Will Flipkart's gamble with new private label fashion succeed?

Flipkart is betting big on fashion with the launch of its private label ‘Divastri' that includes 1,500 styles focused exclusively on women's ethnic wear.

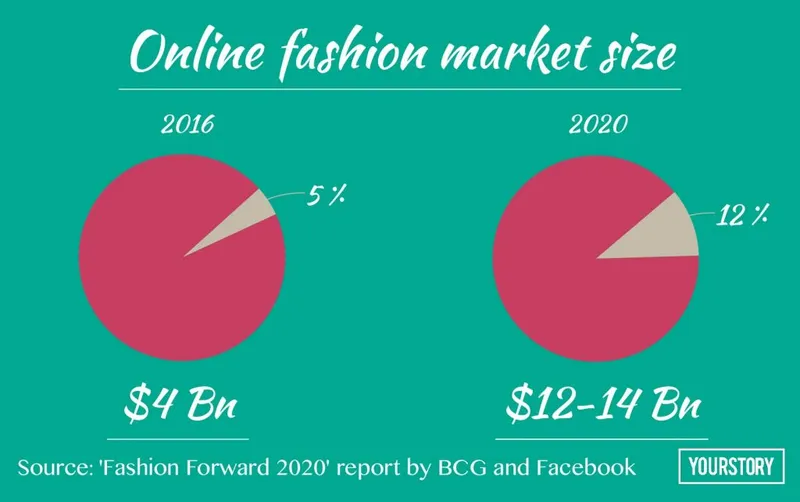

If electronics is the king of GMV, fashion is the king of margins in online commerce. Indian online market for fashion is estimated to be worth $12-14 billion by 2020 from the current $4 billion, according to a study by Boston Consulting Group (BCG) and Facebook.

Home-grown e-commerce unicorn Flipkart, aware of this estimate, has, in the past three years, focussed on this category to ensure that it remains the market leader. In 2014, it acquired Myntra, and in 2016, Jabong. The alliance now claims to have 70 percent of market share in online fashion, with Flipkart alone claiming to have 35 percent.

In its latest effort in this regard, Flipkart has launched its private label in fashion—women’s ethnic wear ‘Divastri’—which includes more than 1,500 styles of sarees, lehenga cholis, and dress materials. This is part of ‘Flipkart Smartbuy’, an umbrella brand that was launched in December 2016, to sell in about 50 categories, including consumer electronics and home category. But fashion is its big bet.

Rishi Vasudev, Head of Fashion at Flipkart, says that all Divastri products will be under 'Flipkart Assured' scheme – which means they have gone through six steps of quality check. Flipkart’s initial focus, he adds, is on establishing the private label’s positioning in terms of quality, design, and pricing, which in turn will lead to sales and revenue.

After focussing on growth for a decade, this ten-year-old company is now endeavouring for profitability. So the timing seems to be perfect. Private label is the only factor that can assure profit for marketplaces, for which sellers’ commission is much lesser than the logistics costs itself.

Flipkart’s arch rivals US-based Amazon and Gurgaon-based ShopClues are also putting massive effort into building on this category -- although hardly two percent of fashion retail in India is currently online.

For Amazon, during the recently concluded ‘Great Indian Sale’, apparel was the single largest category on the platform, ahead of mobile phones, the traditional top seller. For ShopClues, lifestyle category—which includes fashion—contributes to 50 percent of total orders.

Unbranded fashion will remain the largest chunk in online market. E-commerce has managed to organise this unorganised fashion, although they may not inspire customer loyalty with its quality in the way major brands do.

This is where private label will give an upper hand for Flipkart, with absolute control over quality and pricing. Women’s ethnic wear has a few renowned brands, and Flipkart is focussed on this category. To maintain quality, Flipkart claims, each fabric has been defined to have certain standards in terms of weight per meter, composition, yarn count/density, and ensure that they are shrink-proof with zero-colour loss. Rishi says that the products are all in line with what customers buy on Flipkart - decided based on the data they have collected.

Private label advantages

Currently, Flipkart has selected 20 sellers for Divastri, based on performance history, design capabilities, quality standards, manufacturing and sourcing capabilities. It plans to increase the number in due course.

Flipkart provides the design, branding and labels, but sellers manufacture them following the set standards of quality. Once the manufacturing is done, they get approval for quality from third-party global agencies, and then they are able to list it. Rishi claims that since women’s ethnic wear is a long tail category, there is no conflict of interest with other sellers who sell unbranded items.

“Divastri’s look is tightly controlled by Flipkart – we are clear on what products we want. So the sellers should be able to bring in that kind of products in line with our styles,” he says.

Rishi says that Divastri is not particularly of lower ASP (average selling price), but value for money. According to him, MRP will be much lower than in other brands or what you get offline, and these prices have been optimised for cost cutting in the supply chain as well.

But customer segmentation is also important. The most successful brands are able to target customers precisely. For instance, Zara targets young customers. They rarely cater to those above the age of 35. But Zara’s brand ‘Massimo Dutti’ does not overlap with its Zara’s main target customer, as it focuses on children’s wear.

Returns not a problem

In fashion, return rates are very high, mostly due to the lack of touch and feel, and wrong size. But Rishi says that Flipkart does not see that as a problem.

