How Purplle won the online cosmetics industry and grew sales from Rs 45,000 to Rs 15cr a month

Purplle has differentiated itself in the cosmetics and beauty products vertical by providing consumers with a personalised shopping experience that takes skin and hair type into account.

Times have changed for the average Indian woman whose “makeup” used to be just talcum powder, kajal and bindi. The last decade – and globalisation – have transformed the lifestyle of the Indian middle class. Riding the wave of economic growth was a bunch of aspiring entrepreneurs who went on to change the course of enterprising in the country.

In late 2011, three men joined the startup bandwagon by taking a plunge into ecommerce. Purplle began as an online platform for selling cosmetics and beauty products, a virgin vertical in ecommerce at the time.

Unlike furniture or home decor, there is no customisation possible in the beauty and cosmetics’ sector. Since customers already have a certain comfort level with horizontal marketplaces due to electronics, footwear and apparels, they tend to go to more categories on the same platforms like Amazon and Flipkart.

A differentiation in products and shopping experience was essential to tempt customers to choose a vertical player over horizontal ones. The hurdles were many for Purplle. But five years later, the startup is thriving and how.

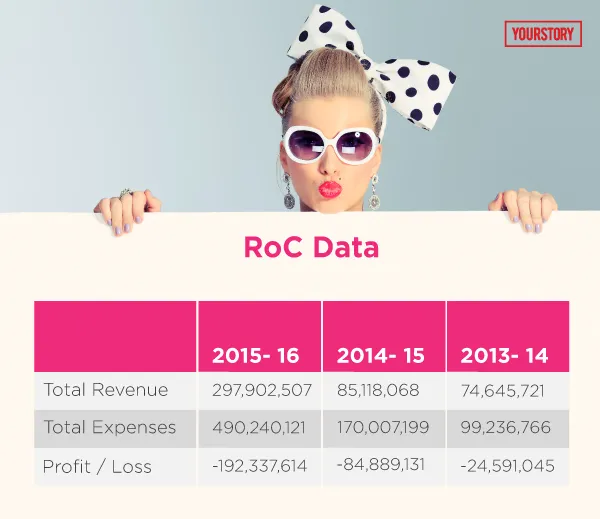

While the Indian ecommerce industry is still in its pre-teens, this early beginner continues to be the top player in the sector. In fact, Purplle claims to have broken even operationally last year and states that it would be EBIDTA positive by December 2017.

Three men and an idea

For Manish Taneja, Founder and CEO, Purplle was his second attempt at entrepreneurship. The first one, which he started when he was 24, had fizzled out in less than two years. Having worked at Avendus Capital earlier, he went back to the other side of the ecosystem and joined Fidelity Partners.

At 27, Manish, an alumnus of IIT Delhi, started up again with Rahul Dash (from IIT Kharagpur, IIM Ahmedabad; then working with Tata Group), and Suyash Katyayani (IIT Kharagpur), who is now Purplle CTO.

It was purely a business call to enter the beauty segment. The trio had debated between furniture and fashion, before settling on beauty. Furniture needed a very high initial investment, and Myntra and Jabong had an early start in fashion and were rocking the party.

Cosmetic is the highest repeat category, thanks to women with increasing disposable income and exposure to trends. It gives the best margins – about 90 percent in luxury brands and 75-80 percent in the budget category, Manish says.

About the beginning, Manish recollects, “In 2011, there was no Sephora in India. There were hardly 100 beauty stores, even in Mumbai, and about 10 big beauty centres where salons did B2B transactions.”

Started with Rs 40 lakh from their savings, Purplle’s first month saw just Rs 45,000 in sales – that too from family and friends. But four months later, Purplle started gaining momentum – with a monthly scale of 30 percent. Today they make Rs 15 crore per month.

Contextualising supply for consumers

Beauty and cosmetics is one of the fastest growing verticals in online commerce today. But consumer behaviour gave Purplle its USP.

Indians are generally reluctant to have conversations with strangers, including beauty store experts. Manish explains: “Few would look up to the brand-allocated advisers in a store. After all, her job is just pushing products and her product knowledge may not be great.” So, due to lack of knowledge, most Indian women use foundation two shades lighter than their face.

Due to physical constraints, offline stores cannot stock a lot of products; they push certain brands without knowing anything about the customer. This is where ecommerce plays its magic.

At Purplle, out of Rs 300 crore of gross sales, no single brand contributes more than 5 percent of the total revenue.

