Winter’s ending! Startup founders, are you ready for spring?

We spent most of 2016 talking about an investment winter, and sure, there was a drastic dip in funding value during the year. However, as YourStory Research data shows, deal volume last year actually increased by three percent over 2015. And while many in the startup world are talking about the chill continuing into 2017, we don’t agree.

Money, money everywhere…where do you deploy it?

There is no dearth of capital. It is not just the traditional pool of investors anymore. Last year, for instance, there was a lot of interest from Chinese investors too,” says Raja Lahiri, Partner at advisory services firm Grant Thornton.

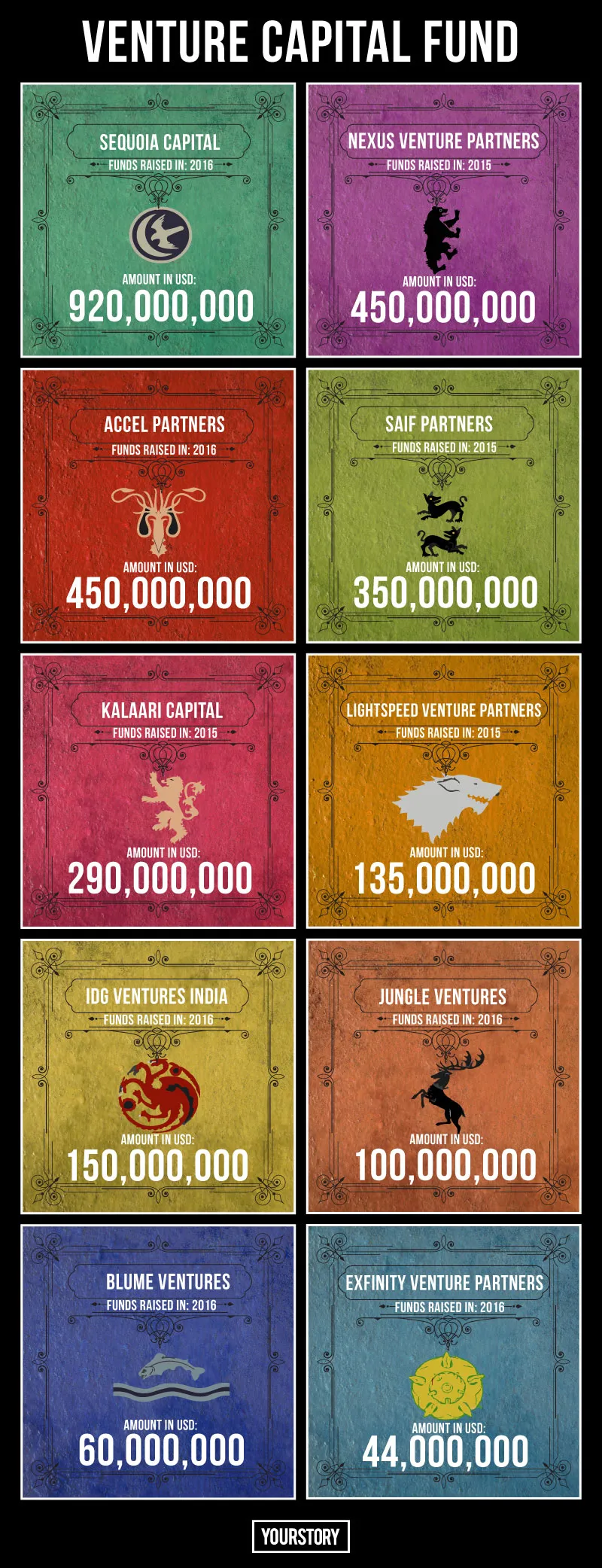

Indian investors are sitting on a record amount of dry powder – the funds available with investors that are ready to be deployed but haven’t been used. According to this report, India-focused venture capital and private equity investors are sitting on $7.1 billion of investible funds. This is not just money that has piled up over several years. LP (Limited Partners) interest in India remains strong. At least 10 VC funds have done new fund raises between late-2015 and today. These were not small fund raises, either. Sequoia led the pack with a $920 million fund raise, while Nexus and Accel have raised $450 million each.

It is not just the tried-and-tested investors who have attracted LP money. A clutch of new funds were also founded in 2015 and 2016. Pravega Ventures was launched in 2016 by former SAIF Partners veterans Mukul Singhal and Rohit Jain. Ex-Helion Venture Partners executives Ritesh Banglani, Alok Goyal and Rahul Chowdhri founded Stellaris Venture Partners last year, and the firm has already attracted capital from Infosys.

Now, let’s go macro. The global dry powder crossed $1.4 trillion in June 2016. “There is an oversupply of money in the world right now. This has built up over the past two years. Which are the markets that can attract investors to deploy this money? India remains a top and attractive destination for investors,” says a senior partner at one of the big three India-focused funds, who requested anonymity. This is a view echoed by others. Raja of Grant Thornton says that India is among the top three economies in the world, and so remains a darling of global investors.