“In an offline store, the seller pays rent as he is choosing to look over that cost as a service to the consumer. Since returns often happen due to wrong size, we have remodelled our interface to be more indicative to the customer – like, this shoe fits one size larger, or a t-shirt might be loose in M size for one brand, and more fitting in another,” Rishi says.

Machine Learning helps pick up the returns and identifies the size differences etc., and educates the customer. In Divastri, too, this will be the case.

The industry standard of returns in e-commerce is 25 percent. But returns are a price these platforms have to pay for customer acquisition. According to Rishi, it is equal to the cost of having a storage location and multi-store strategy in the offline world.

“Not all returns are bad. If people become so conservative that they will buy only those items which they are sure, this industry will not grow. We are encouraging people to trust us, not worry about repercussions, and really buy it,” he says.

'No' to omnichannel route

Women’s ethnic wear fashion in India is worth around Rs 8,000 crore. Divastri is an obvious effort to increase Flipkart’s market share in ethnic wear segment. However, Flipkart is not taking any unconventional route here.

Although Myntra launched its first offline store for its private label in Bengaluru recently, Flipkart Fashion has no such plans. “Divastri’s styles will keep growing. This is a strong online model. If we were doing something which touches only 1,000 customers, we will do open box delivery, or ‘Try and Buy’. If we have a store in Indiranagar, how many people will go to that store?” Rishi says. His view is that since Flipkart is targeting millions of customers, the scale has to be high.

Additionally, to bring exclusivity to their offering for a sustained footfall on their sites, Flipkart hosts brands exclusive to them and exclusive product lines from certain brands. It has tied up with 15 brands (including Chemistry, Provogue, Arrow, and Flying Machine) for men’s footwear – a market which has very few players. “These are our highlights. If we open a store with the same items, it will reach only a few hundreds of people,” Rishi adds.

Curiously, although sister concerns Jabong and Myntra sell some of their private labels on Flipkart, Divastri is not listed in either platform. Myntra has 14 private labels, while Amazon has one each in men’s wear and women’s wear – Myx and Symbol, respectively.

The big game

Women’s clothing will be the fastest growing category in India’s online fashion, touching a market share of 40 percent—worth Rs 2.77 trillion—by 2025, as per a report by Avendus Capital. Although Flipkart presently has an upper hand, it has to be worried about Amazon Fashion too.

One out of almost three new customers comes to Amazon’s India site to buy fashion. Amazon Fashion has deals with top brands like Aeropostale, Emporio Armani, Armani Exchange, Versus by Versace, GAP and Under Armour, as well as with Indian designers, including Tarun Tahiliani, Monisha Jaysingh, and Manish Arora.

But Flipkart has always claimed to have strong relationship with all their brands, and the brands that don’t offer discounts easily—like watchmaker Titan—have partnered with them in Big Billion Days Sales and Big10 sales.

Personalisation is essential for higher conversion and repeat customers. Every time a customer browses through the site, Flipkart collects data on that person’s interests and shows more relevant selection next time.

However, if Flipkart is not to fall behind, their customer service will have to rise to a new level. One in three purchases for Amazon Fashion happens through Prime – which gives its members free faster deliveries and early access to certain deals for Rs 499 per year.

As e-commerce expert Arvind Singhal, Chairman of Technopak Consultancy, says, a private label needs not just normal promotions, but branding like the kind Biba and Anita Dongre have. “It is more important than profit to push your USP; so give it more screen time. Exclusivity is the prime factor since it gives repeat customers,” he adds.

Next 100 million users

Flipkart claims to have 100 million registered customers. But bringing the next 100 million consumers online is essential to increase the market share. “They are the current offline shoppers and browsers. The first set of customers who came online was looking for better prices and better brands. If we are focusing only on them, then the only route is that we give only branded products, give them a price advantage, and may be give loyalty programmes,” Rishi says.

So Flipkart’s strategy is to reach people who browse or watch TV and make them buy online. For clothes, Flipkart has associations with blockbuster movies, TV channels like Zee, Colour etc., to provide merchandise on clothes you see on a TV serial or movie. For sportswear, they have collaborated with Sport Equipment Association.

However, Arvind warns that although there is enough room to grow in the fashion category, it is also the toughest to execute in private label.

“It is difficult to forecast the colour, fit etc., whereas these factors do not come up in other lifestyle categories like 'Home'. On the other hand, as private labels, you have to think like a brand - not like a retailer. Your focus should be on target customers, their tastes, other brands in the same space, and your USP,” he says.

Fashion and the city

It is not easy to make a profit in business-to-customer (B2C) e-commerce. But fashion is a high-margin, high repeat purchase rate category. Also, fashion is the first category that most people buy online, with nearly 30 percent of new shoppers likely to start buying online with apparel and footwear, according to the Facebook-BCG report.

It states that by 2020, more orders will come from women customers, from Tier II and III towns, and a very high share of business will be on women’s ethnic wear. Flipkart seems to be striving for absolute supremacy in this category, and Divastri will pave the way if executed well.

Ethnic wear for kids is another space with a few brands – which gives an open field for e-commerce players. The next two months will show if and how Divastri helps Flipkart establish hegemony over unexplored categories in fashion.