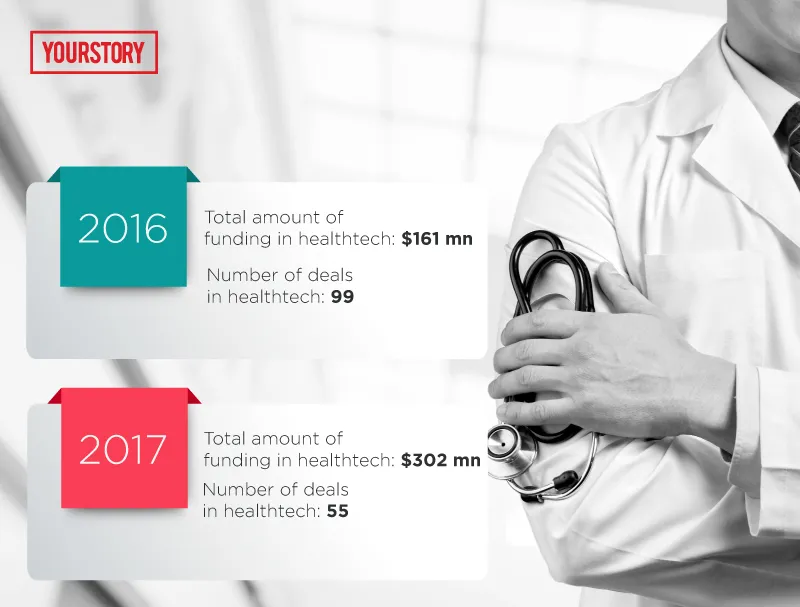

What is an interesting trend is that while the number of deals is lesser, the deal sizes are larger. This holds true for the healthcare sector as well. YourStory research shows that there were 99 deals amounting to $161 million in 2016; this year, there have been 55 deals, which have already touched $302 million.

Prashant Tandon, Co-Founder and CEO, 1mg, an online healthcare startup, says the new drugs and cosmetics rules will ensure availability of drugs at reasonable prices and believes there is a shift towards technology.

Sanjay Anandaram, a well-known mentor in the startup ecosystem, believes that like the e-commerce sector, the healthcare sector too will continue to grow and have a significant impact.

“In recent years, there seems to be a growing awareness towards a healthy lifestyle, rather than just preventive care. Therefore there needs to be a larger market for this,” Sanjay says.

(Disclaimer: Kalaari Capital is an investor in YourStory.)