What major e-commerce acquisitions in 2016 tell us

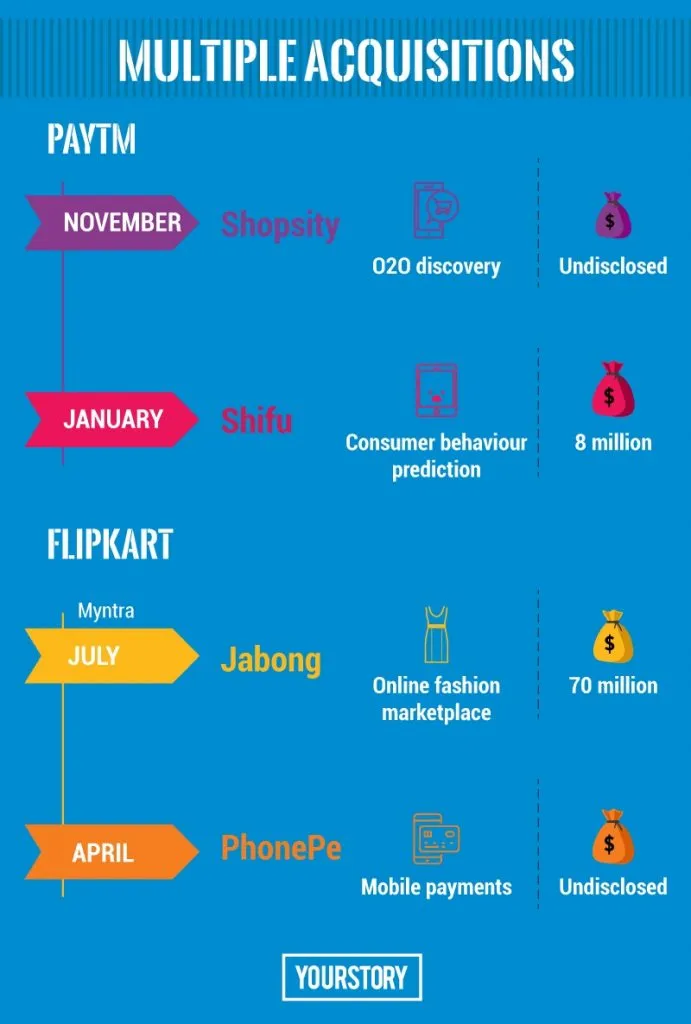

The biggest news in the Indian e-commerce industry this year surely was Flipkart-owned Myntra’s acquisition of Jabong for $70 million. Speculations were rife that Snapdeal was close to fixing the deal when Flipkart entered the scene and closed the deal in just three days.

But beyond the numbers, why do acquisitions make headlines? Putting it simply, acquisitions help get capabilities which they do not possess. In India, e-commerce ‑ the poster boy of the startup ecosystem ‑ has seen unicorns being amply backed by acquisitions of startups in various sectors.

