As Trump turns screws on US imports, can the Union Budget make SMBs go global?

Despite the plethora of central and state government schemes, small and mid-size businesses in the country have continued to be stymied by problems such as lack of access to credit, delayed payments, etc. to truly make it big internationally

Small and mid-size businesses (SMB) are looking at Budget 2017 with a lot of hope. Some of the schemes announced this year will determine whether the Make-in-India campaign will really make SMBs competitive to manufacture for the world. It augurs well that several new-age SMBs are getting into manufacturing and trying to change the way Indians consume. As examples, we have Ather Energy and Ultraviolette, which is building electric vehicle platforms for the Indian market, and Altigreen, a hybrid systems manufacturer for cars in Mahadevapura, an industrial suburb of Bengaluru, helping fleets save on fuel. In Mumbai, Mojo Bars, a two-year-old health brand and manufacturer has just crossed Rs 1 crore in turnover and is well on its way to becoming a large company. There is also United Sportsbiz Pvt Limited (USPL), which manufactures apparel brands like Wrogn. Many others, like Fit and Glow, MCaffeine, Ava, Greendzine, Raksha Safedrive, Kooki, Intuit Things, have cropped up, working alongside big corporates to bring solutions to consumers. Entrepreneurs like Amitabh Saran, of Altigreen, and Anjana Reddy of USPL want to become Rs 100 crore businesses and harbour dreams of going global. But for the vast majority of SMBs in the country, life is anything but easy. Here is why?

There are 50 million SMBs in India, of which only a million export globally and only three million are digitised. The rest have no way of being discovered globally. Despite the government coming up with several Central — under the aegis of the Ministry of Micro, Small and Medium Enterprises — and State schemes that are tailored to help SMBs, India's small businesses continue to languish because they are either not aware of them, thanks to the schemes not being marketed well or are not taking full advantage of those initiatives.

The only popular scheme from the Central government so far has been the Credit Guarantee Scheme that has provided protection to over 2.2 million SMEs. It has helped many SMEs get Rs 1 crore collateral-free credit. “If Make in India has to succeed then it has to be 'Manufacture in India for the World'. This is possible only if you make SMBs globally competitive,” says Pawan Gupta, founder of Connect2India, a platform that provides trading data to SMBs.

