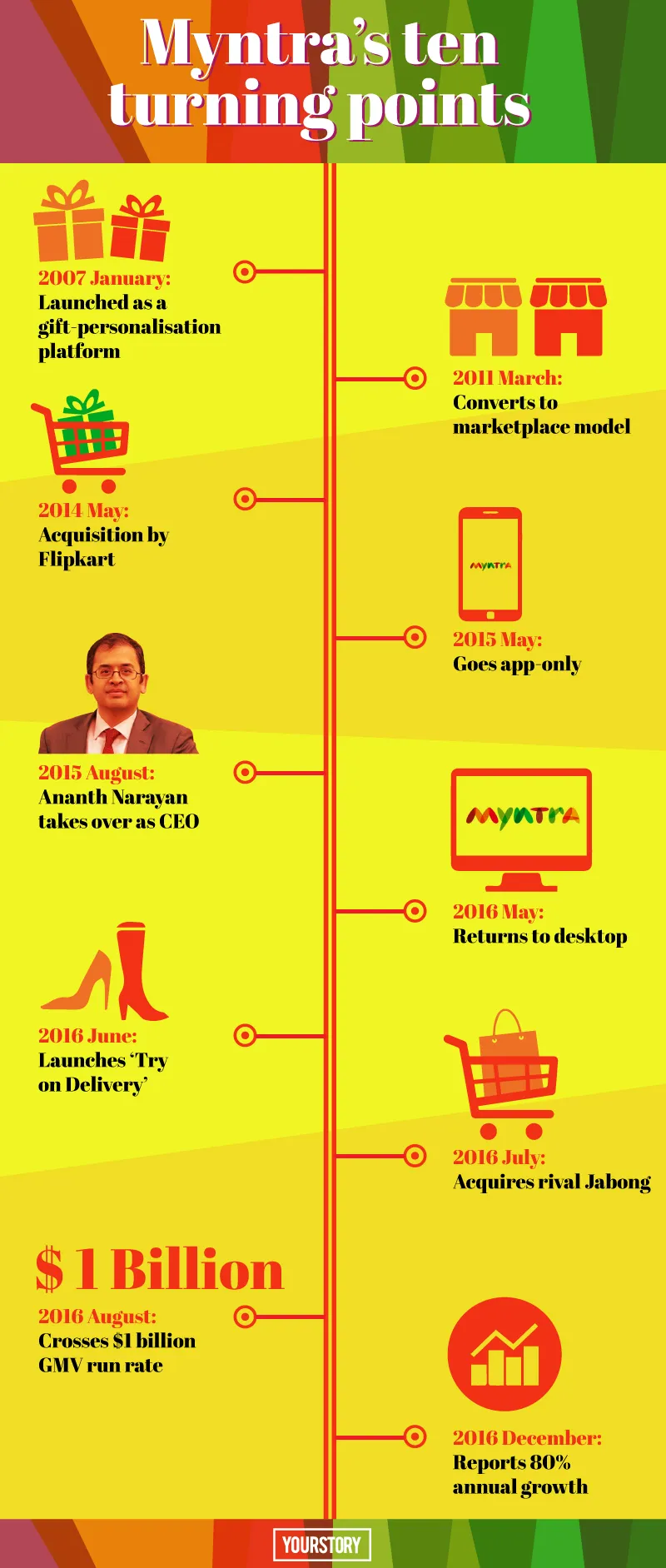

As Myntra turns 10, here are the major milestones in its journey

Now the leader of India’s online fashion commerce, Myntra has had a decade-long run with ups and downs.

Kalaari Capital Managing Director Vani Kola once recollected – “During the end of our first year of investment in Myntra, [Co-founder and then CEO] Mukesh [Bansal] was off by 20 percent of the target that he had projected in his business plan. He came to meet me and said, “I want to apologise that I failed to meet the target. I am sure you will have to explain this to your partners and I have put you in a tough situation. If you want that to reflect in my compensation in some way, I am ready to take the cut because I have not delivered what I promised.”

Myntra has come a long way since then. Now the leader of India’s online fashion commerce, Myntra has had a decade-long run with ups and downs, investments and acquisitions, strategies which worked and some which flopped.

