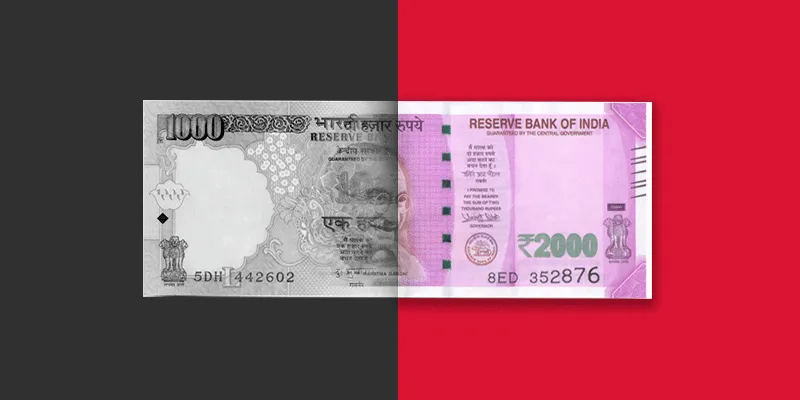

With the proposed declaration scheme, convert your black money to white without 200pc penalty

Introduction

After revealing that there are not enough legal provisions under the Income-tax act, 1961, through which they can levy the penalty of 200 percent, the government is all set to amend said act.

Further, through this amendment, the government is also providing maybe the last option to come clean, declare black money, and pay the tax @ 50 percent with a four-year lock-in period.

The New Declaration Scheme

The government has tabled the new declaration scheme in the Lok Sabha, to provide the black money hoarder an additional opportunity to come clean. This may be the last such opportunity and many people may want to take it.

Let us discuss this scheme in detail:

- Name of the scheme: This scheme may be called the PRADHAN MANTRI GARIB KALYAN YOJANA, 2016.

- Who can avail this scheme: This scheme can be availed by any person who wants to declare his/her black money by depositing it in the bank account, at the RBI, or at a post office in India.

However, the following persons are not allowed to avail this scheme:

- Person on whom an order of detention has been made under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974;

- Person in relation to prosecution for any offence under the Indian Penal Code; Narcotic Drugs and Psychotropic Substances Act, 1985; Unlawful Activities (Prevention) Act, 1967; Prevention of Corruption Act, 1988’ Prohibition of Benami Property Transactions Act, 1988; and Prevention of Money Laundering Act, 2002.

- To any person notified under section 3 of the Special Court Act, 1992.

- In relation to any undisclosed foreign income and asset which is chargeable to tax under Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

- Quantum of amount: There is no limit on the amount to be deposited. However, an approximate tax of 50 percent will be levied on any amount deposited. No deduction or set off shall be allowed against the income so declared.

- Tax rate to be paid: The exact is 49.9 percent, the breakup for which is as follows:

- Requirement of deposit of 25 percent of undisclosed income: After paying tax as specified above, the person shall also have to deposit 25 percent of the undisclosed income in the Pradhan Mantri Garib Kalyan Deposit Scheme, 2016 with a lock-in period of four years.

The withdrawal of amount shall be after four years and will be subject to some conditions as may be specified.

- No interest on deposit: The 25 percent deposited shall not carry interest.

- When to pay the tax and penalty: The tax, surcharge, and penalty as stated above need to be paid before filing the declaration to the government under this scheme.

- How to file the declaration: The procedure to file the declaration has not yet been revealed and hence, we have to wait till the government finalises the scheme.

- No refund: Any tax, surcharge, or penalty paid under the scheme shall not be liable for any refund under the act.

- Immunity from prosecution: No proceeding under the Income-tax Act can be initiated based on the declaration. This is to provide immunity against prosecution.

Let us understand this scheme by way of example.

Suppose a person has black money worth Rs100 crore and now he wants to declare this income under the new scheme. How much does he need to pay?

As per the new scheme, he needs to pay the following amount:

- Tax @30 percent = Rs 30 crore

- Surcharge @ 33 percent of the tax above, i.e. 9.9 percent = Rs 9.90 crore

- Penalty @10 percent = Rs 10 crore

Hence, in total [30 + 9.90 + 10] = Rs 49.90 crore needs to be paid to the government.

Further, in addition to the above, a deposit is also to be made for four years @ 25 percent. Hence, the amount of deposit to be made is Rs.25 crore (25 percent of the undisclosed income).

The rest of the amount, which the person can take home [100 – 49.90 – 25] = Rs 25.10 crore. After four years, he can withdraw his Rs 25 crore deposit.

Conclusion

This may be the last opportunity to come clean and hence, people who have black money are advised to disclose the income under this scheme and become a responsible citizen of India.