While Flipkart valuation dips, technology gives 80pc annual growth for Myntra

Flipkart may have had a double markdown in valuation in less than a week, but Flipkart-owned online fashion portal Myntra claims it will be the first of online marketplaces in the country to become profitable. It has announced an annual growth rate of 80 percent, with a run rate of $1 billion in revenue. If things go well, the company aims to break-even by the end of this fiscal year.

Myntra has had an engaging year– it acquired rival Jabong, returned to desktop from its app-only route, and had a fabulous festive season sale along with Flipkart. In fact, Ananth Narayanan, CEO of both Myntra and Jabong, maintained that 2016 has been their best year. In addition to Myntra hitting $1-billion annual run rate a few months ago, Jabong became unit economic-positive, and Myntra is now targeting $2 billion run rate by 2018. The three marketplaces together claim to hold 70 percent of market share in online fashion in India.

“We are on track to achieve scalable and sustainable growth and will be EBITA-positive in FY18,” Ananth said at an event in Bengaluru on Thursday, attributing the progress to the changing mindset of the consumer as well as the developments in tech that Myntra has pushed in the last one year.

Team Myntra: [LtoR] Gunjan Soni,CMO & Head International Brands Business;Dipanjan Basu,CFO;Ananya Tripathi,SVP & Head Strategy & Planning; Manpreet Ratia, Chief People Officer and Head of New Initiative; Ananth Narayanan,CEO; Ambarish Kenghe,CPO; and Ajit Narayanan, CTO.

Myntra is set to open its first offline store in a few weeks, in Bengaluru’s famed 100-feet road in Indiranagar, intended to be more of a marketing initiative than one that creates revenue. “We are hoping to establish the brand and learn how to do offline-to-online with brands,” Ananth said, of the move.

The Myntra team elaborated on their plans for Jabong and impact of demonetisation on their business.

Tech is the key

When online retailers scale, the risk involved increases, as inventory tends to be spread all over the country. So the real challenge of technology is to make this inventory visible and available to the customer. Also, personalisation—an essential for great customer experience in fashion—is entirely in the hands of technology. Artificial intelligence (AI) and machine learning provide this to customers. Myntra CTO Ajit Narayanan, also present at the event, explained:

“We have built AI into the platform. We have massive data on consumer behaviour through social media. We push it into our core computing platform. We have a rich glossary on fashion semantics, including colloquial terms. Using all of that we can predict what the trends could be.”

Additionally, image analysis is significant in fashion as it is a visual field. Myntra’s artificial neutral network helps break images down into features, and customers get a concrete image of every detail – including the texture and colour of the garment. The company's partner brands can use this to see the trends, and plan the supply to match the demand.

AI is used in everything, from sourcing to personalisation to supply and demand. Understanding the intent of the customer is of utmost significance. Myntra’s new fashion assistant/chat bot gives suggestions according to the user’s tastes – for instance, pair up different items for different looks to choose from. Ambarish Kharge, Chief Product Officer, explained, “When we see an outfit, the machine sees details – model, design, location of the customer etc. Accordingly, we show the customer new collection from their favourite brands, same model in different designs and brands etc.”

Omnichannel is the future

In 2016, e-commerce grew beyond discounts – faster delivery, exchange policies, no-cost EMI etc., have made it to the forefront in bringing more attention to online shopping. Ananth noted, “Brands seldom looked at online platforms as a marketing channel or full-price sales channel. But now we have more than 200 brands, two million followers, and 12 million posts. Brands can build their brand digitally on our platform.”

The company started Myntra Brand Accelerator Program three months ago, with an aim to grow smaller brands using customer data insights.

Ananth believed that the total contribution of online channel to retail in India—which is at two percent now—will rise to 12-15 percent in a few years. “Omnichannel is the future. So we are integrating technology for the two entities to operate seamlessly.”

- Myntra’s current net promoter score (NPS) is 20 points above industry standards. They are targeting 60.

- Myntra is now promoting ‘Try and Buy’ feature, which lets one try 2-3 items at home – thereby solving the problem of size and fit.

- Full price sales have risen by 2-3 percent, proving that customers prefer value to discounts.

- Cataloguing is done using AI, by figuring out all attributes automatically.

- Machine learning reveals customer’s past history, preferences, today’s trends, paired-up looks etc., thereby ensuring conversion and repeat rate.

Jabong to be a separate entity

Despite rumours of Flipkart planning to shut down Jabong and incorporating it with Myntra to be a single entity, Ananth strongly maintained that the two fashion portals will be separate entities. He reasoned that their strategy for growth involved both mass and premium spaces – customers buy different things from both platforms. However, there has been synergy between the two entities in terms of logistics network, and each has leveraged technology from the other.

Ananya Tripathi, SVP & Head Strategy & Planning, Myntra, added that customers look at the three platforms differently. Flipkart is for the masses – choices and price points are different. Jabong is a younger brand, with customers mostly from the north of India, while Myntra has a major customer base, comprising mostly working women in the South. Their overlap is a mere 30 percent.

Myntra now has 13 million monthly users, while Jabong clocks five million.

Demonetisation woes

The ban of Rs 500 and Rs 1,000 currency notes has affected the e-commerce as a whole, and Myntra is no exception. Ananth revealed that their growth rate has slowed down to 60 percent, but would pick up in the next few months. However, half the transactions made on the platform are now prepaid, and even for post-paid transactions, card on delivery has gone from five percent to 50 percent. Cash is just 30 percent in total at present.

Ananth reiterated that there was no need to give additional discounts to push the sale due to currency ban. “No margins were sacrificed even for October’s Diwali sales. Digital wallets are rising now, so we are looking forward to the long term benefits.”

Demonetisation might be a blessing in disguise for e-commerce, as logistics is an issue in cash-on-delivery transactions. Handling cash costs lower for digital payments, as third-party players have lower risk there. Anticipating slower growth over the next few months, Myntra is planning to innovate more on digital payments by working on payment gateway issues and ensuring functional card machines with their delivery boys.

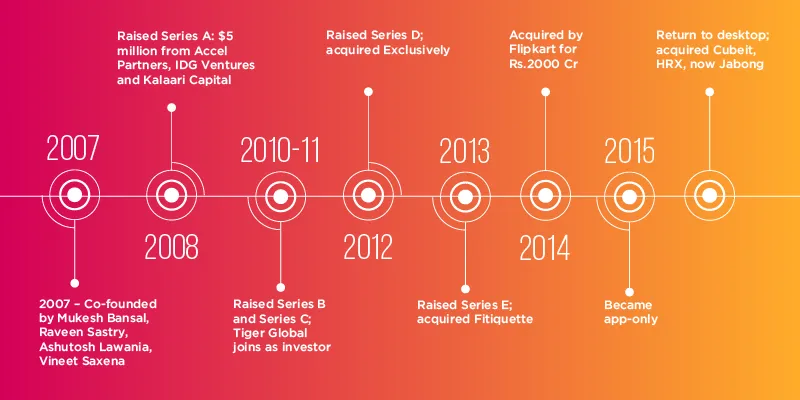

Ananth strongly held that growth and profitability can go hand in hand. Myntra has been making all the right moves: it returned to desktop website in June 2016, a year after it had gone app-only. Currently, its website provides 15 percent of revenue. Myntra’s 12 private labels contribute about 22 percent of revenue; they are targeting 30%. Additionally, features like 'Try and Buy' and now an offline store are seen as drives that will give the customer a sense of security about their purchases. Founded by Mukesh Bansal, Ashutosh Lawania, Raveen Sastry, and Vineet Saxena in 2007, Myntra was acquired by Flipkart in 2014.