Some businesses can opt for fixed GST rate but what are the conditions?

Compliance with GST may be burdensome for small businesses; to protect them, GST has in place a composition scheme.

It would be unfair if small businesses were forced to do a full-blown GST compliance like a big company. To help small businesses comply easily, GST offers a “composition scheme”. This scheme can be opted by those who have an annual turnover of less than 75 lakh and do not do inter-state supplies. Sellers who sign up for composition scheme pay a fixed rate of tax. Let’s understand in more detail this scheme so that we know who can benefit from it.

Who can opt for composition scheme?

- Manufacturers

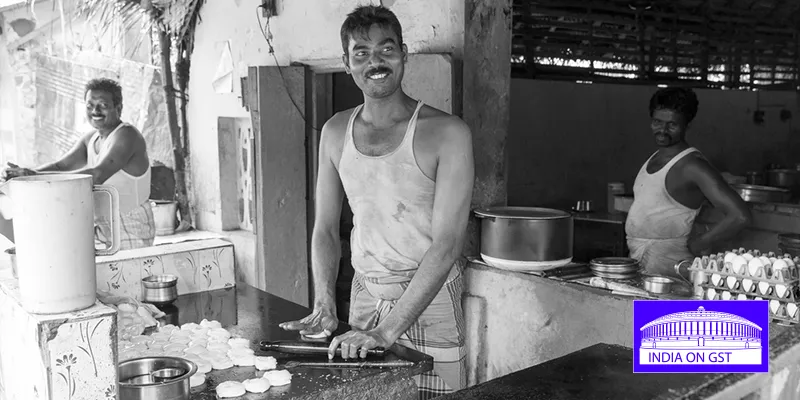

- Restaurants

- Other suppliers of goods

The turnover must be within Rs 75 lakh. This limit has been reduced to Rs 50 lakh for Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, and Himachal Pradesh.

Who cannot opt for composition scheme?

- Service providers other than restaurants

- Any business that makes inter-state supplies

- Any business registered on an e-commerce platform

- Manufacturers of ice cream, edible ice, pan masala, tobacco, and tobacco substitutes.

- A person registering as a non-resident taxable person. This is someone who wants to do business for a short period and is based out of India with no office in India. Registration is valid for 90 days.

- A person registering as a casual taxable person. This is someone who seeks a temporary registration in a state where he has no office. Registration is valid for 90 days.

Unfortunately, composition scheme is not available to service providers other than restaurants. Service providers must register as regular taxpayers if their turnover exceeds Rs 20 lakh. They must mandatorily register if they do inter-state supplies or are listed on an e-commerce website. If one of this is true, the turnover threshold of Rs 20 lakh does not apply.

Rates of tax for composition scheme

Manufacturers – two percent

Restaurants – five percent

Other suppliers – one percent

These rates are an aggregate of CGST and SGST rates and will be the final rate of tax payable by composition dealers based on their turnover.

Moving from regular scheme to transition scheme

If you were registered for VAT as a regular taxpayer, you can still opt for composition scheme under GST provided you meet the conditions listed above. And vice versa will also hold good. This means if you opted for VAT composition scheme, you’d still be eligible for registering as a regular GST taxpayer.

Returns of a composition dealer

Composition dealer will file GSTR-4 on a quarterly basis and an annual return in FORM GSTR-9A.

Other restrictions

- Cannot claim any input tax credit. If composition dealers buy goods on which they pay GST, they cannot set up taxes they pay on inputs from their final tax liability.

- Cannot charge GST on the invoice to customers. They are not supposed to collect any tax on sales. The tax they pay is like a turnover tax; it goes from their own pocket.

- They will not issue a tax invoice, rather a ‘bill of supply’. This has nearly as many fields as a tax invoice and is not much different, except that it has “composition taxable person, not eligible to collect tax on supplies” mentioned on the bill of supply.

- The business owner must also mention “composition taxable person” on his signboard displayed at his place of business.

- The day they cross the turnover threshold or make an inter-state sale, their composition scheme registration stops being effective from that day. And they must start paying regular GST taxes from such date. They also must inform the tax department within the next seven days; there is a specific GST form for this which can be filed online.

- A word of caution for those who may apply incorrectly or fail to seek regular registration when they no longer meet the conditions—strict penalties apply.

The final word

The composition scheme may appear restrictive to some businessmen. However, those who are retailers with operations in a single state and those who supply only B2C stand to benefit from the low level of compliance required in this scheme.

(Archit Gupta is the Founder and CEO of ClearTax)

In the run-up to one of the biggest tax reforms in the country, the market is abuzz with new rules and guidelines about the Goods and Services Tax (GST). How will GST really impact your business? How will your financial reporting change? Find out the answers to all this and more, directly from industry and tax experts who will share their expertise on YourStory’s new series ‘IndiaonGST’.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)