Rejecting naysayers, Nykaa has broken even after 5 years and is gunning for IPO in 2018

Started in 2012, Mumbai-based Nykaa is breaking the myth that e-commerce and beauty retail do not work in India. Set to reach a turnover of Rs 250 crore, the beauty e-commerce platform is all set to be profitable soon.

“I want to start up on my own.”

Falguni Nayar had made up her mind. As a stock broker and investment banker, Falguni had come in contact with many people and businesses. She had been able to size up the market, translate business plans and projections, and understand the financial projections of a project, and had even done a lot of IPOs for businesses.

But what really enticed her into starting up on her own was the drive and passion she saw in the eyes of the entrepreneur. In the nineties, entrepreneurs like Ronnie Screwvala would unveil grand plans and visions of building a studio like Disney in India. Falguni would also note the disbelief that usually greeted such plans.

“I felt that there is a lot of early-stage value creation by entrepreneurs, and yet, there are several naysayers. It was the entrepreneur’s drive and belief that intrigued me, and it was something that I wanted for myself,” she says.

So, from starting homestays with an AirBnB touch to branding content, Falguni thought of different businesses where she would feel that same kind of passion and zeal, eventually zeroing in on beauty e-commerce.

Surging ahead

Today, while many are already giving up on e-commerce, Nykaa isn’t only raising the bar, but is actually all set to reach operational breakeven, and will be EBIDTA-positive by summer. All this with a team of 330, at a time when e-commerce biggie Flipkart, which has close to 30,000 employees, is still struggling to break even.