“Since we guide 40 percent of our beauty users through a personalised shopping experience, they do not just land on the most-selling brands,” Manish says.

Tech is the only way to personalise solutions for the customer. Purplle’s USP is its product knowledge engine. Within seconds, it can decipher and collate things like tea tree can help an itchy scalp, party wear needs brighter lipstick shades or lipstick shades that match a customer’s skin tone.

The different attributes of lipsticks – finish (matte, gloss, semi-matte), pigmentation, moisture formulation, SPF, etc – can also be sifted through.

Purplle’s target audience is women in the age group of 21-32 years, who want to discover the products right for them. When a customer visits Purplle’s app or website, it pops up a questionnaire to understand the user’s needs, by asking about skin tone, type, and specific problems like pigmentation or dry skin. All results are then personalised – not by browsing history but by the customer’s traits.

Revenue from repeat customers

By December 2015, Purplle decided that it was time vendors started investing in them; so they moved to the marketplace model. “It gives us control over our entire user experience. We do the logistics ourselves,” Manish says.

The one common factor for all B2C ecommerce firms is their focus on discounts more than customer service. But in Purplle’s case, it’s just the opposite. Manish says that out of their 70-member team, customer care is the smallest as they rarely get any complaints. This has been the case since 2014, although the business has grown 20 times since then.

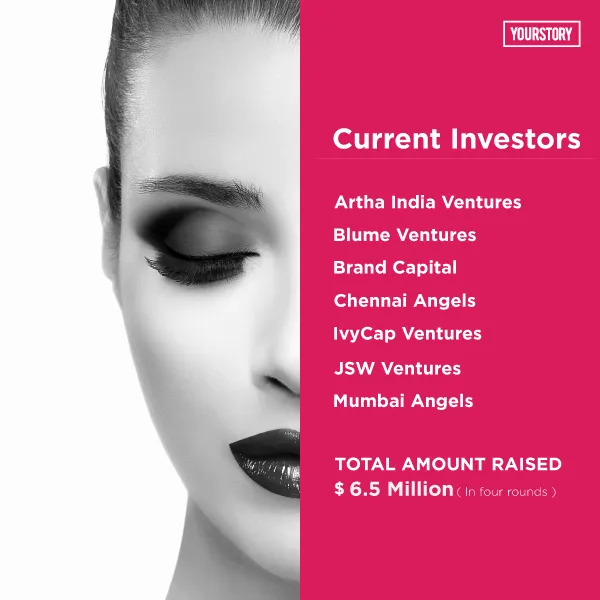

Cautious of cash burn, Purplle gives no discounts. Manish claims that Purplle is the most capital-efficient company in ecommerce. “We have so far consumed about Rs 30 crore, and GMV of Rs 180-200 crore. We have built it organically. Our marketing spend is right now at an all-time low; 80% of our revenue now comes from repeat customers,” he says.

More than GMV, Purplle focuses on the number of people who are giving their persona information, which is now about a new 5,000 people daily.

Investors were impressed not only by the co-founders’ high understanding of the industry, but also by the use of technology to help discover products. Gaurav Sachdeva, Partner at JSW Ventures, recollects their first meeting: “They were building a supply which is very contextual to the consumers – unlike traditional inventory-led businesses.”

Purplle had initially included salon bookings in its portfolio. But over a period they realised that they had stretched themselves too much. “We have put it on the backburner for now and focus only on products. But it’s still on the site, and gets lot of traffic,” Manish says.

Fighting the bigger fish

The online cosmetic industry starts with Flipkart and Amazon in India as the duo has taken online shopping to the masses.

Satish Meena, Senior Forecast Analyst at Forrester Research, says vertical players don’t really have an advantage as women often buy cosmetics from Flipkart and Amazon before Nykaa and Purplle.

The market for premium cosmetics and international brands market is miniscule; it is the mass market that decides the volume. Flipkart and Amazon are already at the right spot on this.

Also, Amazon and Flipkart can afford to tie up with international brands exclusively and give larger discounts.

“If horizontal players focus on this category aggressively, it will affect the growth of the vertical players’ repeat rate and frequency – because this is not a niche category; the product and branding is the same across platforms,” Satish warns.

Private label helps score more

Purplle is the exclusive distributor for some international brands like Moda, Vipera and Gravitale in India, and is bringing 12 more in FY18. In makeup, international brands contribute to 20 percent of their sales.

