Flipkart trumps Amazon in first sale of festive season

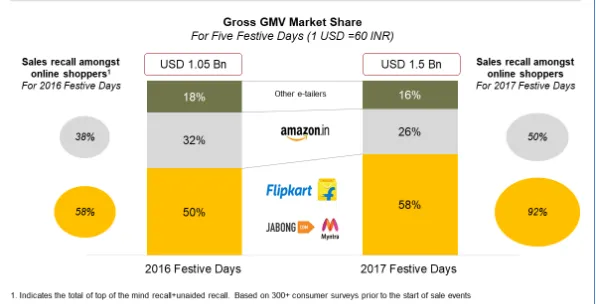

Flipkart has emerged as the leader after the just-concluded festive season sales with a market share of 58 percent versus Amazon's 26 percent, according to a report by research and advisory firm RedSeer Consulting. Flipkart's market share includes Myntra's and Jabong's sales numbers.

Overall, online retail firms had sales of $1.5 billion. In 2016, the companies had seen sales worth $1.05 billion.

This year's sales number is at the lower end of the projections — $1.5–1.7 billion — made by RedSeer. Flipkart has claimed it doubled its Gross Merchandise Value (GMV) during its five-day Big Billion Days (BBD) sale this year compared to the same sale last year. This would put the number at over $900 million. However, industry sources put the number at below $800 million.

Amazon's market share has come down this festive season from 32 percent last year. Even before the sales started Flipkart had managed to amplify buzz. In a survey done by RedSeer, 92 percent of respondents said they were aware of Flipkart's BBD sale. Only 50 percent of respondents showed awareness of Amazon's Great Indian Festival sale. Further, about 80 percent of respondents said they intended to make a purchase on Flipkart during the sale, while only about 23 percent of respondents showed an intent to buy on Amazon.

The RedSeer report does not show Paytm's performance separately. Paytm Mall was doing a festive season sale for the first time and had announced that it would offer cash backs worth over Rs 500 crore to its customers. After Flipkart and Amazon, all other e-tailers put together had a market share of 16 percent. This includes Paytm, Snapdeal, and ShopClues.

The strong awareness among consumers, driven primarily by high-voltage ad campaigns in the days leading up to the sale, contributed to the 40 percent growth in overall GMV over last year. Other factors called out by RedSeer include:

- Strong offers across categories, especially on electronics

- Superior shopping and delivery experience

However, the performance is not as impressive as the targets the e-tailing companies had internally set. Flipkart had expected about $1 billion GMV, according to multiple people YourStory spoke to. This could be a reason why the e-tailers are planning to have more sales during the festive season, with the next one as early as the first week of October. A report by The Times of India on Tuesday stated that Flipkart and Amazon have already informed their sellers to be prepared for a sale next week.

This might be good news for customers, but companies should also consider the risk of sales fatigue!

Also Read

Why the festive season sales can make or break Flipkart and Amazon

Amazon India’s real Prime strategy is not the obvious one