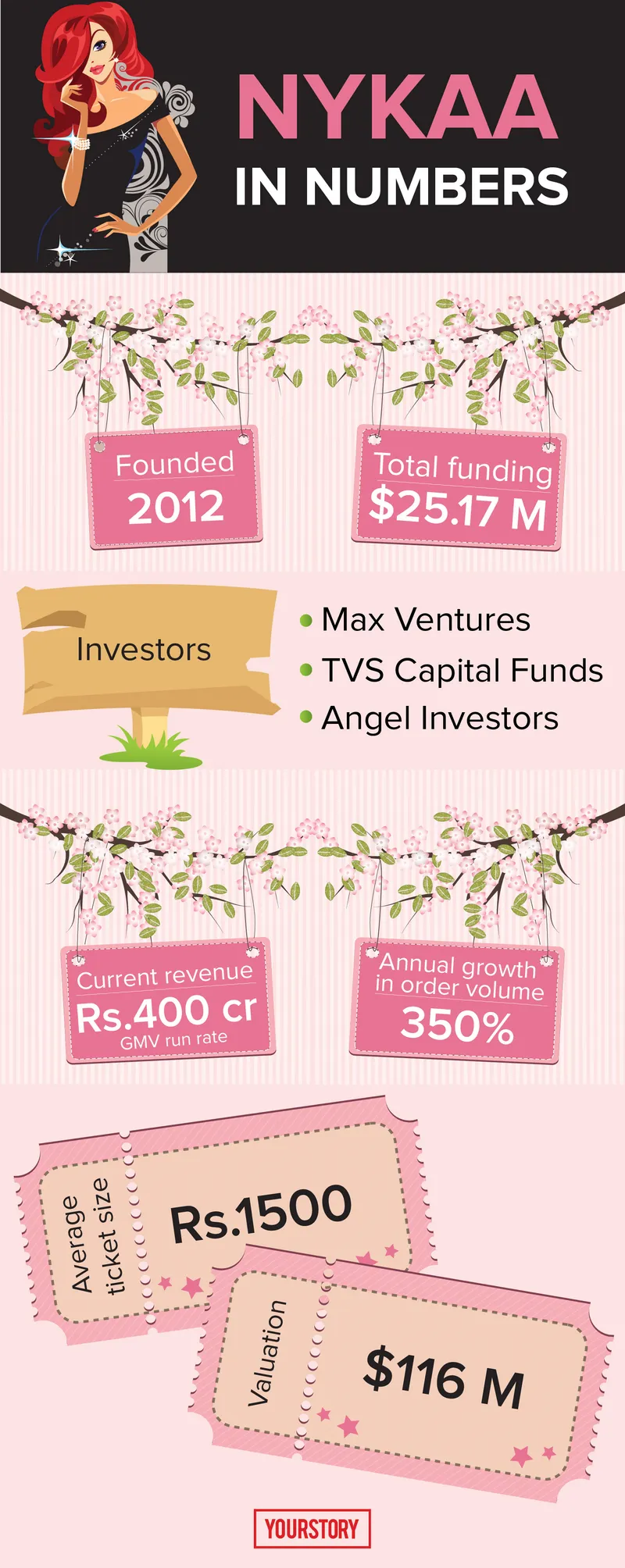

Nykaa had raised $9.5 million (roughly Rs 61.6 crore) from TVS Capital in 2015, and followed that up by raising Rs 82 crore from Sunil Munjal and the Mariwala family in September last year. Launched in 2012, Nykaa began scaling within a year, and with well-established courier partners, their quality of service significantly improved.

Nykaa is among the few e-commerce companies that are inventory–led. The company now has its own inventory spaces of 50,000 square feet in Delhi and Mumbai each, and one of 15,000 square feet in Bengaluru.

But why e-commerce?

While her other ideas presented markets and business models that were clearly viable, Falguni somehow gravitated towards e-commerce, and that too the beauty segment within it. It was at that time that Myntra and Jabong were taking off and online fashion was on the rise. The space was something she was closely following, and she decided to look at beauty as a segment.

Falguni says,

“I was aware of how big the beauty space was in the US and other countries like Japan, and I knew that it would have a positive future in India. I decided to start in an industry that Tata and Ambani were not focused on; they have deep pockets and I did not want to fight them. I wanted to ensure that I made a space for myself. I did believe in e-commerce, technology, and the power of being able to supply beauty all over India from a centralised location.”

Gopal Srinivasan, Chairman, TVS Capital Funds Limited, says that TVS is a growth equity fund with a focus on whether late-stage companies are on the path to profitability. The focus is towards investing in companies that are headed towards EBIDITA positivity.

He adds, “From Amazon’s numbers, we know that e-commerce is a profitable business model. But if there was a vertical that we felt would sustain and show growth and profitability, it was the beauty segment.”

Adding to this point, Arvind Singhal, Chairman of Technopak Advisors, believes that when it comes to beauty retail, while the margins abroad are good, it is the brand owners who control margins in India.

A different entrepreneur

Gopal also felt that Falguni was a great entrepreneur with a sense of vision. “I wouldn’t hold her investment banking background for or against her. What I would say is that she is a very driven and balanced entrepreneur, who has the ability to attract the high-level talent of matured seasoned players and young and vibrant people,” he says.

The first order of business for Falguni was setting up a team, and her early employees were entrepreneurs themselves. “Entrepreneurs have a lot of courage; I like that about them – the courage to create something new,” she says. Also, keeping in mind that it was e-commerce, Falguni first hired a COO, a CTO and a Chief Content Officer.

E-commerce grows on three pillars - marketplace, logistics, and payments. With over 40,000 SKUs, Nykaa today boasts of stocking every shade of lipstick there is. The idea to ensure that everything was stocked on the website started with the kind of company that they wanted to create.

Building the full-stack approach

After launching its website in 2013, Nykaa launched a private label of its own last year, which today contributes close to 10 percent of its total revenues.

Gopal also adds that being believers of the full-stack model – of a company having their own brand, online and offline play, and logistics - Nykaa stood on the path of a strong profitable company. While she refers to Nykaa as part of the third generation of e-commerce startups, Falguni doesn’t live in a bubble where she believes that she doesn’t have any competitors. On the contrary, she believes anyone can compete with Nykaa. She, however, says that,

“The key is to create the kind of site where you can get customers to buy a lot more. Somehow, Nykaa achieved that. Our average ticket size is high, and we have four items in a cart on an average. We are trying to understand the combination that the customers are buying. We also educate customers.”