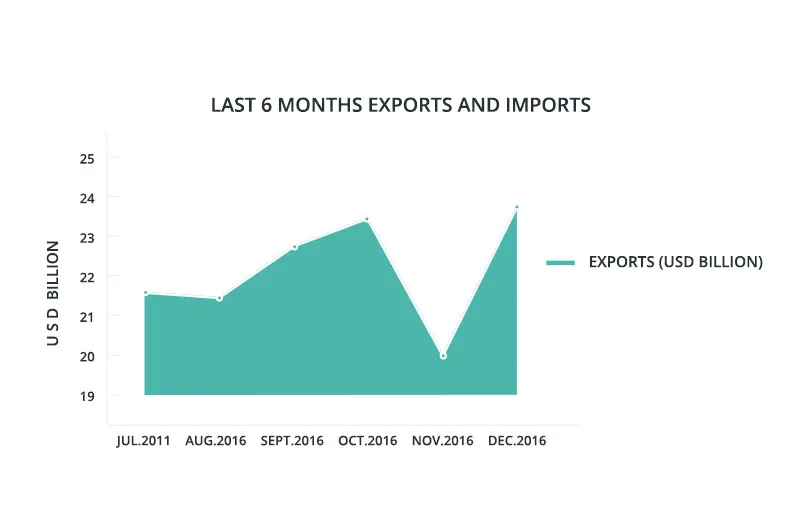

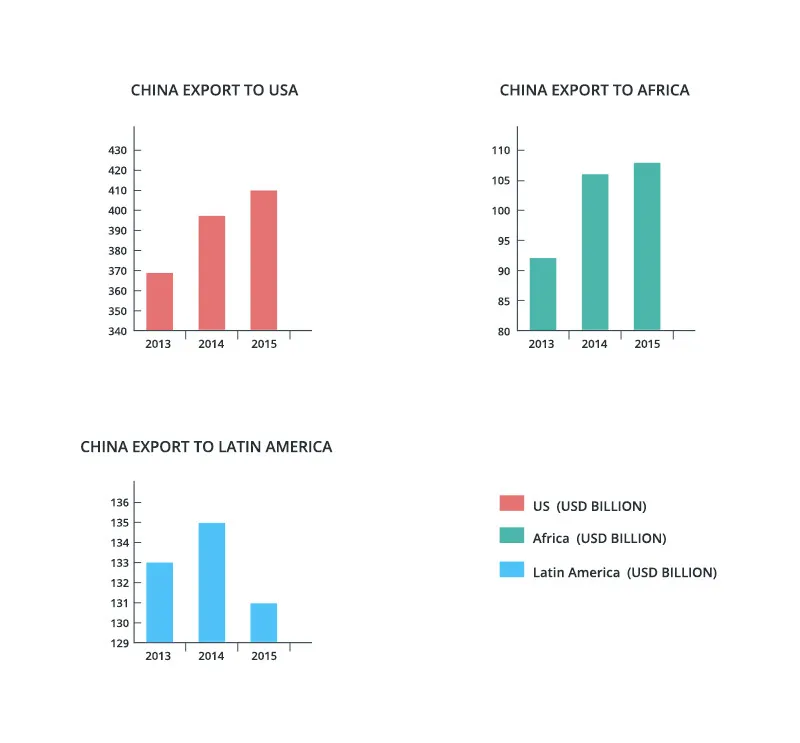

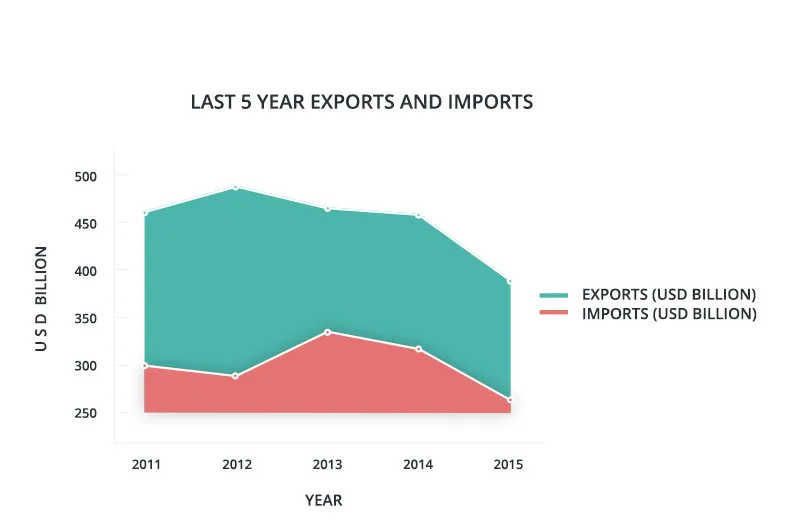

According to data available with the firm, out of India's total exports of $265 billion in 2016, $40 billion was to the US alone. But with the US policies taking a protectionist turn under President Trump, Pawan feels the Indian government has the perfect opportunity to create an avenue for competitive SMBs to find new markets for export. “Many SMBs do not even have websites, although their products are globally competitive. They must discover these schemes offered by the government to go global,” adds Pawan.

Take, for example, the Export Credit Guarantee Scheme. If an SMB gets an order from abroad for manufacture and supply of a product, then the government will provide 80 percent of the credit required for manufacturing and exporting the product. Unfortunately, only Rs 25 crore has been disbursed so far out of a Rs 1,000-crore corpus in this scheme. Asian Development Bank says that in order for the Indian SME sector to be competitive, it needs $300 billion in credit, an amount that is simply not available.

Lack of access to merchants who know the global market, a necessity for exporting, is another impediment for SMBs in trade. Forty percent of all exports from India are handled by merchants, who source products from manufacturers and export to other countries. This means that many SMBs have no way of discovering these merchants, who typically deal in products with higher margins.