Now, why is India so attractive? The most obvious reason is that the country is one of the few large economies that is showing high growth rates. India’s GDP grew 7.3 percent year-on-year in the third quarter of 2016. While the impact of base year change is quite high, the fact is that India is growing. Other indicators all add to the good news.

India is a large economy, it is growing, has a young population, adoption of smartphones is growing rapidly. The offline alternative for most consumption we do is very poor, be it buying a ticket or buying clothes, due to bad infrastructure and other reasons. So, there is scope for tech penetration,” says Rahul Chowdhri, Partner at Stellaris.

So, as T. C. Meenakshisundaram, Founder and Managing Director of IDG Ventures India, says, “India has a lot of challenges, and so, there is a lot of scope for entrepreneurs to innovate.”

Now, many of you will be thinking – all these factors were present in 2016, so why didn’t investors invest? 2015 saw many investors being gripped by the ‘Fear of Missing Out’ (FOMO) syndrome. “There was a mad rush in 2015. Those who shouldn’t have gotten funds also raised money,” says the investor who did not wish to be identified. That resulted in many me-too companies getting funded, and in turn, saw a number of closures as many of these companies could not achieve their targets or even build a sustainable business. That spooked investors in 2016.

“While there was reasonable activity in the seed and Series A stages, the larger deal makers like Tiger Global and SoftBank cut back investments in 2016, and that was amplified,” says Sandeep Singhal, Co-founder of Nexus Venture Partners. That affected sentiment, and many investors chose to wait and watch. Valuations also zoomed up in 2015, and many founders expected similar high valuations in at least the early part of 2016; however, many investors refused to participate at those valuations.

Mirror, mirror…what will investors do in 2017?

This year will be different because of a few resets that have taken place.

Capital, or the ability to raise capital, became the differentiator in 2015. We had companies coming in saying they wanted to raise $20 million when they needed only $5 million. Their worry was that if they didn’t raise the larger sum and their competitor did, they would be wiped out. That feeling needed to change, and it has. 2016 was a reset year for entrepreneurs. It became clear that capital is not available for everyone. Maturity has come in, the knowledge that capital has to be earned; so, being innovative, creating barriers to entry, creating sustainable differentiation – these are the areas that founders need to focus on,” says Sandeep.

Valuations have also become reasonable. Flipkart, which was valued at $15.2 billion when it last raised capital in 2015, saw its valuation crash to $5.54 billion late last year when one of its investors, Morgan Stanley, slashed the value of shares held by the fund in the e-commerce major. SoftBank cut down the valuations of Snapdeal and Ola, and rumours are rife that the latter is taking capital at a 40 percent lower valuation compared to its previous round. These larger companies set the trend for others in the industry.

“A number of companies that raised Series A or B earlier but have burnt through most of the cash are looking at raising fresh funds at the same valuation, or even lower,” says Sandeep. Also, Sandeep adds, investors have shaken off the FOMO syndrome.

Investors will be cautious this year to the extent that they will invest based on the actual business and the teams building those businesses, and not because a sector is hot. “This year, we will see entrepreneurs who are interested in building businesses long term. In 2015 (post the funding frenzy), there were a lot of closures even after raising B and C rounds. That showed that those guys were not interested in building businesses. New entrepreneurs will not come in because of easy money, as money is not easily available anymore – that’s good for investors,” says Rahul.

Investors YourStory spoke to all said that they are looking at sustainable businesses, which are not simple copies of other Indian or global counterparts and cannot be disrupted by foreign companies entering India.

The other piece of good news is that early-stage investors continued to invest in 2016, and will do so in 2017 too.

We did not slow down at all in 2016. In fact, 2016 saw the highest deployment of funds for us at $41 million,” says T. C. Meenakshisundaram of IDG.

However, he adds that companies raising Series B and C rounds will face some crunch as hedge funds that had done deals in India in 2015 have flown away. But with investors like Sequoia, Accel and Nexus raising larger funds, they can participate in follow-on rounds of their portfolio companies or even become lead investors in the series B rounds of one another’s portfolio firms. Sandeep says that while hedge funds might be available for those looking at Series C and growth funding, there is a large pool of traditional growth investors like Warburg Pincus and General Atlantic around the globe that are looking keenly at India.

In terms of sectors, fintech is an obvious darling right now, and it will be one of the buzz-sectors of 2017. Artificial Intelligence is another buzzword, while enterprise software and B2B services will also see activity.

So, the final word from investors is this – if you are building a serious business over many years, the target market is large, you are focused on business fundamentals, and are looking for capital to help speed up growth, then you will find that capital. Founders should be able to live with that.