But building an e-commerce platform meant understanding a lot of different nuances. Taking Amazon as a benchmark in logistics, Falguni hired logistics experts to head operations. The team soon tied up with Ecom Express, Delhivery, Wow Express and BlueDart, and ensured that courier partners were selected based on geography.

Discounts and e-commerce – the hand in glove relationship

Arvind is of the opinion that online buying behaviour itself is often driven by discounts. “A middle-class lady will be attracted if she is getting to buy beauty products that she couldn’t normally afford at discounts of 30 to 40 percent,” he says.

Bengaluru-based techie Neena Sukumar (27) buys cosmetics online at least five times a year. But she doesn’t buy it from any random e-commerce website – it’s always Nykaa. Neena mostly buys lipsticks, even though the shade and texture are easier to understand at a physical store.

“Nykaa has a great collection, including brands like MAC and Sugar, which you do not find on other e-commerce websites. Also, Nykaa’s selection comes in wide price ranges – it always fits my pocket,” she says.

Neena adds that she sometimes tries out lipstick shades at offline stores and later buys them on Nykaa, as the website often provides discounts. “Nykaa’s ‘Try-on’ feature has helped me get shades that suit me. I also watch YouTube videos and read online reviews before buying an item,” Neena says.

What is most important in e-commerce is assortment, which Nykaa works hard to make unique. “We launched many brands that nobody else has,” says Falguni. Secondly, trust matters. Nykaa acts in accordance with the desires of the brand – whether they want to provide a free product, discounts, or cashbacks.

However, Falguni is very clear about not wanting Nykaa to be a discount site. Looking at the reason behind why people buy online, the team’s research led them to the discovery that customers buy because of the whole collection that has been brought together - assortment is very compulsive for them.

“Anyone who competes with us will have to focus on that,” Falguni says. She adds that 30 percent of the inventory is always part of the latest collection. “We monitor what percent is at sales. For instance, 15 percent of our products are in luxury – they have no discount at all,” says Falguni. The team is in fact gunning for 300 to 400 percent growth this coming year, and they are hoping to achieve an IPO by 2018.

Breaking the COD glitch

Most of Nykaa’s consumer base is between the ages of 22 and 35, and their most popular categories include lipsticks, kajals, and bath and body products. Over the past five years, Nykaa has also seen a strong shift from COD to online payments.

In 2012, COD orders stood at 50 percent; later, the company was seeing 60 percent COD orders, but after demonetisation, the ratio has reversed, with the online payments standing at 60 percent. Nykaa follows a no-returns policy, except in return-to-origin cases or if there is something wrong with the product.

“We are among the few e-commerce companies on the path to profitability,” says Falguni.

One of the compelling reasons for Nykaa to actually succeed and be profitable is the fact that they have a strong base in terms of their private label. Gopal adds that in their research, they found that consumers do not wander as much in the e-space as they would offline. So Nykaa’s vertical was defensible.

The private label path

Also, the space for private labels felt strong. Gopal adds that the world of beauty and makeup is made of contractors, where all the Lakmes and Revlons of the world buy from. So, the opportunity for a great quality Nykaa-labelled product stood out.

Arvind also believes that only private labels can help you compete against other vertical players like Myntra and horizontals like Amazon. “There is no advantage as an early beginner. About a 15 to 20 percent margin is what you get in online beauty retail, and that is not enough online - it ends up in cash burn,” says Arvind.

Private labels help these marketplaces offer discounted prices, as brands do not often do that as they need to follow the minimum operational price. Arvind warns that the cost of maintaining physical stores is too high, with their maintenance, inventory and management.

It was in keeping this in mind that Nykaa hired Reena Chhara, who brought with her experience in brands like Colorbar and Lakme, as CEO of their private label. Falguni says that the private label is a global trend now – all retailers do it now for improving consolidated margins and profitability.

