How Ola is spreading its eggs across 9 different baskets to retain market share and ensure future growth

“We are a land of diversity. India is a country where everything from the cuisine and clothing to the weather and even the type of tea or coffee you drink changes every 100 kilometres. No two human beings are the same or want the same things, so how can their ride preferences be restrictive?” asks Raghuvesh Sarup, Category Head at Ola and Chief Marketing Officer, sitting in one of Ola’s three plush offices in Bengaluru.

While we have had several reports and market speculation on what’s next for Ola in the aftermath of the Uber-Didi deal, internally, the team has always met these reports and talks with silence. They have focused on their vision of mobilising a billion Indians.

Keeping the lion’s share

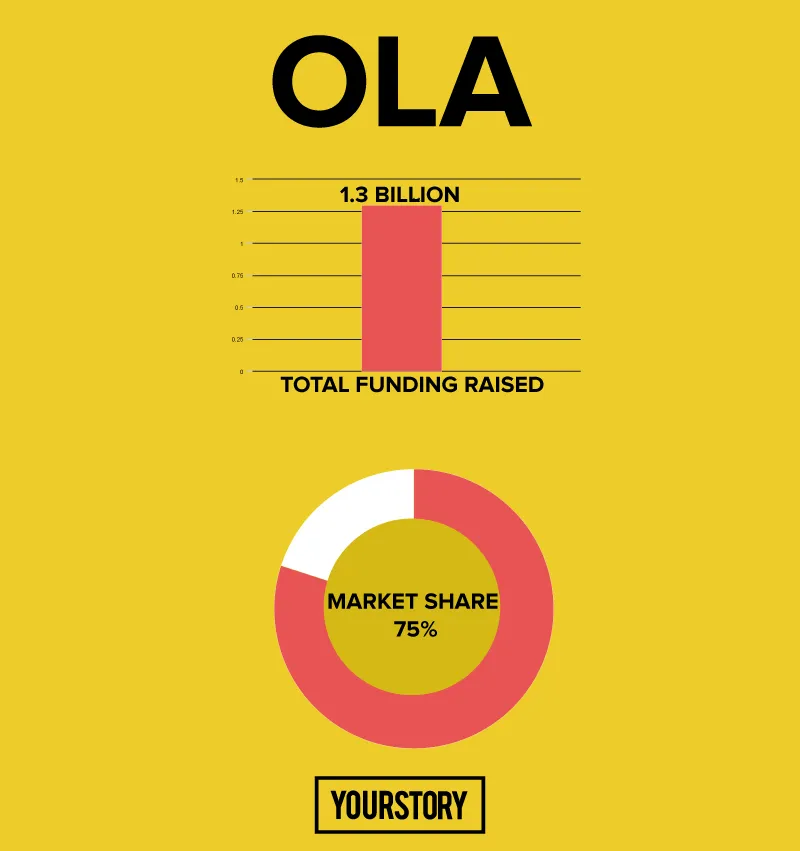

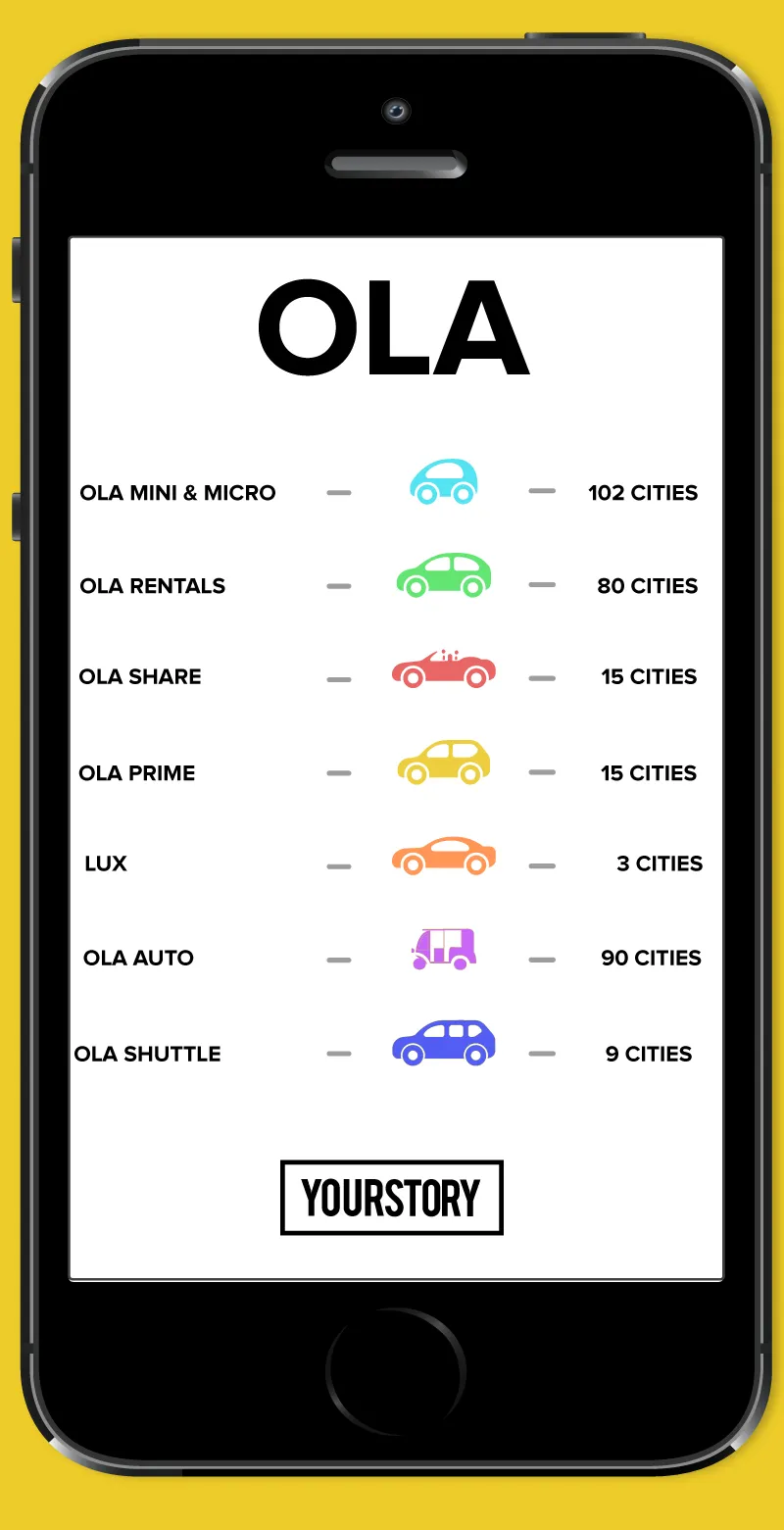

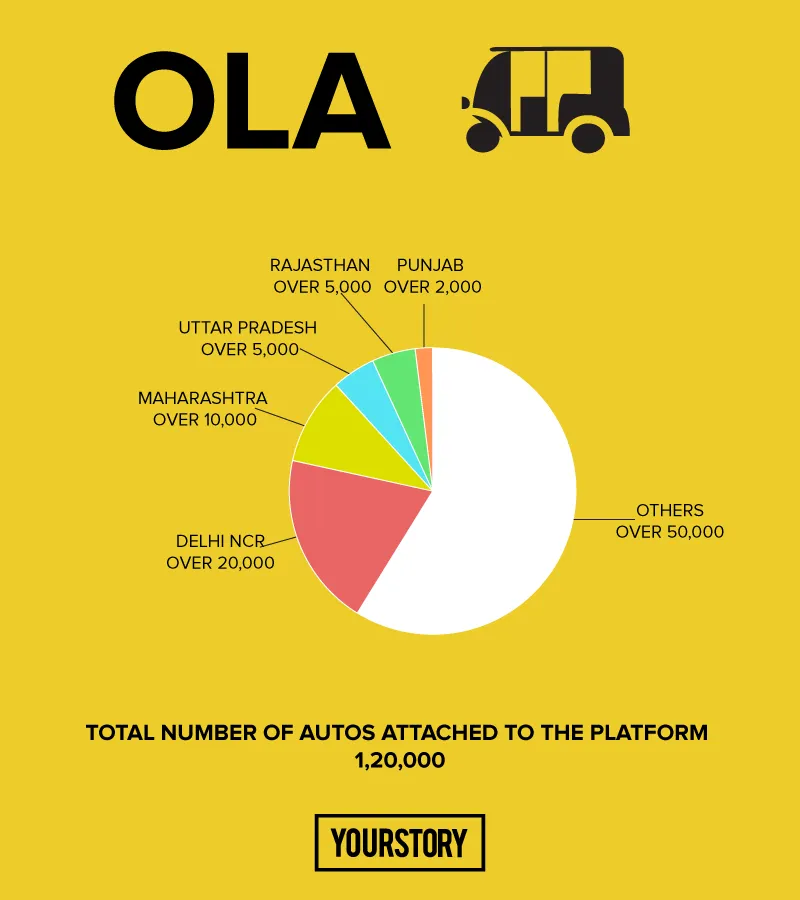

Ola also has deeper penetration of the market, being believed to have 75 percent of the market share. The cab aggregator is also present across nine categories – Mini, Micro, Prime, Share, Shuttle, Auto, Lux, Rentals and Outstation.

Raghuvesh adds that Ola is operating in a country where less than two percent have access to four-wheel transport, and says that their job is to ensure that the remaining 98 percent soon gain access to the same. He explains,

We are not disrupting; we are creating something. It isn’t about transferring demand from one thing to another. We started out because there are roads in India, where people cannot go from point A to point B. However, we know that our 75 percent market share has come predominantly from the main cities we operate in, and not just because we operate in over 102 cities. In fact, the bulk of the business is from the top six metros.

Ola believes that they have been able to reach this market share because they cater to more use cases. It makes business sense to diversify.

