IBM’s cognitive solution driving shift to digital in the banking space

India has one of the highest instances of fraud in the world, according to the Global Fraud Report 2015-16 by risk mitigation consultancy Kroll, with the aid of the Economist Intelligence Unit. In such a scenario, a secure Digital Trust Infrastructure is the need of the hour to strengthen the financial system. Blockchain, among other technologies, could be a game changer for the banking and financial sectors.

Earlier this year, the Institute for Development and Research in Banking Technology (a Reserve Bank of India unit) organised a ‘Payment System Innovation’ contest to find solutions for financial frauds, reduce cost of transactions and develop an effective e-payment infrastructure in India.

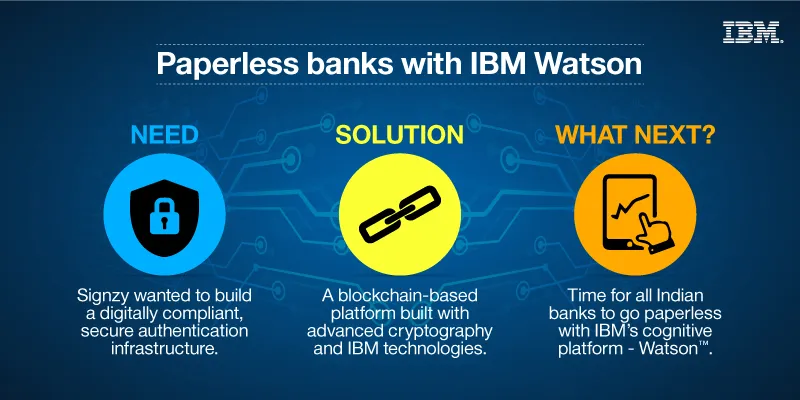

Bengaluru-based start-up Signzy emerged as a winner with its blockchain-based solution. Signzy’s solution enables the extraction of information from identity proofs and documents, and runs a check for forgery. For instance, it is mandatory for banks to conduct a know-your-customer (KYC) check when onboarding a customer, and banks need to continue with these checks periodically. This process often lacks agility and calls for additional manpower. Such a task can be simplified using Signzy’s advanced cryptography, and digital compliance can be ensured by operating in a secured environment.

Signzy uses IBM’s cognitive platform Watson to build cognitive capabilities and deliver them on the cloud to make the digital onboarding processes simpler, secure, and more compliant, especially in the financial services sector. Its online contracting solution uses technology like biometric signature to complete the entire online digital trust system.

“We chose IBM because they have an integrated ecosystem. This brings down Signzy’s integration cost and reduces efforts, accelerating the go-to-market phase,” says Ankit Ratan, co-founder of Signzy Technologies Pvt Ltd.

“A lot of the other APIs are not from the large players, and even though they are good, they lack enterprise readiness, and may lack required certificates and long-term stability,” he added.

Signzy’s solution, in conjunction with proactive efforts by the government, will also enable its various departments to go digital and avoid the hassle of paperwork.

Applying cognitive technology is the critical next step for mining and analysing complex unstructured data that companies can then use to better understand and deliver services and products in accordance with consumer demands.

IBM is making a big push in the Indian market with Watson, driven by the abundance of a good talent pool, to fast track growth in the technology products and solutions segment. IBM will soon make Watson’s cognitive capabilities available to college students and teachers allowing them to get richer learning experiences and meaningful insights.

With IBM’s cognitive solution, digital intelligence meets digital businesses to improve the decision-making processes. To learn more about how startups in India are redefining the digital value chain using cognitive technologies, IoT and Blockchain, be there at IBM India Onward.