Margins by retailers are otherwise limited, so you can’t always offer the customer the experience that you would want to. It yields a better customer experience. Chains like Boots have also adopted this approach.

However, sourcing in the beauty business is a complex affair. While there are global suppliers for the products in Europe, the bottles and packages need to be sourced from China, and these need to be filled in India later.

Going the retail route

Currently, everything that is sold on Nykaa is sourced directly from the brand. They work as a direct seller, an inventory-based retailer – not a marketplace. “Everything has a stamp of Nykaa. We get margins just like any online retailer, and some revenue from advertisements. We broke even operationally a few months ago, and will break even in terms of EBIDTA soon,” says Falguni.

The relationship that Nykaa shares with brands is similar to what they would share with a Shoppers Stop or a multi-brand outlet, and that makes the platform a retailer. And being a retailer makes their path to profitability easier. The platform also shares the same margins of close to 15 to 20 percent as retailers. While there is a risk taken by managing inventory, it is believed to be more viable than a marketplace model.

When Nykaa first started, e-commerce was in its nascent stages, and so, was focused on the early adopters. There are about 100 million online shoppers now, of which 40 million are women, most of whom Nykaa has been able to attract. Currently, the average basket size is at Rs 1,250, and 15 percent of the company’s turnover is from luxury products.

They will continue to grow that and their non-beauty offering in a logical manner. The Indian beauty market is expected to touch $13 billion by 2020, 20 percent of which will be from the online medium.

“Online players selling offline should understand the different dynamics of managing staff, offering width of merchandise (although it would be lesser variety than online), and more importantly, generating decent margins. A product worth Rs 120 can’t be sold with Rs 100 in discounts through the offline channel; you lose margins unless you are a private label,” Arvind says.

Nykaa says it will not completely shift to the private label route like Zivame did. They aspire to be a multi-brand retailer like Sephora, which has its own brand too – as does Amazon with Amazon Basics.

But the team is aware that digital consumers want category extension. If they are happy with the brand, they want to see other things. So Nykaa has a curated offering in other categories – only those things they are truly impressed with, and a more logical extension of what a customer may want to buy together, like lingerie and accessories.

However, Arvind advises against having multiple categories (like lingerie). Zivame, he believes, is still struggling. “More categories bring more challenges. Even beauty services, for that matter, need careful attention. Lakme Beauty Salon did not expand much, and it is not an area of focus anymore. Marico’s Kaya Skin Clinic also ended up becoming small stores focusing on products rather than services,” he cautions.

The multi-brand route

The team has focused on digital marketing, and Falguni adds that it has been the right decision, allowing them to build their brand effectively. “With Google and Facebook, we can retarget customers. We are trying to introduce a marketing budget of 12-14 percent of our annual expenditure, which is similar to normal consumer marketing,” says Falguni.

Nykaa had also ventured into the jewellery pop up to understand what the customer wants, and the lingerie section as well. Falguni adds that the lingerie category is actively contributing to the company’s revenue. However, they also don’t want to lose what they have in beauty.

Nykaa is looking to grow further, however. They are also looking at an offline presence. Falguni adds that there is a lot of research that points to e-commerce basically moving towards omni-channel, with people losing the ability to differentiate between channels. “We will have to provide a seamless experience for customers across channels,” she says.

The Nykaa lux (luxury) store has only 50 brands (offline), whereas the website has more than 650. “By 2020, we will have more under the luxury format. We are coming up with a new retail concept, under which we will have our first trial store. If it succeeds, we will build more by 2022. You don’t need offline now. But all retailers will have to move offline in the long term,” says Falguni.

“As a woman entrepreneur, I believe in Sheryl Sandberg’s statement that women actually want to lean in, as they are constrained by themselves. We do not want to go for it. I tell women to learn to dream – and then you will get where you want to get. There was no glass ceiling for me,” she signs off.