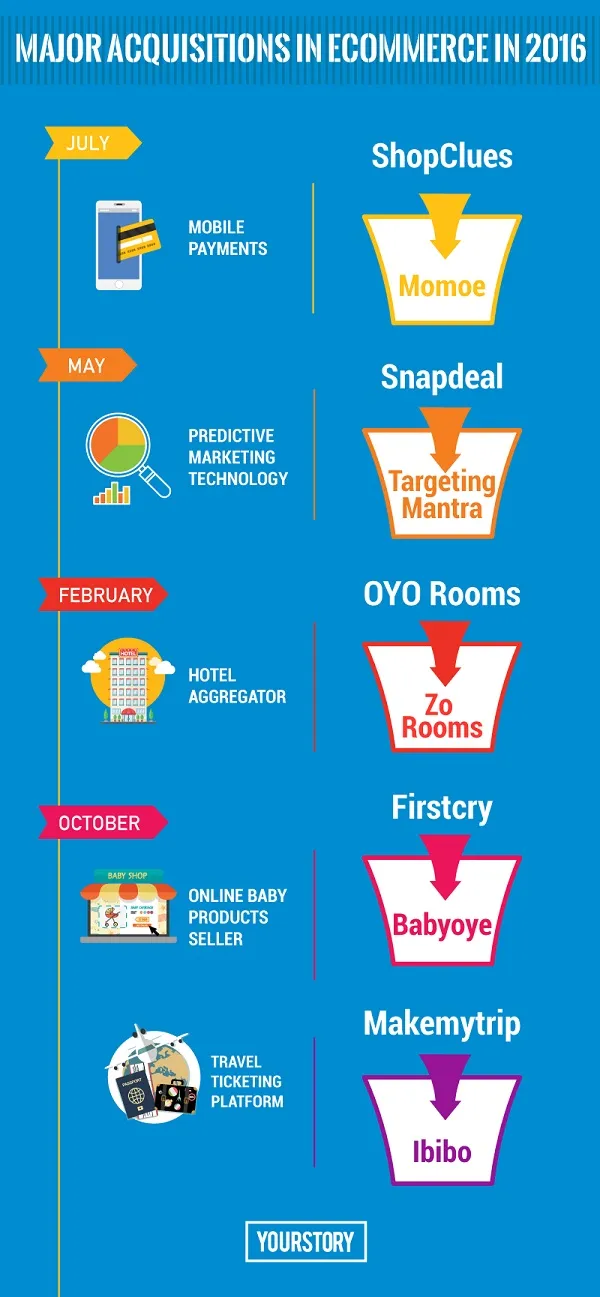

With the hype over valuations and GMV dying down, the focus has been more on strengthening backend services and providing better customer experience with advanced technology. YourStory takes a look at the major e-commerce acquisitions this year, and what it means.

Five at a time

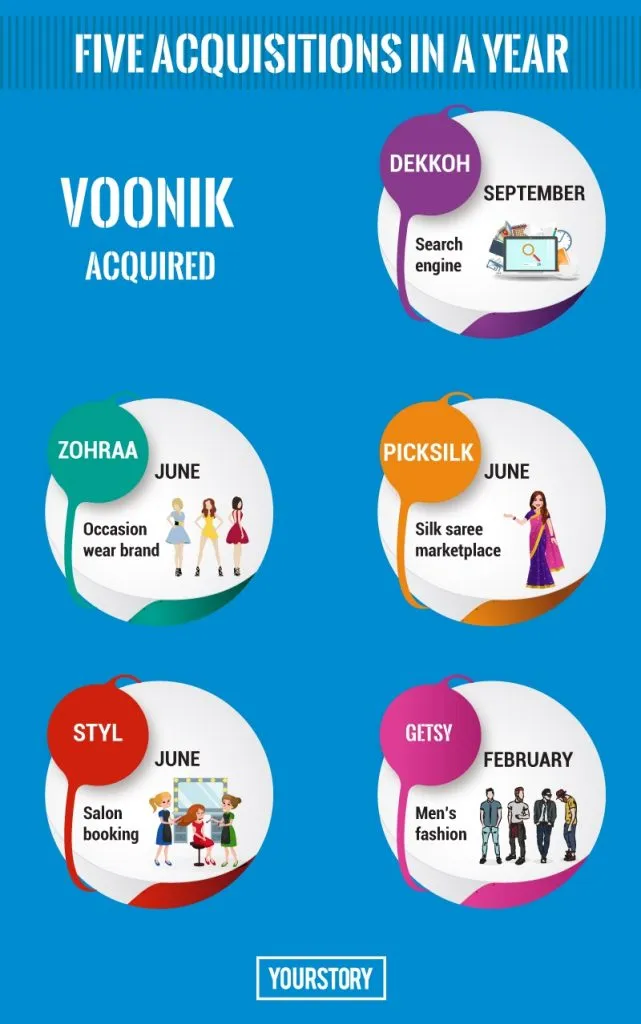

Online fashion portals witnessed a huge hike in sales this year. Fashion discovery and marketplace platform Voonik alone acqui-hired five startups this year – all of them, which Co-founder and CEO Sujayath Ali claims to be for the teams’ capabilities. “We bought TrialKart in 2015 for their image intelligence technology, which helps in auto cataloguing by gathering intelligence with image. Their 20-member team has made our system three times better. We never acquire assets. We ask them to come to Voonik and redevelop their tech for Voonik,” says Sujayath.