But profit in ecommerce comes with a private label. Purplle’s private brand Stay Quirky, which was launched in April 2017, sells on Amazon too, and will soon be available on all online marketplaces and offline stores.

“We make 60 percent margin on our private brands, and expect to do Rs 10 crore business from private brands in FY18. We will break even by December,” Manish says.

However, Satish warns that it will take years to build a brand (and an online one at that) in beauty and cosmetics compared to clothing and footwear. Metro cities have more offline options too. But Manish argues that private labels have great potential in India as the cosmetics market is largely unbranded. Apart from Lakme, Maybelline and Colorbar, the rest of the brands cater to hardly 10 crore women, he says.

Private label and offline stores will help Purplle to position their business at a different scale, with no need to compete with Amazon and Flipkart.

“In China, Alibaba rules with 80 percent market share, but Vipshop also has 5-10 percent market share. So even with Amazon and Flipkart around, there will always be space for smaller players with around 5 percent market share,” Satish says.

Walking the omni-channel path

Purplle is also looking at omni-channel options. But Satish warns that in cosmetic’s case, offline stores won’t add value unless they are in malls like Ambience Mall. Purplle uses data to decide where its stores will be most successful.

“We try to find out which pin codes we are popular in, and then segregate the data into orders received from offices and homes. Our first store is coming up at Phoenix Market City, Kurla. We plan to open five stores in the next six months,” Manish says.

Although Purplle has not made any startup acquisitions yet, they plan to acquire brands beneficial from a distribution stand point.

“If you are a small brand that wants to be distributed across the country, and needs visibility, ecommerce is the best way. We acquire sellers and build those capabilities for them as we do with StayQuirky and many international brands,” Manish says.

Purplle’s competitor Nykaa also has a private label in cosmetics. While Purplle follows the marketplace model by on-boarding more than 300 sellers, Nykaa is an online retailer (which also has a few flagship stores).

Although Nykaa, as a B2C retailer, owns its private label, Purplle is allowed to do only B2B due to FDI restrictions. So they produce brands and sell it to vendors, who will sell it on the online platform.

As India grows bolder, more consumer brands will come up in the beauty space in the next five years. The consumer base will expand with larger internet penetration. Almost 60 percent of Purplle’s orders are already from outside metro cities – Jaipur, Ahmedabad, Lucknow, Coimbatore, Cochin, Patiala, and Surat among others. With the next 100 million online shoppers expected to come from tier-2 and tier-3 cities, Purplle has a clear advantage.

Although he did not reveal the current number of orders per day, Manish stated that their plan is to hit 10,000 orders a day by mid-2018. He claims that in the last one year, their average order value has increased from Rs 1,000 to Rs 2,000. “We are also focused on improving our brand mix and gross margins,” he says.

The way ahead: Beauty & cosmetics online

According to a report by Google and Bain & Company, beauty and hygiene-related searches on Google are the third highest after apparel and mobile phones in shopping-related searches. But contextualising supply for the consumer by building the right selection will decide the market leader.

Beauty is one of the very few categories in ecommerce where competition is minimal.

Gaurav believes that three players have space in every vertical; whether in pure play ecommerce, subscription models or brands selling directly. “Flipkart and Amazon are commoditised like Big Bazaar, but vertical players like Purplle are like Health & Glow. We help discover what is new and unique in each category,” he adds.

Purplle claims to have around 20 percent market share in the mass to premium online beauty space.

“We will start generating profits from January 2018,” Manish says. But it is too early for an exit for Purplle. The team plans an IPO in 2021-22, with profit of Rs 200 crore.

No B2C ecommerce company in India has turned profitable yet. The Indian market is starkly different compared to the rest of Asia as well as the US and Chinese ones (the first and second worldwide respectively).

“India’s average spend on beauty or cosmetic products in a year is less than $8, whereas South Korea’s is $35. It will take a long time for India to get there,” Manish says.

The premium products’ market is still miniscule in India. Lakme is still the most popular brand here. On the other hand, L’Oreal and MAC rule South Korea, Asia’s third largest market and the world’s second largest exporter of cosmetics (after France).

But there is hope in social media’s impact on the rising Indian middle-class and millennials’ increasing purchasing power. India has seen bigger transformations in retail in the last 10 years than it has in all the decades before that. The cosmetic industry hopping on to the ecommerce bandwagon is a natural succession. With AI entering the market, it may not be long before online becomes the primary channel to buy your lipstick.