What were these 40 Indian startups doing in China?

While India is prized for its creativity and ideas for business, China has a robust ecosystem with proven business models and IPOs. YourStory was in China at the Chindia TMT Dialogue Summit 2017 to understand the peculiarities of both these neighbouring mobile internet startup ecosystems.

In the past, we have seen some poster boys of the Indian startup ecosystem venture into South Asian markets like Singapore, Indonesia, Malaysia, and the Philippines, but only a few have dared to enter the dragon.

This is in spite of China being India’s largest trading partner, particularly in terms of imports, which stood at almost $51 billion in 2015, whereas exports to China from India that year stood at a mere $14.8 billion.

However, Chinese venture capitalists have had a keen eye on the Indian startup market with much Chinese capital flowing into various Indian startups. This includes funding from Ctrip in Makemytrip, Alibaba and ANT Financials in Snapdeal and Paytm, Didi Kuaidi in Ola, and Tencent in Practo.

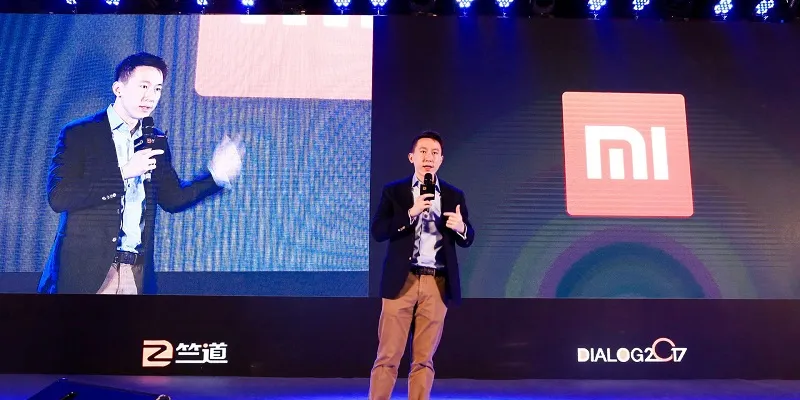

Exploring this relation was the ChiIndia TMT Dialogue Conference 2017 held in Beijing last week. Organised by Chinese accelerator and venture-fund ZDream Ventures as a part of their Demo Day, the conference saw more than 40 Indian entrepreneurs and investors (including IDG, Blume Ventures, and Redcliffe Capital) travelling to China to understand the Chinese technology landscape through planned visits across conglomerates such as Baidu, Tencent, Alibaba, Xiaomi, and Huawei.

Talking about the ultimate purpose of the conference, Jason Wang, Co-founder and CEO of ZDream Ventures, told YourStory,

“The conference aims to establish a communication platform for the Sino-Indian tech industry. As the two biggest emerging economies, China and India share a lot in common, for example, the large, young population, fast-growing GDP, massive but price-sensitive consumer base, rapid urbanisation, as well as the huge amount of young talent migrating from rural to metropolitan areas.”

He further added,

We really feel there are great opportunities ahead, and huge potential for cooperation. But we unfortunately recognise a huge gap between the industry players in both countries, along with little understanding of each other. Our ultimate goal through this conference is to fill this gap and encourage more interaction through our platform, which would possibly bring about more positive outcomes.

While addressing an audience made up of both Chinese and Indian delegates, Amit Narang, Deputy Chief of Mission, Embassy of India in China, had a message for both nations:

“China needs to see India as more than an ecosystem to sell to and needs to co-innovate and partner with India. There is also a strong need for Indian entrepreneurs to look at China beyond cheap exports and focus on capital and learning from the country.”

The dragon has entered!

There is no disputing that the Indian market has, to a great extent, been infiltrated by Chinese businesses like Xiaomi and APUS, among others, over the past three years.

While APUS claims to have got 20 percent of their one billion consumers within one year of their launch from India, Xiaomi has succeeded in becoming the second biggest smartphone company in terms of market share.

Shou Zi Chew, Chief Financial Officer of Xiaomi, at the event talked about the hardware manufacturers' strategy in India, saying,

“We have always focused on placing ourselves as a mass market company, empowering everyone to enjoy technology. While that is prime, our efforts have also been put in a big way on building a trustable brand in the market.”