He believes that acquisitions made for GMV/traction will fail. “We do acquisitions for tech which we do not have access to, or will take time to build. The acquired startups like Getsy already have a system in place. For instance, to redevelop our app ‑ they already know how to do it,” he says, adding that besides domain expertise, functioning of the team and its style matters too.

Post-acquisition of Zohraa and Styl, Voonik launched its premium category platform Vilara. Their other acquisition Picksilk takes care of silk sarees category for Voonik. “They already have a network of weavers and there is no pain of middlemen. They are able to provide these products at half the price,” says Sujayath. Dekkoh had machine learning technology which is currently being rebuilt in Voonik.

Rivers to the same sea

Mostly, acquisitions happen because of the acquired company’s (lack of and) inability to raise more funds. Very often, rivals are acquired to weed out competition as well. (An exception in Indian e-commerce history to both of these statements might be Flipkart’s acquisition of Myntra for over $300 million in 2014.)

In China, the acquisition of world’s most highly valued startup – cab aggregator platform Uber ‑ by Alibaba-backed Didi Chuxing in August 2016 was a classic example of keeping your enemies closer. In fact, the development had a rippling effect in India – speculations were strong that Uber might now acquire its Indian rival Ola, thereby eliminating competition and establishing itself as the market leader in their biggest market in Asia. However, there has been no developments on that front, although there have been reports of Uber buying Meru Cabs earlier.

Myntra acquiring Jabong is another instance where the better-off company acquires its smaller rival. Once reported to have been in talks with Amazon for a buyout at a valuation of $1.2 billion, Jabong had a tough two years with lack of capital and leadership changes. The Rocket Internet-backed fashion portal built itself back from the ruins this year, and was reportedly in talks with Snapdeal for acquisition, as its parent was keen to exit. Flipkart-Myntra-Jabong alliance now has an undeniable upper hand in online fashion in India, without building or acquiring a new technology or category per se.

More acquisitions on the way?

One of the most interesting speculations on e-commerce in 2016 was Flipkart’s talks with American retail giant Walmart to take on Amazon, both companies’ biggest rival in India and the US, respectively. (Walmart had bought Jet.com for a whopping $3.3 billion earlier this year to fight Amazon in the US.) Flipkart was also rumoured to have been in talks to buy the other e-commerce unicorn ShopClues.

A few weeks ago, China’s biggest e-commerce company Alibaba acquired its South-east Asian counterpart Lazada at $1.5 billion valuation. There have been rumours of Alibaba acquiring Snapdeal in India, where it has a stake. But Sanjeev Aggarwal, Co-founder and senior MD of Helion Ventures, is of the opinion that acquisitions should not be done for scale. “Two competitors merging is not very good value for capital. Buying companies for capabilities that will take a long time to build is more useful.” He adds that it’s not central to the strategy of Helion’s portfolio companies.

Delhi-based ShopClues, in which Helion has participated in multiple rounds of funding, acquired Bengaluru-based mobile payments company Momoe a few months ago to build its own payments business, for a deal rumoured to be worth $10 million.

The fact remains that acquisitions are intended to boost a company’s sales and organic growth. Sanjeev puts it this way:

For the next few years, there is too much to do organically. Occasional acquisitions are done for essential capabilities.

The past 12 months have seen amazing additions in e-commerce empowered by technology ‑ be it in payments, logistics, or customer experience. Will the next 12 months see more of it? Who will be acquired by international players, and who will manage to survive? What are the acquisitions and mergers that 2017 holds? Watch this space.