Is the battle of the cab aggregators going to get bigger and uglier?

There is currently a lot brewing in the world of cab aggregators and the taxi market. Especially since the Uber and Didi truce that took place in August this year. Before the deal, Didi and Uber were at loggerheads, and news of the merger created quite a ripple. One of the biggest questions being asked in the aftermath of the deal was – What next for Ola? Now that Uber has its focus completely on the Indian market, how much can Ola compete?

Over the past year, things have been heating up for Ola, with Uber being a tough competitor. There has been a constant stream of questions and speculations, with several possible permutations and combinations of things that can possibly happen in India and with Ola being discussed.

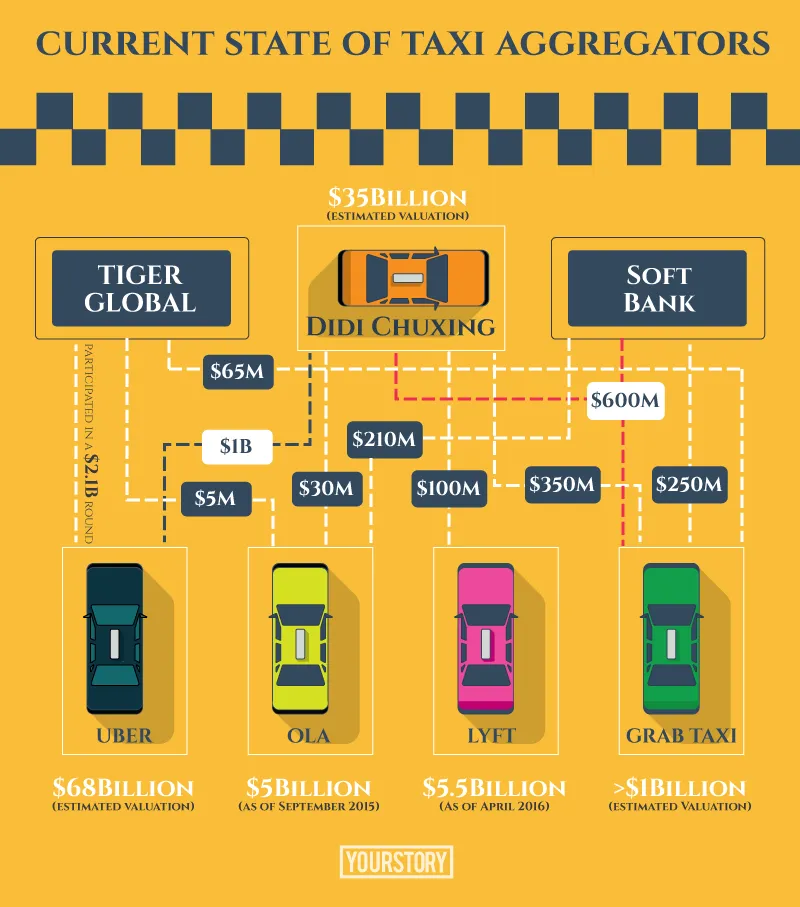

Especially when under the terms of the deal, Uber got a 20 percent stake in the combined entity of Uber China and Didi Chuxing. The value of the combined Chinese entity is at $35 billion, up from $28 billion prior to the deal.

The Indian market

The Uber-Didi deal came over a month after massive fundraising from both players. In June, Uber had raised $3.5 billion from Saudi Arabia’s sovereign wealth fund, while Didi Chuxing had raised $7 billion, encompassing $4.5 billion in funds from multiple investors (including $1 billion in funding from Apple and $600 million from China Life Insurance) and a $2.5 billion debt package from China Merchants Bank.

Dhananjay Sharma, Associate Consultant, RedSeer Consulting, believes that:

China was a bleeding market for both Uber and Didi Chuxing because of intensive cash burn for customer acquisition. Now, as Uber China merges with Didi, it will likely be a win-win situation for both from the business sustainability perspective. It will certainly be interesting to see how this development impacts Uber's strategy in India going forward, now that Uber is free to focus entirely on winning the Indian market.

The dynamics between Ola and Uber saw a perceptible shift after this deal, given that Uber had freed up all of its resources for the Indian market. The cab market in India is growing exponentially, and Uber, Dhananjay believes, sized up their competition well.

The clash of the titans

This can be clearly seen in the heavy discounting that the San Francisco giant has used, apart from the increased incentives that were given to drivers. However, for the time being at least, Ola claims to have a larger market share than Uber.

