In glory of my investment thesis

An article published on Forbes.com listed me as part of the 8 most prominent angel investors in India. It has increased the pipeline of deals multifold. I enjoy working with new entrepreneurs, but with an ever-burgeoning portfolio, it's difficult to allocate time to everyone. This note is to respond to criticism on my not engaging, replying or investing in some deals shared. I hope that the sharing of my investment thesis helps founders understand what angel investors look for.

A rock star technology team, and founders with exceptional domain expertise.

For e.g.: LogiNext founders Dhruvil and Manisha are both alumni of Carnegie Mellon University with deep experience in Logistics and the Big Data space.

A technology platform that has the potential to become the infrastructure building block of the future. This kind of innovation will be measured in generations.

For e.g.: Zippr. It is rapidly building an ecosystem of businesses and governments that are using the new format to communicate addresses for a number of reasons. India is moving towards smarter cities, and Zippr will impact a billion lives by solving day-to-day address-related problems through innovation.

WOW! A unique product with the unfair advantage of Intellectual Property.

For e.g.: AdstringO compresses image, PDF, audio and video files by 90 percent without any quality loss. It has created the world’s fastest endpoint compression algorithm IP, which means that on mobile itself, files are compressed at source.

A very large market opportunity.

For e.g.: Box8, India's fastest growing on-demand food delivery company. Product innovation with All-in-One meal boxes, fulfilling new-age Indian meals that are convenient to eat anytime, anywhere. Box8 QSR (Quick Service Restaurants) is right now in India all about limited service and infinite growth possibilities.

Strong brand loyalty to make profits.

For e.g.: NaturallyYours is a nutrition-based health food brand. There is willingness from the buyer to pay a higher price for food to be healthier and better for the environment. It is the No.1 brand in the Organic Food category on Amazon, with sustained sales momentum.

A market-validated business model, technology solution or offer the customer is willing to use.

For e.g.: PayTunes. An interactive delivery platform for audio and visual advertisements such as ringtones and banners. Currently delivering more than four million daily advertisements and reaching out to more than two million unique users daily.

Hunger for resources and investments to grow.

For e.g.: Blubirch is a reverse logistics startup with a vision to put assets back in the hands of users. It is transforming the reverse logistics industry with technology to handle dead assets across the full range of electronics from mainframe to mobile. The company generated Rs 17 crore in revenue, with bottom line profit, in its first year.

Prefer founders over markets and disruption over differentiation

Angel investors like myself look to provide funding to startups with small bets rather than trying to pick a select few winners. It is finally the market that determines the winners in the portfolio. I do not run a fund. I invest my own money. I am not getting paid by anyone for my time to evaluate, review and engage with startups. Even full-time investors like myself have finite bandwidth, so please excuse us if sometimes queries are not replied to. Interesting startups will be replied to within seven days of sending the detailed pitch (PDF) via email. Do you have the next big idea? Email the detailed business plan (PDF) to [email protected]

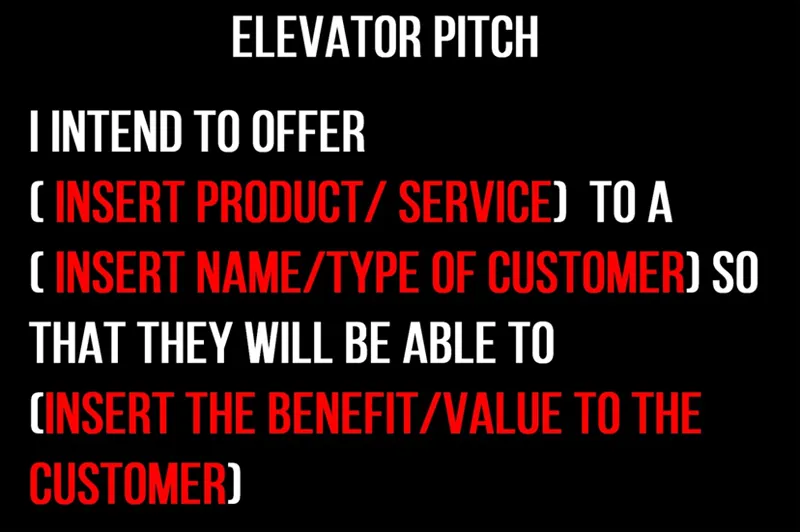

Follow me on Twitter @mehtasanjay and share your elevator pitch to get a response.

This article was first published Link