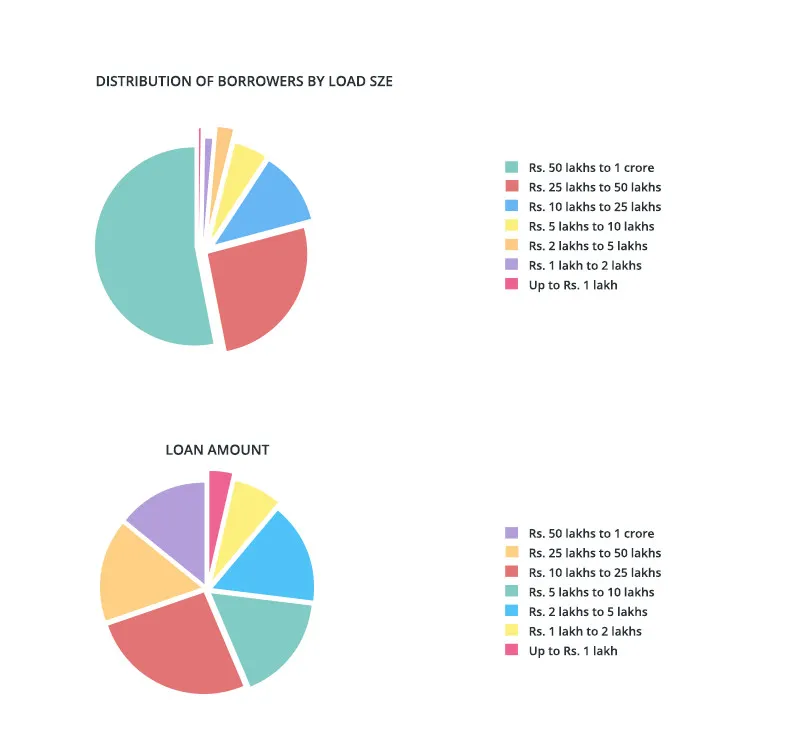

The graphs in the story explain the current state of the SMB sector. The loans disbursed in the sector are Rs 1,08,990 crore for 23 lakh SMBs, with Rs 50 lakh to Rs 1 crore being the most popular loan amount disbursed.

About a third of the country’s GDP is contributed by more than 48 million MSMEs in the country, acknowledged as the backbone of Indian economy. They are expected to further contribute towards its growth. “The sector will inevitably support India in improving the nation’s financial inclusion and mitigating the urban-rural divide,” says R. Narayan, founder of Power2SME, a 'buying club' and supplier for small businesses. And with India expected to have the largest job-ready, youth population in the world by 2020, he adds that a favourable business ecosystem in the manufacturing sector will not only help generate employment but also become the hotbed of entrepreneurial activities. “The MSME segment is in dire need of a level playing field, with not only great policies and campaigns but also with proper implementation of those policies,” says Narayan.

Power2SME has put together the following recommendations, a wishlist, if you will, of the SME sector:

“The government must focus on reforms that not only encourage new businesses in the manufacturing sector but also affect the existing SME players."

- The government should devise policies that help SMEs step up and ensure that the sector is able to participate as expected, in ambitious government initiatives such as GST Bill, demonetisation, Digital India, Make in India, and others.

- Some of the biggest enterprises in India collectively owe Rs 10,000 crore to MSMEs against the supplies made by small units, as per a recent study by Knowledge and News Network, a venture between FISME and GIZ. If paid duly, this amount can make a huge impact on the operations of MSMEs. However, delayed payments are adversely affecting the functioning of small businesses. This problem requires immediate government attention and focus.

- To resolve the longstanding financial crises of the MSME sector, there is a need to establish a mechanism of e-platforms, on which supply bills and receivables could be offered for discounting by MSMEs to banks and other financing institutions like NBFCs and factoring companies. These platforms should facilitate the banks, financing institutions and other interested parties to offer their competitive discounting rates for MSMEs, who should be able to opt for the best financing sources. Further, MSMEs supplying to various corporates and other buyers should be able to get their bills realised on due dates as per agreed terms, or within a maximum of 45 days.

- In the event of a corporate delaying payment beyond 45 days, the bank/NBFC involved pays the MSME and the corporate in question must pay the bank with 14 percent interest. The buyers should be strictly made to bear interest for such delays.

- Fast-track legal actions on bounced cheques: Under Section 138 of the Negotiable Instruments Act 2002, a firm can file a case against customer if his or her cheque is dishonored by the bank. However, the long procedures and the time taken to hear the case have a cascading effect on the SME players and their cash flow. The government, in this case, must establish strong laws against cheque bounce and also advise courts to fast-track such cases to solve the issue within a month’s time.”

A call for support rings loud in the SME sector. “Indian manufacturing needs the support in the form of automation, quick availability of loans and also ensuring the availability of skilled labour. Most importantly, doing business should be easy, there should be transparency and no barriers,” says Vimal Kedia, founder of Manjushree Technopack, which makes plastic packaging products.

What Vimal and other SMB entrepreneurs now hope is that the Budget announcements for their sector will help propel their enterprises onto the global platform, so that they can compete alongside corporates with deep pockets, as well as take a serious stab at the vast market opportunities within the country itself.

Sources: Ministry of MSME, Power to SME and ISED SME Obesrvatory.

Design of Graphs by YourStory Design team