Interestingly, over the past couple of months, since Uber’s announcement of the China deal with Didi, Ola seems to be coming up with several aggressive pushes and announcements in the market, like the Ola tie up with Mahindra, partnership with Practo for doctor visits, corporate travel, location mapping with Siri, offline bookings and also the collaboration with the Karnataka State Tourism Development Corporation to launch exclusive Tourism flights from Bengaluru to Mysuru till October 6th.The cab aggregator has also aggressively expanded Ola Share to Chandigarh, Jaipur and Ahmedabad, and have even cut their per kilometre prices to Rs 3.

While Ola seems to be taking several aggressive measures, Uber isn’t far behind. The San Francisco-based entity has also been pushing deep into the market with their ‘book later’ facility, corporate plans and the offline calling facility.

In June, there were talks of Ola raising funds of $300-400 million, and the company was in talks with both existing and new investors for the same. The reason to raise the funds was to ensure its lead over Uber. However, till date, attempts at raising funding have met with little success.

A tough time ahead

Jaspal Singh, Partner at Valoriser Transport Consultants, says,

It is a little obvious in the market that things aren’t going too well for Ola. And for them to retain their market share in the near future will be a little challenging. Uber is focused completely on the Indian market, and while Ola is finding it difficult to raise funds, Uber has the resources.

Reports suggest that over the past year, Uber has been spending significantly on recruiting new cabs, and opened up cash payments and call facilities. A Mint report suggests that the San Francisco based cab aggregator’s India market share had touched roughly 40 percent at the beginning of the year, from five percent last year.

To fight this, Ola launched Micro, one of the cheapest cab offerings in the market. While this has seen Ola’s market share jump, the cash burn has also significantly grown. Apart from Micro, the team has expanded into rentals, outstation and shuttle businesses.

A focus on revenue

“There is also talk in the market on the number of hacks that drivers use to game the system and create fake rides. Added to that, there is an increasing pressure for Ola to increase prices and focus on revenues. Internally, there is also a lot of pressure on the team to focus on their leasing out cars,” adds Jaspal.

When you give a vehicle on lease to a driver, you’re ensuring that the driver sticks to your platform. Also, the driver needs to make sure that he is earning over Rs 800 to 900 per day, and makes revenue for the company as well.

Jaspal adds that if you look at the market Ola is targeting, you see that it is looking strongly at the outstation market, which will bring in a jump in their revenue. Uber isn’t venturing into that space. Ola has realised that café and delivery didn’t work, and transportation is their only focus now. And hence, they are strongly diversifying there, says Jaspal.

Since the Uber-Didi deal, Ola has aggressively been working towards retaining its market share, which has taken on an amount of urgency given that market sources believe that investors have become sceptical after the deal.

“What happened in China was unexpected, and investors now just want to wait and see how the market shifts. Uber has deep pockets that it is willing to pump into India. And Ola has to face a wary investment community,” says Dhananjay.

The shutting of TaxiForSure and the significant layoffs were believed to have been done to reduce costs. The layoffs bring in a total cost reduction of Rs 30 crore a month for Ola.

The need for healthy competition

Amidst talk of this dilemma, there has also been speculation in the market for several months now that Reliance is eyeing the space. Also, both Ola and Uber have, over the past few months, been facing government pressure to follow the decided norms and regulations. Many believe that it is in the best interests of the industry that all cab operators and aggregators follow a uniform code of rules.

Siddhartha Pahwa, CEO, Meru Cabs and Secretary, Association of Radio Taxi India says:

The job of the regulator is to ensure that there is healthy competition in the market, which lies in the long term interest of the consumer. Whatever has to be used, let it be common for all. This battle for supremacy might help the consumer in the short term, but over the longer term, it harms the economy and the consumer.

Competition creates value and ensures that there is good quality service. Sidharth adds that with the limited resources that Ola is left with, they are now realising the need for regulation. He claims that they have accepted the idea of a common regulation for all.

Sidharth believes that in the fight, some basic reasons for why the cab services were started have been forgotten. He adds:

Everyone is now focussed on pumping money on consumer and driver acquisition, and the focus on good quality service is lost. The training etiquette for drivers and changing behaviours isn’t happening. There still needs to be strong dignity of labour in India. The customer needs to value the driver and the driver needs to value the customer.