As of 2015, Ola had raised over $1.3 billion, and claims to have grown more than threefold since April last year. However, according to the RoC data filed by the company, they suffered losses of Rs 796 crore in the last fiscal year. Despite this, Raghuvesh believes that the future looks bright for the unicorn.

He adds,

Micro alone is bigger than all our competitor's categories combined.

Personalising according to use cases

Launching products isn’t new for Raghu; while at Nokia, he says that they would, on average, launch 43 products a year. He also believes that there is a human need to personalise the world of choices around you.

“Personalisation is super important, and eventually, that’s where we will go even from a tech point of view, making it easy for you to personalise the app the way you want it,” says Raghu.

While Ola has nine different categories, Uber has four.

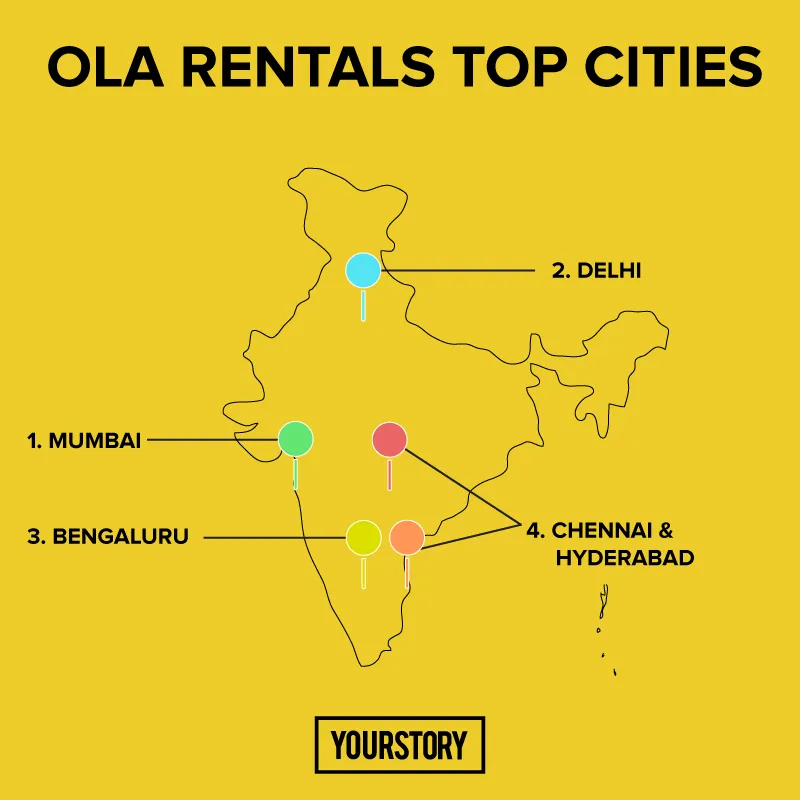

Each person, driver and usage occasion is different, and there are even more usage occasions to be tapped. Indian consumers are very diverse, and their needs are different. We saw a huge market for rentals, and that’s when we decided to launch rentals.

Over the past few months, Ola has been pushing its boundaries, diversifying every time it sees an opportunity.

The company has tied up with Mahindra, entered into a partnership with Practo for doctor visits, ventured into corporate travel, engaged in location mapping with Siri, taken up offline bookings, and had also collaborated with the Karnataka State Tourism Development Corporation to launch exclusive tourism flights from Bengaluru to Mysuru during Dassera.

There are use cases for rentals that aren’t present anywhere – going to the bank for a few hours, going to drop off the children at school and pick them up, a wedding, and meetings in different cities. Instead of waiting to book another cab, it made sense to have a cab that would wait.

Raghu explains,

I think that, by any standards, we launch categories and expand them faster than anyone else anywhere in the world. The only reason it takes a little longer is that when we launch Rentals, we need to train our drivers a little differently and check the cars a little differently from what we do for city taxi operations.

Focus on retaining the market share

Outstation and Lux being among the more recent categories, the team refused to disclose intricate details. However, in terms of Outstation, Ola has recently also launched a one-way journey. The shuttle rides, considering the grey area in terms of government regulations, are, at present, only for corporate rides.

Also, Raghu adds that he personally believes Share to be an important aspect of the transport business. He says that Share solves the problem of growing traffic congestion that cities are facing. Not only is it economically viable for the consumer, the driver makes more money for the same trip.

He says,

Also the matching algorithm ensures maximum 'matching' of users headed the same way, as well as ‘same route sharing’. Thus, Ola Share users don’t go out of their way as the cab picks up or drops other users sharing the same cab.

Ola and Uber had also launched bike taxis, but government regulations forced them to put a stop to the same. While Uber is fighting to gain a high market share, Ola is focused on retaining its position.

Jaspal Singh, Partner at Valoriser Transport Consultants, says,

There is a strong focus on rentals, outstation and categories that are stronger and more revenue generating. Uber is not even present yet in these segments, and I doubt they will touch the space. Their focus is transportation, and they believe in diversifying there, to touch every segment possible.

While the team refused to share revenue growth percentages under Ola’s nine different categories, they surely believe that diversifying for an Indian market is the way forward.