He went on to state a few metrics to show Xiaomi’s strong market position globally. The average time spent by users on the Xiaomi app ecosystem is five hours every day. Also, by distribution, Xiaomi claims to be the eighth largest manufacturer in the world.

Claiming to be the second largest smartphone manufacturer for India, the company says that it sold 1.36 million devices in India during Diwali last year.

Till date, the Chinese conglomerate has made investments in more than 160 businesses in China. Shou added,

“We continue to invest and support our partners, and India is as important to us as China. We have already invested in our partner and supplier ecosystem in India and want to continue our investments and building the ecosystem in the country.”

But with the stellar success of these Chinese businesses, are there strong similarities between the two nations that the Indian ecosystem can learn from?

Kunal Shah, Founder of Freecharge and Advisor to Sequoia Capital, said,

China is the closest a nation can come to building a great consumer experience. What China has figured out is the approach to how to get the first few customers online. Both economies are run on high trust, allowing trusted brands to offer different segments of services. This is quite opposite to the markets in the West, where there is one brand that stands for one product.

Kunal highlights that 68 percent of Chinese women are a part of the country’s workforce, a trend that our own nation should learn from. The corresponding number in India stands at only 14 percent.

Chinese investors and Indian investments

As leaders in verticals like e-commerce, payments, and logistics, Indian businesses have been on the receiving end of investments from the Chinese.

India having proven to be an opportune market, what do the Chinese investors think about the country in terms of investment potential?

Min Zhang, Managing Partner at Empower Investment, believes that the Indian economy is better than China in sectors like SaaS, P2P, and Information Technology (IT), while also having a strong talent pool spread across the world.

Min Zhang believes that India’s development of the startup ecosystem is similar to that of China’s with both ecosystems having seen large amounts of foreign capital from the West, particularly the US, flowing in in the beginning.

He further added,

Both China and India have skipped certain technology developments and leapfrogged to the next one. Unlike the US, which has gone through multiple circles of business computers, personal computing, and mobile phones, China caught up fast at the end of the PC era and went into mobile. And that has been happening to India as well. Also, India and China are huge markets with their large populations.

With businesses still building and developing for the under-penetrated Indian market, India becomes an opportune market to invest in and start up, according to Min Zhang.

Zijing Zhou, Founder and CEO, Ether Capital, meanwhile, said,

“Today, the Chinese market has seen large capital and high development. And we think the same will happen with India at an even better scale. Investors in China are exploring investment opportunities in Indian businesses, but we need a local team to help us in identifying these businesses.”

Li Jian, Co-founder and Chairman of ZDream Ventures, believes that with fewer exits and no localised teams in the Indian ecosystem, Chinese investors are still testing the ground before opening up their investment strategies towards India.

The India entrepreneur experience in China

With the dialogue involving both Indian and Chinese startups, how did the former react to the experience?

Ananth Goel, Founder and CEO, Milk Basket, said,

“We have been trying to understand the way Chinese businesses think, and believe that the entire ecosystem has been built for startups by the government to help them navigate. We believe that there is a set of investors in China who are looking at funding either enabled startups from India that are doing something similar to Chinese enterprises or startups that are doing something new altogether.”

Sanjay Nath, Managing Partner, Blume Ventures, believes that India and China are one family, together sharing a population of 2.7 billion, which is a significant part of the world population. He believes,

“The language barriers can be overcome, and a couple of synergies through either Indian companies selling their products here (in China) or manufacturing in China and selling in India can be explored. And that is somewhere already happening.”

He added,

“It’s so interesting. Even though China is just next door, with the leg between Bengaluru and Silicon Valley so well proven, people hop on to a plane to the US, but don’t visit China as often.”

Answering a question as to what Indian businesses have to cover in China, Arpit Agarwal from Blume Ventures said,

“Broadly, China is far ahead of the curve, considering the billion-dollar exits the companies have received. As an ecosystem, in India, we don’t have much of an understanding of what works with China, hence making the visit a valuable learning experience for Indian entrepreneurs and the venture capital industry to grow their businesses.”

According to him, India needs to learn a lot more on how to build end-to-end customer experience, and handle the complexities of scaling while keeping in mind the consumer experience for first-time users of the internet. With all of this being well understood by Chinese businesses, there is much learning to be gained from active knowledge exchange between these two neighbours.