It all began when three IIT-Kanpur alumni – Vineet Saxena, Ashutosh Lawania, and Mukesh Bansal – got together to start up by themselves in 2007. As a B2B platform for personalised gifts, Myntra was the market leader in three years.

In 2011, when e-commerce started becoming more familiar to Indian customers, Myntra pivoted to becoming a retail marketplace. With the current statistics, Myntra is ready for another decade or even more. Find out how it reached where it is now; and where it can go from here.

The allied powers of Indian e-commerce

Myntra was not taken seriously till 2013. Jabong (which had entered the space in 2012) – at $500 million valuation – was the undisputed leader then.

The acquisition of Myntra by India’s largest marketplace Flipkart in 2014, when the former was valued at $300 million, was claimed to be one of the largest in history. Two years later, Flipkart-owned Myntra acquired Jabong for a mere $70 million. It was a blow to Flipkart’s biggest competitor Amazon for which the fashion category was Achilles’ heel.

Fashion is the highest margin category and it demands differentiation. The ‘Flipkart Group’ – that includes Flipkart Fashion which serves the masses, Myntra which serves professionals with premium fashion, and Jabong for youngsters and students – now holds 70 percent of market share in India’s online fashion segment.

Myntra hit $1billion annual run rate a few months ago, Jabong became unit economic-positive, and Myntra is now targeting $2 billion run rate by 2018. In fact, if Myntra’s claims become true, it will be the first e-commerce player in India to turn profitable.

When app-only became flop only

To date, Myntra remains the only B2C e-commerce platform that took the app-only route, albeit for just a year. Myntra shut down its desktop website in May 2015 based on the traffic received via its mobile app – more than 90 percent of traffic and 70 percent of orders.

With 235 million people accessing the internet only via mobile, a large part of online commerce in India is surely ‘app-commerce’. But mobile-only, not app-only, approach works better for e-commerce in India. With poor data connectivity, it is not always feasible to install the app.

Besides, it is important to channelise a larger pool of customers through multiple interfaces, especially in apparel and fashion as smartphone devices may not have the same visual and functional experience as a computer. Myntra came back to desktop exactly a year after the shutdown, and now the website provides 15 percent of its revenue.

Standing out

Fashion contributes to 20 percent of GMV in online retail in India, and 37 percent of online retailers' revenues, according to a report by Redseer Consultants. Myntra has gone extra miles to keep up the leadership – with initiatives like ‘Try and Buy’ feature, which lets one try two to three items at home – thereby solving the problem of size and fit.

Myntra has 12 private labels – including Anouk, Roadster, Mast and Harbour, and Dressberry – which are now being sold on Jabong too. They provide about 22 percent of revenue; Myntra is targeting 30 percent. Myntra is also taking efforts for standardisation of sizes which should reduce returns due to wrong fit. Myntra has reported 80% annual growth rate as of December 2016.

Looming glory

However, it’s not a perfect picture on Myntra’s canvas. In October 2016, Myntra announced that they would be opening an offline store in Bengaluru to push their private labels. But no development has happened on this front so far. Now, with Flipkart’s cost-cutting plans, it was reported, Myntra will face cut in its budget too.

Myntra’s losses also seem to be rising, thanks to marketing expenses and irrational discounting. In FY 2014, their loss was Rs173 crore, with a revenue of Rs 427 crore. In FY 2015, it became Rs 740 crore, with revenue of Rs758 crore. In FY 2016, it reported a loss of Rs 816 crore, with revenue of Rs 1,069 crore.

To their credit, January 2017 saw Rs 850 crore in revenue, thanks to the much-publicised three-day-long End of Reason Sale. Also, Myntra’s B2C arm Vector E-commerce saw 40 percent jump in revenue – with Rs 1,747 crore – in FY 2016. But Vector E-commerce reported Rs 8.7 crore in loss during the same period, a major fall from FY 2015’s profit of Rs 6.5 lakh.

The entire founding team of Myntra has now left the firm. It is up to Myntra–Jabong CEO Ananth Narayan and Flipkart Group CEO Binny Bansal to show the path to profitability for Myntra. Industry insiders speculate that the recent assigning of Myntra CMO Gunjan Soni as Jabong Head is a move to integrate Jabong into Myntra’s platform. The next few months will show the real game changer for Myntra.