Find out more about Flipkart’s fifth devaluation in a year

It has not been the best week for India’s largest online marketplace. The 10-year-old company, which is reportedly in talks to raise funding, has been devalued by two of its investors.

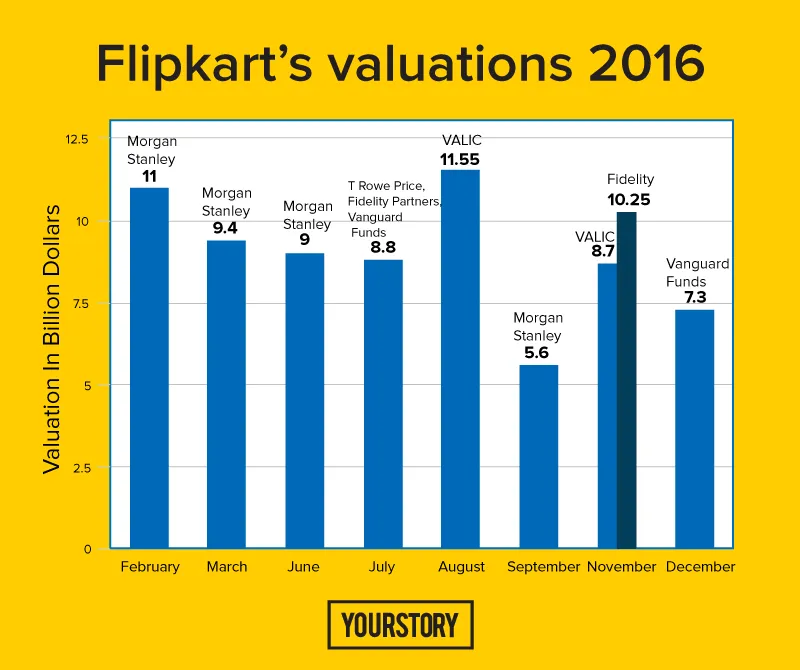

On November 29, Morgan Stanley marked down Flipkart’s valuation — for the fourth time this year — to $5.6 billion. This effectively shows a 40 percent reduction in the value of shares which Morgan Stanley Mutual Funds holds in Flipkart, according to Morgan Stanley Select Dimensions Investment Series filings at the US Securities and Exchanges Commission.

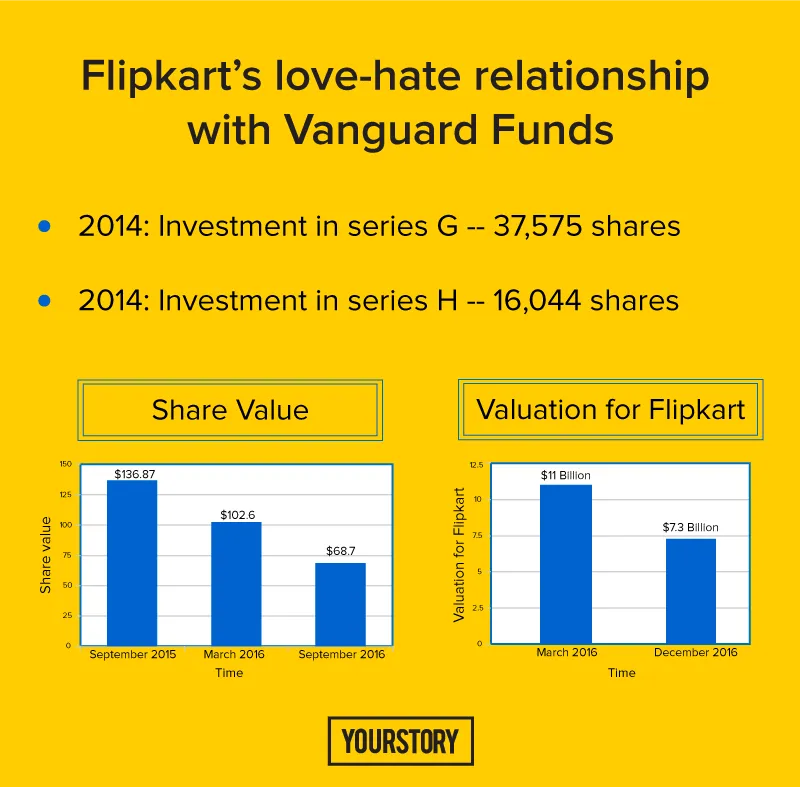

Ever since it raised a record-breaking $1 billion in December 2014 and achieved the valuation of $7 billion, this is Flipkart’s lowest markdown. Things weren’t made any better by the fact that, within three days, Vanguard Fund devalued its shares in Flipkart by 33 percent, effectively dipping its previous valuation of $11 billion (in March 2016) to $7.3 billion.

Valuation tumbles down

Flipkart had raised $700 million in July 2015 in private equity funding led by Tiger Global Management and Qatar Investment Authority at a valuation of $15 billion. About six months later, things began going downhill.

Valuations are decided according to a company’s market share, its gross margins, and rate of market growth, among other factors. Not a startup anymore, Flipkart’s sale figures over the years would also have been taken into consideration.

Despite these, Flipkart-owned Myntra acquired online fashion portal Jabong, thereby establishing a clear upper hand over competitors in online fashion. Currently, the alliance claims to have 70 percent market share in online fashion commerce.

Timing is the villain

Having raised more than $3 billion since 2007, Flipkart is reportedly now in talks with US-based retail conglomerate Walmart to raise $1 billion. Obviously, these multiple devaluations couldn’t have come at a worse time for Flipkart.

Flipkart’s year began with top leadership changes when Sachin Bansal left the CEO position to his co-founder Binny and took over as executive chairman. Soon, Mukesh Bansal, Ankit Nagori, Punit Soni, and most recently, CFO Sanjay Baweja and private label head Mausam Bhatt along with engineering head Peeyush Ranjan left the company. Industry experts believe that Kalyan Krishnamoorthy, who was working with Flipkart’s top investor Tiger Global Management, was made head of category design, commerce, and advertisements as the board members were keen on giving the company a lift.

Market scene

According to Morgan Stanley, Flipkart’s market share is 45 percent in Indian online retail. While US-based rival Amazon had surpassed Snapdeal to become second in line, Flipkart is also wary of the rumoured entry of Chinese e-tail titan Alibaba, an investor in both Snapdeal and Paytm.

To Flipkart’s credit, it has fought fiercely against Amazon, which has not just billions in its kitty but also comes with more years of experience in wider geographies. In fact, the recently-concluded festive season sales had pulled in Rs 1,400 crore for Flipkart in a single day, the largest ever in the history of Indian retail, and sold 15.5 million units in five days.

Maybe devaluation is just white noise — taken in isolation, T Rowe Price’s devaluation of its shares in Flipkart by 15 percent could have been seen as a big deal, but a look at the larger picture would tell you that T Rowe Price had already lowered the value of its shares in 12 unicorns, including Uber, Airbnb, and Evernote.

Uber’s Indian rival Ola, which was earlier valued at $5 billion, is rumoured to be raising funding at a 40 percent lesser valuation, according to a report in the Economic Times. While this might be a normal turn of events, devaluations will always grab attention because till a few years ago, India had not heard of unicorns and billion-dollar funds, and the young and energetic market is yet to reach its full potential.

To prove skeptics wrong, will this unicorn spread its wings again?